Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Apr, 2022

By Anser Haider

Microsoft Corp. is gaining ground on Amazon.com Inc. in the cloud-computing market, and the software company's rapid ascent has drawn the attention of European regulators.

The European Commission is circulating a questionnaire to Microsoft customers and rivals to gauge whether the company may be using its dominant position in the market to stifle competition with its cloud business and licensing deals. Analysts say while Microsoft has grown its business by leaps and bounds in Europe, growth in multicloud strategies leaves plenty of room for competitors big and small.

The questionnaire follows an antitrust complaint filed by French cloud-computing services provider OVH Groupe SA's OVHcloud and two other companies that accused Microsoft of making it very difficult for users of its cloud-computing services to switch to those of a competitor.

"We can confirm indeed that the commission has received the complaint," a European Commission spokesperson told S&P Global Market Intelligence, adding that the agency cannot share any additional information at this stage.

OVHcloud confirmed in a statement that it filed a joint complaint against Microsoft with two other European plaintiffs.

"Through abusing its dominant position, Microsoft undermines fair competition and limits consumer choice in the cloud computing services market," an OVHcloud spokesperson said.

In a response to an email seeking comment, a Microsoft spokesperson said the company is continuously evaluating how to best support partners and make Microsoft software available to customers across all environments, "including those of other cloud providers."

The Big 3

The three largest cloud providers in the world — Amazon, Microsoft and Alphabet Inc. — account for 69% of the European cloud market, according to Synergy Research Group. In comparison, the largest European cloud provider, Deutsche Telekom, holds only a 2% share of the European market, followed by OVHCloud with a 1% share.

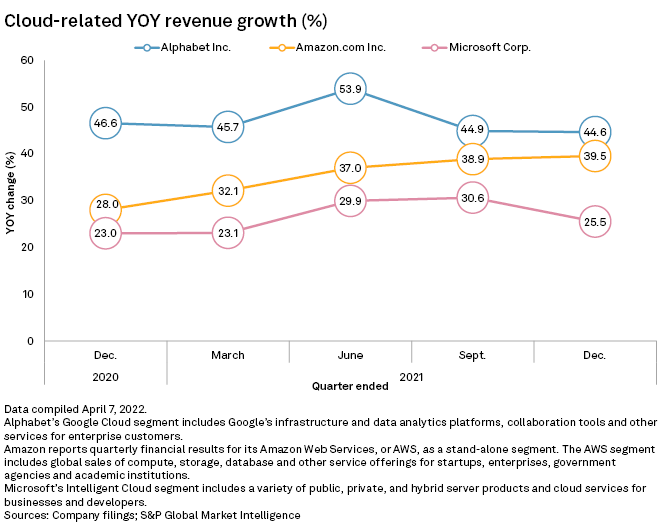

Among the top three providers, Microsoft in particular has been growing rapidly in recent years and has managed to gain considerable market share in Europe, said John Dinsdale, chief analyst and research director at Synergy Research Group.

"Microsoft's growth rate has comfortably outpaced both Amazon and Google, who themselves have been increasing their market share," Dinsdale said. "In the last three years, Microsoft's share of the European cloud market has increased by nine percentage points, and it now controls over a quarter of the market."

Microsoft's strengths

While Microsoft's cloud ambitions share some characteristics with Amazon and Google — including a strong corporate focus on cloud, willingness to continue making huge infrastructure investments and a global presence — one thing that sets it apart is the company's long-standing relationships with enterprises through a rich history of supplying software products, Dinsdale said.

"Prior to AWS, Amazon was a pure consumer play and Google also never had strong relationships with enterprise customers," Dinsdale said. "Microsoft will work hard to use its existing products and relationships to help it drive sales of new services."

Microsoft's grand vision of making its Azure cloud-computing platform "the world's computer" is also paying off as the company pursues the strategy on many fronts, said Jean Atelsek, an analyst in the cloud transformation and digital economics unit at 451 Research.

"Microsoft is appealing to developers with open-source tools and supporting multiple runtimes other than its own Windows operating system," Atelsek said. "There are alternatives to Microsoft's productivity suite, such as Google Cloud Workspace, but they don't have as much traction in the market."

