S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Apr, 2022

By Anser Haider

Microsoft Corp. is expected to maintain its streak of profitable quarters on the enduring strength of its cloud business when the company reports earnings April 26.

Microsoft's cloud services drove much of the company's better-than-expected earnings and revenue results for the past four quarters, and analysts expect an encore in the company's upcoming fiscal third-quarter report given the continued acceleration of digital transformation across many enterprises.

"Microsoft continues to represent a rare combination of strong secular positioning and reasonable profitability-based valuation within the software space," said Keith Weiss, an equity analyst at Morgan Stanley.

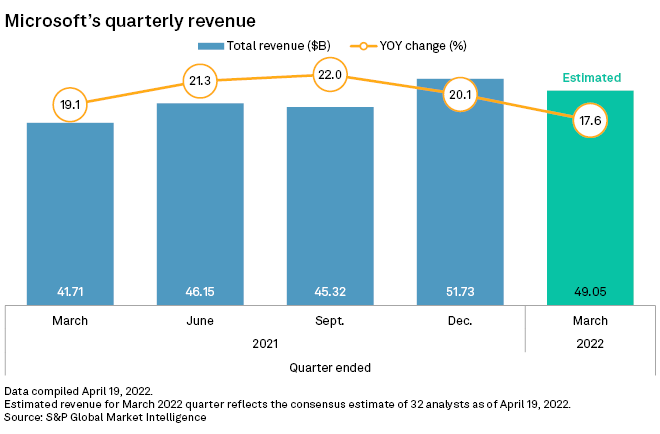

For its fiscal third quarter ended in March, Microsoft is expected to post revenue of $49.05 billion, up 17.6% from the year-ago quarter, according to S&P Global Capital IQ estimates.

Cloud growth picks up

Microsoft's Azure cloud platform has been the backbone of growth for the company amid the COVID-19 pandemic. As a result, the company's Intelligent Cloud segment, which includes a variety of products including Azure, has consistently been Microsoft's top-performing segment.

After several quarters of 50% year-over-year growth for Azure during the pandemic, its gains fell slightly to 46% in the most recent quarter. Azure's year-over-year growth rate is expected to remain at 46% in the March period.

Azure's growth rate is supported by digital transformation initiatives as companies are increasingly turning away from legacy apps in favor of cloud-based offerings from providers such as Salesforce Inc., ServiceNow Inc. and Workday Inc. Those expanding app installs, in turn, are supported by services from Azure, Amazon Web Services Inc. and Alphabet Inc.'s Google Cloud, said John Freeman, vice president of equity research at CFRA Research.

"There is plenty of fuel in the cloud migration tank to drive much of that growth to Azure and the other big cloud infrastructure providers," Freeman said. "Competitively, there is really no way a new entrant can catch up to the sheer scale of the big three and be a player in the mainstream cloud market."

Of the big three cloud providers, however, Microsoft is expected to gain the most market share in the next three years.

A Morgan Stanley survey of about 100 chief information officers across the U.S. and Europe found that 42% of respondents expect Microsoft to gain the largest IT share as a result of a shift to the cloud, followed by Amazon at a distant No. 2 at 17%.

The survey also found that 43% of respondents expect Microsoft to maintain its lead over the next three years.

Activision deal

Microsoft's gaming division is also increasingly in the spotlight, as its record $68.7 billion deal to acquire Activision Blizzard Inc. faces mounting scrutiny.

The high level of regulatory attention makes the deal more vulnerable to failure, which could potentially derail Microsoft's plans to add Activision's games to its Xbox ecosystem, including the Game Pass subscription service, said CFRA's Freeman.

"The deal has bigger question marks than I first thought," Freeman said. "I have a feeling that if it does go through, Microsoft will have to reorganize Game Pass and all its video game-related services in some way."

Even if Microsoft has to make compromises to win regulatory approval for the acquisition, it could be worth it for the company to fold in Activision's intellectual property, which consistently drove revenue of more than $2 billion per quarter in 2021.

"Activision has nearly 400 million monthly active users across 190 countries that play its games across consoles, PCs and mobile devices," said Chirag Upadhyay, an analyst at market research firm Strategy Analytics. "This deal will allow Microsoft to reach broader audiences across multiple platforms while expanding its gaming footprint across the globe."

On the gaming hardware side, Microsoft continues to grapple with supply chain shortages impeding production and sales of its Xbox video game consoles.

"We're working as fast as possible with our manufacturing and retail partners to expedite production and shipping to keep up with the unprecedented demand," a Microsoft spokesperson told S&P Global Market Intelligence.

Office price bump

Microsoft also stands to see some additional revenue growth from its Office enterprise software following a price increase the company implemented for most of its commercial customers in March.

"The price increases definitely would make a revenue growth difference but do not seem so draconian for the end user to prompt any significant abandonment of Microsoft Office, which, let's face it, still has no real competitor in basic productivity tools," said Freeman.

Office may have benefited from a pull forward given the price increases went into effect March 1 as some customers may have renewed before the increase, said Jefferies analyst Brent Thill. Upside for Office revenue may be more limited for the rest of this calendar year as a result, Thill added.

Office also faces potential headwinds from slowing growth in the PC market. According to a report from IDC, global PC shipments fell 5.1% year over year in the March quarter.

The "Office 365 juggernaut is likely to begin a gentle deceleration," given the high penetration rate among commercial PC users as well as a slowdown in work-from-home demand that was spurred by the pandemic, said UBS analyst Karl Keirstead.