S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Jan, 2025

By Tom Jacobs

|

An aerial view of neighborhoods destroyed by the Palisades Fire on Jan. 9. |

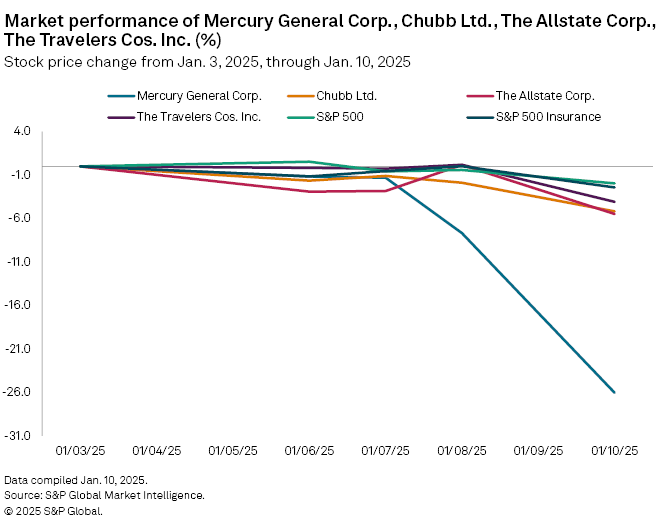

Los Angeles-based Mercury General Corp., which writes the bulk of its business in California, was the worst-performing insurance stock this week as historic wildfires raged through Southern California.

Mercury's share price plunged more than 27% for the week through 2:20 p.m. ET on Jan. 10. Other insurers with significant exposure in the Golden State also saw their shares decline as loss estimates from the Los Angeles-area fires continued to soar.

Chubb Ltd., which has exposure to high-value homes in the region, was down 5.3%. Other prominent P&C carriers in the state include The Allstate Corp. which was down 6.2%, while The Travelers Cos. Inc. and American International Group Inc. were down 3.8% and 3.2%, respectively.

The S&P 500 Insurance Index was down 2.89%, while the broader S&P 500 was off 1.73%.

The five fires, including the Palisades fire, the Eaton fire, and the Hurst fire, had scorched almost 36,000 acres as of mid-morning on Jan. 10. More than 10,000 structures have been destroyed and at least 10 deaths have been attributed to the blazes. AccuWeather revised its preliminary damage and economic loss estimates, increasing them to a range of $135 billion to $150 billion from $52 billion to $57 billion.

J.P. Morgan analyst Jimmy Bhullar in a research note estimated that insured losses for the industry are "roughly $20 billion." The wildfires are "a modest negative for personal lines carriers and reinsurers" in the near term but does not change his view on the sector's stocks.

Sizable but manageable

Even with the looming possibility of additional damage, Keefe Bruyette and Woods analyst Meyer Shields said insured losses should be "sizable, but very manageable" when looking at the preliminary estimates.

"We went through a bigger loss with Hurricane Milton ... and it's not something that made a difference to the industry," he said in an interview.

The prospect of the loss tally running up further is significant. According to CoreLogic, there are more than 456,000 homes with nearly $300 billion in reconstruction costs within the Los Angeles and Riverside metropolitan areas. Moody's said the blazes are "likely among the most costly wildfires in the state's history."

Some investors are concerned that the incident could turn into a big loss for insurers, said Piper Sandler analyst Paul Newsome.

"It's very, very difficult to tell at this point the size of the insured loss," Newsome said in an interview. "It looks like it's going to be meaningful, meaning that you'll hear companies talk about it on the earnings calls."

That said, the industry is well-capitalized, well-versed in underwriting fire risk and has reinsurance to help cover losses.

"We would have to see a big increase in the size of these events to have a situation where we'd be concerned about insurers' solvency and I'm not worried about that at all," Newsome said.

Chubb has significant exposure to the high-net-worth homeowners market in areas such as Pacific Palisades, Shields noted, which is the home for many celebrities. The payouts for homes destroyed will surely be steep, but Chubb was sitting on $65 billion of capital at the end of the third quarter of 2024, he said.

"This is a loss that they're built to absorb," Shields added.

The road may not be as smooth for Mercury General, which is among the top 10 homeowners insurers in California by market share. Mercury writes the bulk of its business, 86%, in the Golden State. Its larger peers like Chubb, Allstate and State Farm Mutual Automobile Insurance Co., the state's market share leader, are spread throughout the country.

Mercury said in a news release that while there currently is no definitive total for losses, it expects its losses to exceed its reinsurance retention level of $150 million. Mercury did not immediately respond to a request for comment.