S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

5 Apr, 2023

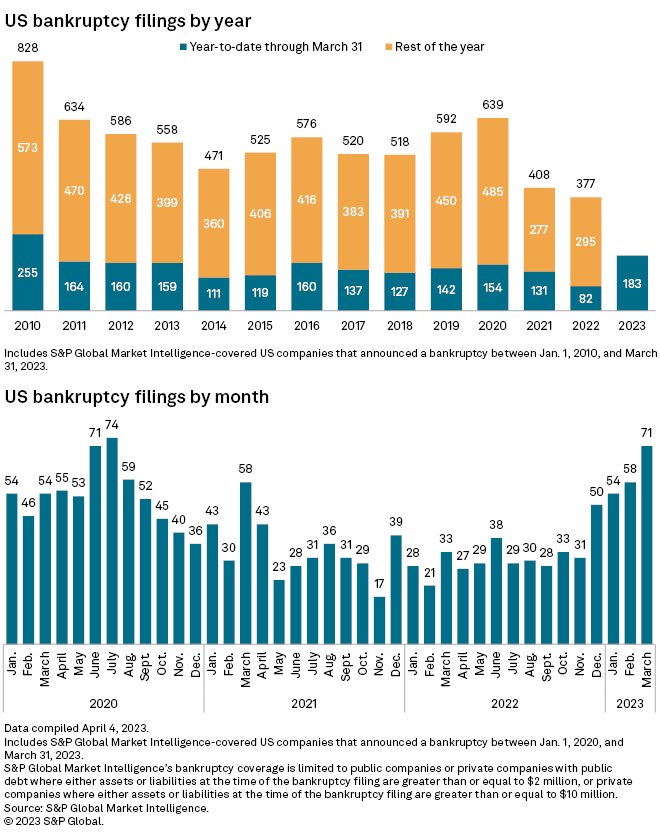

US corporate bankruptcy filings spiked in March, pushing the first-quarter tally to the highest level for the first three months of the year since 2010.