AWS maintains global lead

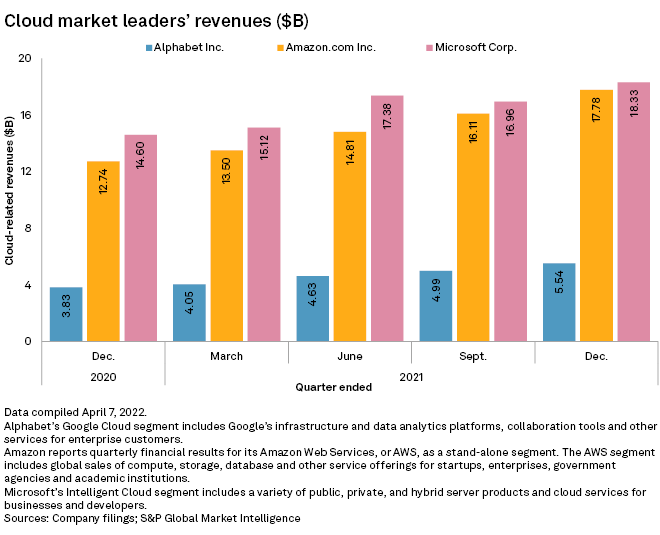

Despite Microsoft's significant growth in recent years, the company's cloud offerings still trail behind Amazon Web Services Inc. The Amazon unit's revenue grew 39.5% year over year to $17.78 billion in the quarter ended December 2021.

Although Microsoft does not disclose exact revenue for its cloud offerings, the company's intelligent cloud segment, which includes Azure as well as server products, grew 25.5% over the prior year to $18.33 billion. Cloud services alone saw revenue growth of 46%.

Meanwhile, Alphabet's Google Cloud, which trails behind the top two providers at a distant third place, saw the most significant year-over-year growth in the December 2021 quarter, with revenue up 44.6% to $5.54 billion.

"It's pretty noteworthy that if you look at the three big cloud businesses, AWS not only remains the market leader but continues to maintain steady growth rates," said Scott Kessler, global sector lead for TMT at research firm Third Bridge.

Path forward

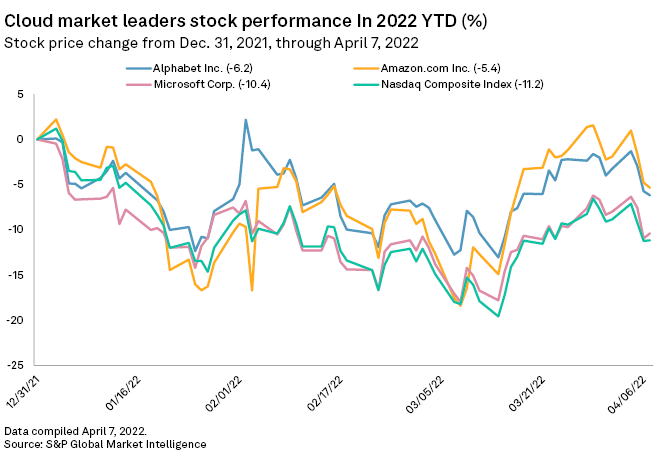

Although Microsoft has largely avoided the intense regulatory scrutiny that many Big Tech companies have attracted in recent years, it is not surprising that it is now drawing attention over concerns that its cloud growth may be coming at the expense of smaller competitors, Kessler said.

"Big tech companies have targets on them, and they are being put in positions where they need to not just provide great products and services, but also try to do so in a way that is perceived positively by everyone, from customers to other constituencies including regulators and legislators," Kessler said.

Microsoft could soften the scrutiny by easing off on aggressively bundling free software deals into its cloud contracts, a practice competitors can rightfully argue gives the company an unfair advantage in the space, said John Freeman, vice president of equity research at CFRA Research.

"However, there are a lot of enterprises that have developed their own apps using Microsoft's .NET framework software, and they could argue that they want the company to make it cost effective and easy for them to migrate to the cloud," Freeman added. "So, removing these perks to satisfy the competition could badly impact clients who heavily rely on these offerings."

Rising tide

However, in the long run, analysts think there is plenty of space in the cloud market for Microsoft and other cloud providers, both big and small, to further grow their respective operations due to the growing trend of relying on multiple cloud operators.

"When it comes to the cloud, it can be easier in some cases to have interoperability across different platforms and solutions, so the concept of multicloud is getting very prevalent," Kessler said, adding that Snowflake Inc. is a great example of a provider whose business is predicated on companies pursuing a multicloud strategy.

Three out of four enterprises are now using more than one cloud provider, primarily as a way to leverage best-of-breed services as well as insurance to avoid locking themselves into a single provider, according to 451 Research.

"We're still very much in a land-grab situation when it comes to attracting enterprise workloads to cloud," Atelsek said. "Azure and Google Cloud stress their multicloud capabilities as a way of setting themselves apart from AWS."

451 Research is part of S&P Global Market Intelligence.