S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

20 Apr, 2021

By Allison Good and Harry Weber

Financial losses due to a severe winter storm in February should not materially overshadow the outlook for demand recovery in the natural gas midstream sector as companies release first-quarter earnings results, industry experts said.

The extreme winter weather in Texas and nearby states in February disrupted gas transportation and distribution operations and seasonal maintenance at LNG export facilities, and it is expected to be a factor heading into the summer. But analysts at Morgan Stanley said the midstream sector's fundamentals are relatively strong as coronavirus vaccines roll out.

"We have ... an attractive view on midstream, driven by re-opening progress/end-market demand improvement, durable above-market free cash flow yields, and emerging opportunities to participate in the energy transition," the analysts told clients April 15.

Still, investors will be looking to see more of the capital discipline that pipeline firms imposed in 2020. Kinder Morgan Inc., which kicks off the reporting season on April 21, has cut capital spending and held off on launching a third Permian gas pipeline project.

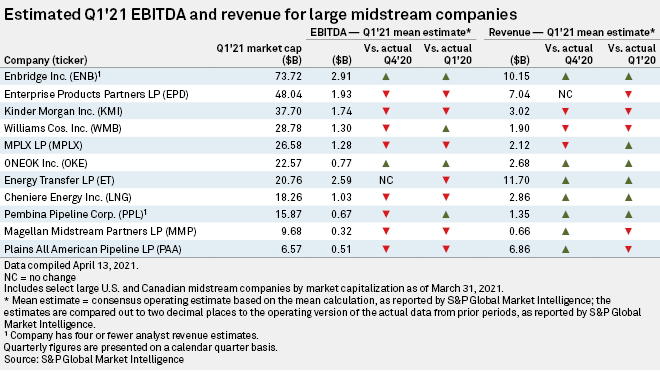

According to analyst consensus, the 11 major North American pipeline companies analyzed by S&P Global Market Intelligence should mostly record year-over-year and quarter-over-quarter losses in adjusted EBITDA, even though revenues will likely increase.

The severe winter storm, which left millions of Texas customers without electricity in February, is a major factor in these lopsided expectations, according to Raymond James & Associates' Justin Jenkins.

"It's definitely going to move results in a pretty meaningful way, both up and down depending on where you were exposed either to the cost or the volume side of the equation," Jenkins said in an interview. "Most of the conversation wants ... to ignore the first-quarter noise because it's very much a one-time event in nature."

Analysts at UBS agreed that investors will be focused on determining which companies benefited or saw negative impacts. "We believe those with gas storage (for their own use) were likely able to see some positives and [we] specifically highlight [Energy Transfer LP] as favorably exposed; however, most positives were likely partially offset by downtimes, ethane rejection and higher power costs," they told clients April 6.

Enterprise Products Partners LP, Crestwood Equity Partners LP and Oneok Inc. were also "favorably exposed," while DCP Midstream LP and Western Midstream Partners LP saw "headwinds," the UBS analysts added.

Energy Transfer has sued pipeline customers to collect on bills related to the storm. Subsidiaries Houston Pipe Line Co. LP and ETC Marketing Ltd. in March alleged that Valero Energy Corp. affiliates Premcor Refining Group and Diamond Shamrock Refining Co. LP refused to pay a combined $69 million for gas delivered during the week of the storm. Houston Pipe Line and ETC Marketing withdrew the lawsuit after Premcor and Diamond Shamrock paid all the money they owed, an Energy Transfer spokesperson confirmed.

Energy Transfer remained on the offensive with City Public Service of San Antonio, also known as CPS Energy, after the Energy Transfer subsidiaries Houston Pipe Line and Oasis Pipeline LP filed a counterclaim in March against the utility's price gouging claims.

As the world transitions toward cleaner energy sources, pipeline and LNG exporters will try to guard against the potential for declining global gas consumption. Cheniere Energy Inc., the biggest U.S. LNG exporter and the country's biggest individual physical consumer of gas, said in February it would give its LNG customers emissions data associated with each cargo it produces at its Sabine Pass and Corpus Christi terminals.

In March, NextDecade Corp. launched an aggressive carbon capture project tied to its proposed Rio Grande liquefaction terminal in Texas. It announced April 19 that it will partner with Project Canary Inc. to certify that gas supplied to the project is responsibly sourced. In the upstream sector, several producers have already partnered with Project Canary, including EQT Corp. and Chesapeake Energy Corp.

With strict carbon emissions goals, European utilities have felt pressure to stay away from new deals for importing U.S. shale gas. In November 2020, France's Engie SA said it had halted talks with NextDecade about a supply deal tied to the Rio Grande LNG facility.

Harry Weber is a reporter with S&P Global Platts. S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.