S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

11 Oct, 2021

By Sydney Price

After a sudden and drop in demand in the government's ongoing auction of mid-band spectrum, analysts are now theorizing that a large bidder chose to drop out, potentially putting the success of the entire auction at risk.

The Federal Communications Commission kicked off Auction 110 on Oct. 5, offering up 100 MHz of contiguous spectrum in the 3.45 GHz band. Mid-band spectrum is considered crucial for next-generation 5G networks because it balances speed and range, providing broader coverage than high-band spectrum and faster speeds than low-band spectrum.

While the auction got off to a strong start, there was a notable drop in demand in the 10th round of bidding on Oct. 8, signaling that a major player may have dropped out. With telcos and other wireless players having already spent a record-setting $81.17 billion on mid-band spectrum in an auction earlier this year, analysts note that if more players decide to stay on the sidelines, the current auction may fail to reach the FCC's auction reserve price of $14.8 billion.

Verizon: In or out?

Based on the timing and size of the drop in demand on Oct. 8, New Street Research analyst Philip Burnett believes it was Verizon Communications Inc. that decided to back down. Identities of bidders remain anonymous until results are released after all bidding is finished. A total of 33 bidders qualified for participation, including Verizon, AT&T Inc. and T-Mobile US Inc.

"When a sharp drop in demand occurs in a single round, we tend to assume it was a single bidder. ... The timing and size of the move suggests a single, large bidder fully dropped out of most of the top 132 markets," Burnett wrote in a research note.

|

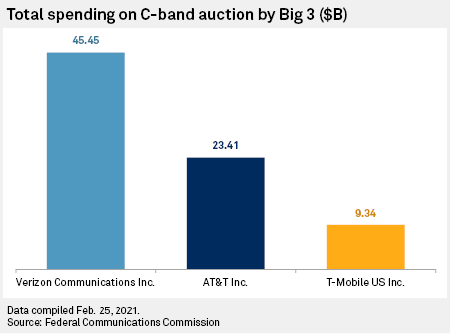

Burnett noted that he and others "have always assumed Verizon would drop out of the auction" given that the telco spent $45.45 billion on C-band spectrum in the FCC's previous mid-band auction, when the FCC offered 280 MHz of spectrum in the 3.7 GHz-3.98 GHz band. The amount is almost 2.5x Verizon's capital expenditures in 2020, according to S&P Global Market Intelligence.

Without Verizon's participation, the auction may be in danger of failing to meet the FCC's reserve price, especially if another major carrier drops out. But an impasse may be what wireless carriers have intended.

"Verizon has a strong lead in 3GHz spectrum following the C-Band auction [earlier this year]. We are sure they wouldn't mind if the auction failed completely," Burnett said.

The T-Mobile question

A big question for analysts is to what degree T-Mobile will participate in the auction. On one hand, the company has no need for more mid-band spectrum in the wake of its 2020 purchase of Sprint's massive 2.5 GHz spectrum holdings. On the other, it does not want other carriers catching up to its spectrum lead.

"I do believe that T-Mobile will bid in this auction, if for no other reason to deny competitors (i.e., AT&T) the ability to get spectrum too cheaply," Chief Operating Officer at BitPath Sasha Javid wrote.

Burnett noted that T-Mobile may be hoping Auction 110 fails altogether to keep the 3.45 GHz spectrum out of competitors' hands.

Auction 110 may be the last near-term opportunity for wireless carriers to acquire mid-band spectrum, said Lynnette Luna, an analyst at Kagan, a media research group within S&P Global Market Intelligence. As such, she expects AT&T to bid high despite potential financial concerns.

"While AT&T is likely to be the most aggressive in bidding, there is also concern about the operator's debt load. It may not have a choice as it needs to stay relevant against its nationwide competitors," Luna said.

AT&T has already spoken out about trailing other carriers in terms of its mid-band spectrum holdings. Last month, AT&T asked the FCC to update its rules to prevent any single company from acquiring too much mid-band spectrum.

Unique features of Auction 110

Auction 110 imposes a 40-MHz cap for the amount acquired by a single bidder. This auction also requires companies to use frequencies that must be shared with the Department of Defense, its existing user.

Javid wrote that he expects the new restrictions to be one reason the participants will not bid up prices as high as the previous 2021 auction.

"This 40-MHz cap in particular could suppress auction revenues because carriers generally prefer larger contiguous blocks for their 5G services," he wrote.

"By my estimates, roughly 18 percent of the MHz-POPs will be subject to coordination at the close of the auction. ... It will be interesting to see if there is any impact on spectrum prices for these 'impaired' blocks as the auction progresses," Javid added regarding the required spectrum sharing with the Defense Department.

Major cable players sit out

Neither Comcast Corp. nor Charter Communications Inc. filed applications to participate in Auction 110. Both qualified for the C-band auction that took place earlier this year, but neither placed a bid.

Both Comcast and Charter largely rely on mobile virtual network operator agreements, Wi-Fi off-loading and cheaper spectrum options for their wireless offerings, Kagan's Luna said, so the costs associated with Auction 110 may be unreasonable for both companies.

"It is also not surprising that cable companies are sitting this out, as they are very cost conscious when it comes to the wireless business, which they see as an augmentation to their broadband services," Luna wrote.