S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

24 Feb, 2023

By Kip Keen

| Russia's invasion of Ukraine in 2022 pushed some potash buyers to seek product from countries including Canada, which produces potash from underground mines such as the one pictured above. Source: Gary Gladstone/Stockbyte via Getty Images |

Russia's fertilizer exports have rebounded from the fallout of the country's February 2022 invasion of Ukraine, calming the panic over potential supply deficits and raising expectations that Russia will continue exporting potash at close to pre-war levels.

|

However, the country's expansion plans have been disrupted and customers are looking to other potash producers to diversify their supply chains.

Russia and key ally Belarus have typically accounted for about a third of the potash market in recent years. Canada, another top producer, also supplies about a third of the global market.

In the year since the invasion of Ukraine, Russia has continued to supply the market at roughly 85%-90% of its usual capacity, analysts told S&P Global Commodity Insights. There has been some self-sanctioning, especially by European and U.S. buyers, but otherwise top potash consumers such as Brazil have largely continued to buy Russian product.

The invasion's most lasting impact for the potash market will be on trade flows, according to analysts and industry executives. Canada will likely fill some gaps as buyers avoid Russian product, especially in the EU and the U.S.

"What we're talking about is not a change in supply-demand dynamics," said Ben Isaacson, a Scotiabank fertilizer analyst. "We're actually talking about change in trade flows. It's just musical chairs."

Canada fills the gap

Executives at Nutrien Ltd., a Canadian potash miner, expect global potash shipments to be in the range of 63 million to 67 million tonnes in 2023, up slightly from estimated 2022 shipments.

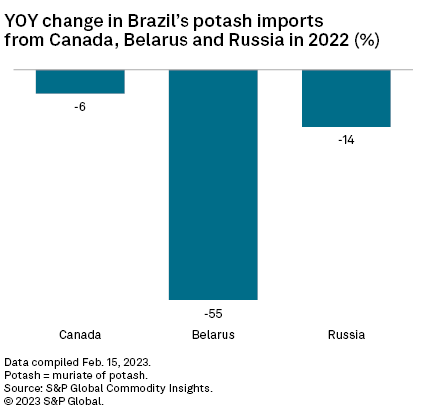

Brazilian imports of Russian muriate of potash, a major form of the product, fell 13.7% year over of year in 2022, according to S&P Global Market Intelligence data. Much of the dip came soon after the invasion, as Brazil fell back on its mineral reserves and turned to other countries such as Canada. Imports of Russian potash decreased more heavily in countries including the U.S., down 38.7% year over year in 2022, and throughout Europe, which slapped a 837,570-tonne quota on Russian imports for 2022.

European muriate of potash imports from Russia fell 77% year over year to 360,000 tonnes in 2022, said Kwadjo Ahodo, a potash analyst with Commodity Insights, citing preliminary trade data. Meanwhile, European imports of muriate of potash from Canada climbed about 66% year over year to 1.1 million tonnes in 2022.

"As long as the war continues and sanctions on banking and insurance remain, there will be some level of difficulty in trading Russian potash, and self-sanctioning of Russian potash," Ahodo said in an email. "And EU and U.S. buyers will continue to fill their import gaps with product from Canada or elsewhere."

Russian project delays

In the longer term, major potash expansions in Russia and neighboring Belarus are likely to be slower coming online as a result of the invasion of Ukraine and the subsequent geopolitical fallout. New projects will be delayed in Russia and Belarus, which account for about 60% of planned potash mining expansions over the next five years, Ken Seitz, CEO and president of Nutrien, said on a Feb. 16 earnings call.

The delays could open the door for producers beyond Russia and Belarus to grab market share or support higher potash prices in coming years.

"We expect there will be some delays to these projects," said Humphrey Knight, a fertilizer analyst with research consultancy CRU Group. "How much ... is very hard to know."

While Russia's potash industry has largely avoided direct sanctions, its financial industry has not, making trade in equipment and services from countries such as the U.S. much harder. This could make project development more difficult.

"The Russians, although they're able to get their product out, are largely cut off from international financing [for mining projects]," said Matt Simpson, CEO of Brazil Potash Corp, a junior developer that has plans to build a large potash project in Brazil. "And I would assume that only half of the new tonnage that was supposed to come from Russia will actually be constructed, which means we will find ourselves in a longer-term supply deficit. And that's going to support higher prices."

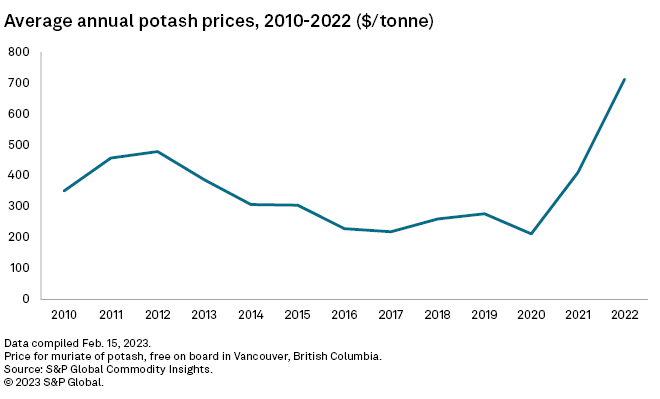

Potash prices have recently traded in the $500 per tonne range after skyrocketing in 2022, breaking over $1,000/t in top markets such as Brazil, Scotiabank's Isaacson noted. The price climbed in early 2022 — in response to sanctions implemented by the U.S. in late 2021 that cut off Belarus from shipping its potash through Lithuania — and surged even higher after Russia invaded Ukraine. Belarus was forced to reroute through Russia and was only able to ship about 40%-50% of its typical output in 2022, analysts said.

Isaacson expects Russian potash expansions to face delays, but said they will ultimately get built. "If it's not [funded] by the Russian oligarchs, it will be financed by the Chinese," he said.

Diversifying supply

The invasion and supply chain disruptions in 2022 have pushed some countries to accelerate plans to depend less on Russia and Belarus for potash.

In 2022, Brazil committed to lowering its dependence on fertilizer imports from 85% to 45% by 2050. With this kind of announcement, Russia may see its potash market share fall in the decades to come as countries increase focus on security of supply.

"That was the wake up call for the world," Simpson said, referring to Russia's invasion of Ukraine. "It's not just Brazil exposed. The world's food security is exposed when you've got so much of this essential nutrient in the hands of [Russian President Vladimir] Putin and [Belarusian President Alexander] Lukashenko."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.