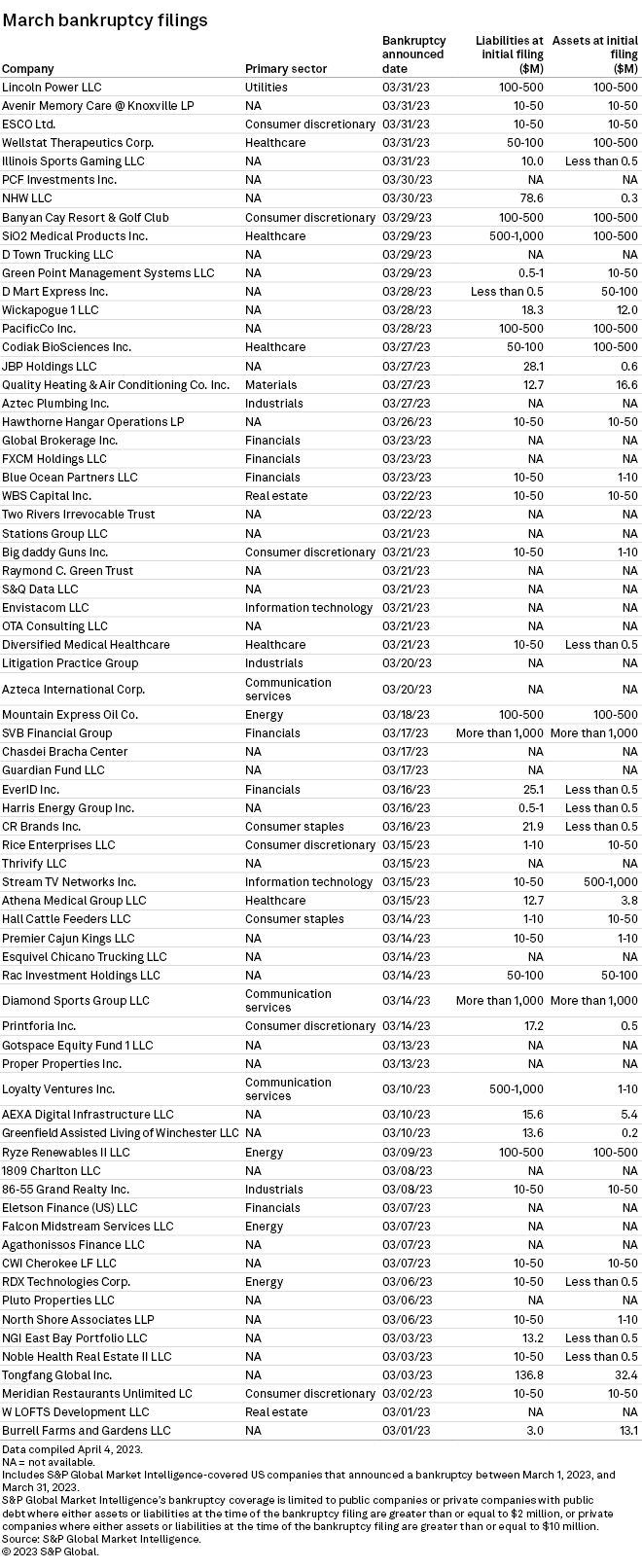

S&P Global Market Intelligence recorded 71 corporate bankruptcy petitions in March, the fourth straight month of increases and the highest monthly total since July 2020. The recent filings brought the year-to-date total to 183 as of March 31, more than any comparable period in the past 12 years.

Prominent filings

The most noteworthy filing of the month came from the banking sector, with SVB Financial Group filing for Chapter 11 bankruptcy on March 17. The largest unsecured claims in the filing came as $3.30 billion worth of senior notes, with U.S. Bank NA listed as the trustee on each. The downfall of the firm's banking subsidiary, Silicon Valley Bank, marked the second-largest bank failure in US history.

The collapse of Silicon Valley Bank was one of several major bank failures in the month, placing heightened scrutiny on the sector.

On March 8, La Jolla, Calif.-based Silvergate Capital Corp. announced its plan to liquidate banking subsidiary Silvergate Bank. Just days later, on March 12, the New York Department of Financial Services took control of New York-based Signature Bank.

– Click here to download the charts in Excel format.

– For retail-specific bankruptcy data, check out the monthly Retail Market series.

Another prominent filing during the month came March 14 with Sinclair Broadcast Group Inc.'s regional sports business, Diamond Sports Group LLC, filing a voluntary petition for reorganization under Chapter 11. The filing listed both its assets and liabilities in the range of $1 billion to $10 billion.

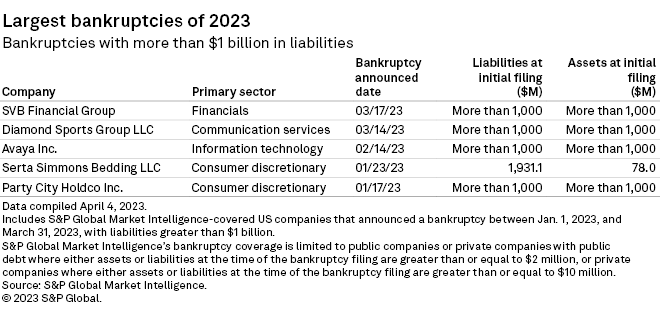

Five bankruptcy filings year to date listed liabilities in excess of $1 billion. In addition to SVB Financial Group and Diamond Sports Group in March, other large filings year to date included Avaya Inc., Serta Simmons Bedding LLC and Party City Holdco Inc.

Consumer discretionary leads filings

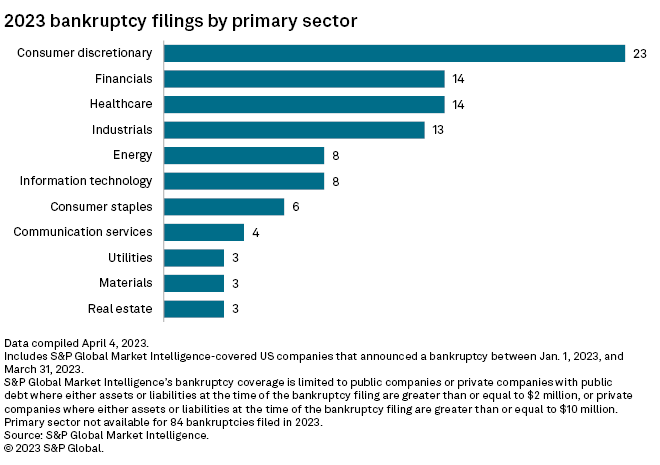

While the consumer discretionary sector still accounts for the highest number of bankruptcy filings year to date, the financials sector experienced a windfall of filings in March and is now tied for second place with the healthcare sector's 14 filings.

Editor's note: This Data Dispatch is updated on a regular basis. The last edition was published March 3.

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. S&P Global Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion.