S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

3 May, 2023

By Alex Graf and Zuhaib Gull

As the financial industry wrestles with depressed stock valuations and low M&A volume, mergers of equals have become increasingly attractive for community banks.

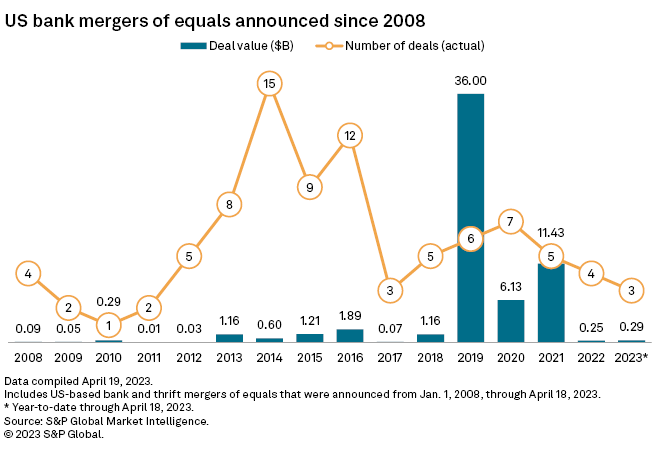

In what is shaping up to be a historically slow year for bank M&A, mergers of equals (MOEs) make up an unusually large portion of the deals announced so far in 2023. US banks have announced three MOEs so far this year, representing nearly 11% of the 28 US bank deals announced through May 2. Strikingly, MOEs returning to vogue comes after they hit a five-year low in 2022.

In a depressed M&A environment in which there is a dearth of buyers offering a higher premium, it can be easier for a bank board to

"In an MOE, the parties by definition aren't usually focused on an acquisition premium," Mercer Capital Partners managing director Jeff Davis said in an interview. "It often can be a win-win when there's not any focus on 'what is the price?'"

Putting premiums aside

With bank stock prices at their current low, MOEs become more attractive as banks focus less on deal premiums and more on the benefits of a merger, Davis said.

Community banks can use MOEs to create operating leverage and spread their overhead costs across larger asset bases, Davis said. Such deals can also help smaller institutions manage rising technology costs or create larger and more attractive franchises as an intermediate step toward selling to a larger institution, he added.

"The benefits that you get from doing a merger of equals are really going to be related to scale, such as balance sheet and business line diversification as well as the efficiencies that come with scale," Hovde investment banker Sean Enright said in an interview.

Wheeling, W.Va.-based Main Street Financial Services Corp. and Wooster, Ohio-based Wayne Savings Bancshares Inc. are doing just that with their MOE, announced in February. The two banks were more focused on the benefits of their combination rather than getting the highest multiple, Wayne Savings President and CEO James VanSickle ll said in an interview.

Combining Wayne Savings and Main Street Financial Services will allow them to expand their branch footprint faster than they ever could as stand-alones, VanSickle said. The deal enhances shareholder value and its scale allows the combined company to better serve customers, Main Street President and CEO Rich Lucas said in an interview.

"In today's market, you really do have to look to enhance shareholder value, but still be able to deliver to the customer," Lucas said.

Concentrated among community banks

Of the 20 most recently announced US bank MOEs, the vast majority involved community banks. As such, the average asset size of the buyers involved in those 20 deals was $8.45 billion, while the targets had an average asset size of $8.68 billion.

The three MOEs announced so far this year all involved community banks. Future MOE activity will likely remain concentrated among community banks, especially because national and regional banks are more concerned about liquidity right now and have less appetite to make acquisitions, Lucas said.

Investment bankers expect more MOE announcements this year as the wider dealmaking environment remains weak.

"Mergers of equals are probably the ones that are going to make the most sense," Enright said. "True mergers of equals will continue to be a high percentage of the deals."