S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Jun, 2022

By Regina Liezl Gambe and Eden Estopace

|

| An Asian Malay groceries shop owner calculating the price of an item for her customer. |

| Source: Edwin Tan via Getty Images |

Malaysia's Islamic financial technology companies are making slow progress in a booming Islamic finance market, amid competition from large local banks and a lack of funding and product offerings.

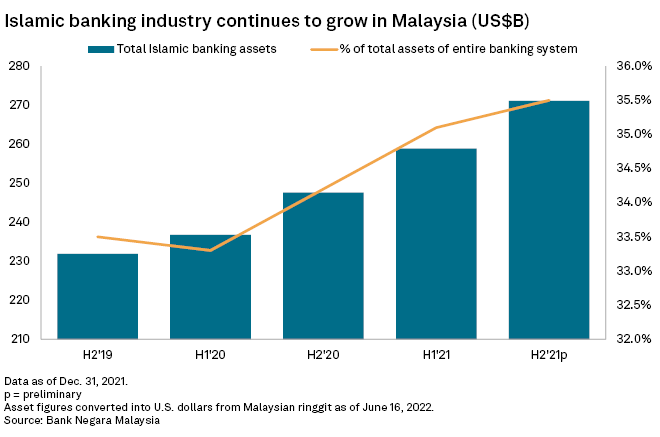

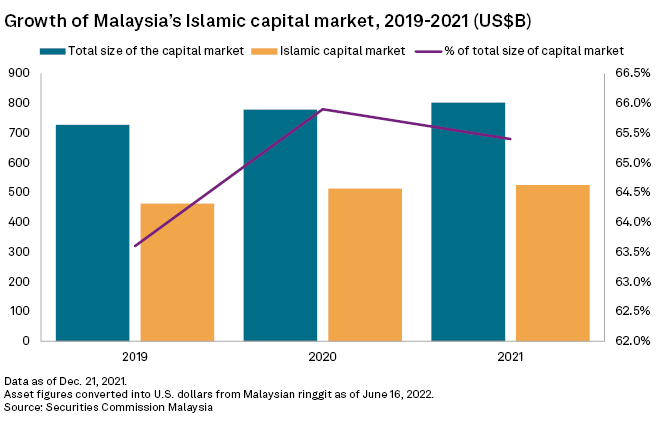

The Southeast Asian nation's nascent Islamic fintech sector was estimated to have generated about $3 billion in transaction volumes in 2021. That is a very small piece of the local Islamic finance industry, which reported assets of over $272 billion at end-2021, according to central bank data.

Islamic finance assets also represent 35.5% of total banking assets in Malaysia.

"Malaysian fintech companies typically serve niche, underserved markets such as [small and medium-sized enterprises], microfinance institutions and B40 [the bottom 40% of income earners] that do not have good access to banking products and services," said Nikita Anand, associate director at S&P Global Ratings. "As such, their target market segment is relatively small compared with that of Islamic banks in Malaysia."

Many of these fintech companies have also struggled to attract more than a few hundred million dollars in funding rounds, industry experts said.

Well-known Malaysian fintechs include crowdfunding platform Ethis Ventures, peer-to-peer microfinancing start-up MicroLEAP PLT and investment platform Wahed.

Islamic finance is a fast-growing segment of global finance, serving a population of 1.8 billion Muslims across the world. Islamic fintech companies offer technology-enabled financial services that comply with Sharia laws, which prohibit interest charges, investments in businesses profiting from prohibited products such as alcohol and gambling, profiting from debt and requiring investments to be backed by real assets.

Tough competition

Malaysia's financial services landscape is dominated by Islamic banks such as Maybank Islamic Bhd., CIMB Islamic Bank Bhd. and RHB Islamic Bank Bhd., which are part of large banking groups with huge resources and large customer bases.

Six of the top 20 Islamic banks globally are headquartered in Malaysia — Maybank Islamic, CIMB Islamic Bank, Bank Kerjasama Rakyat Malaysia Bhd., RHB Islamic Bank, Bank Islam Malaysia Bhd. and Public Islamic Bank Bhd. — according to The Asian Banker's 2021 ranking of the 100 largest Islamic banks and financial holding companies.

The country also boasts a highly banked population — about 92% of the general population had a bank account — according to a 2018 central bank survey, the latest available data.

Despite tough competition from banks, the Islamic fintech sector in Malaysia is expected to grow by a compound annual growth rate of 23% to $8.5 billion by 2025, according to the Global Islamic Fintech Report 2021 published in May. "Malaysia offers the perfect platform for Islamic fintech companies to roll out their product offerings before tapping into other Muslim-majority countries," the report said, noting that the government has been instrumental in providing support to Islamic finance and digitalization.

No unicorns yet

Southeast Asia is fertile ground for fintech development as the COVID-19 pandemic encouraged large-scale demand and adoption of digital financial services.

In Malaysia, the Malaysia Digital Economy Corp., an agency tasked with developing the nation's digital economy, has rolled out several measures in recent partnerships with regulators, financial institutions and other stakeholders.

One such initiative is digital financial inclusion, aimed at improving the knowledge of customers in the bottom 40% of income earners and micro-SMEs about financial services. The collaboration, in partnership with 11 fintech companies, has onboarded 2,300 users from the three main product offerings, mainly microfinancing, microinvestments and microinsurance.

There are also collaborative programs between the central bank and the Malaysia Digital Economy Corp. to help fintech companies, both local and international, to develop their products and services by offering legal and compliance, business model and technology assistance.

Yet, the country has not produced a single fintech unicorn, or a startup valued at over $1 billion, compared to regional neighbors such as Indonesia, the Philippines and Vietnam, all of which have developed at least one $1 billion-plus startup.

Fintech startups in Southeast Asia netted $4.70 billion in 217 deals in 2021, up from $1.13 billion across 118 deals in the prior year, according to S&P Global Market Intelligence data.

In Malaysia, fintech startups raised $116.9 million across 16 funding rounds in the first nine months of 2021, with payments companies sealing five of those, including electronic money company BigPay's $100 million transaction, according to the FinTech in ASEAN 2021: Digital Takes Flight report by United Overseas Bank, released in November 2021.

Funding challenges

Limited funding remains a key hurdle in the growth of Islamic fintech entities in the country.

The Southeast Asian nation has sought to establish itself as an international center for Islamic finance, but still has some way to go before it can catch up with other leaders such as the United Arab Emirates and Saudi Arabia, which have rapidly deployed capital to attract fintech startups, said Syakir Hashim, senior vice president at digital investment platform Wahed Invest.

The platform, which has investors such as Wa'ed Ventures, the venture capital arm at Saudi Aramco Entrepreneurship Center, allows users to invest in a portfolio of Sharia-compliant stocks, commodities and Islamic bonds.

The Islamic finance sector is still finding its feet on how to bring its offerings to scale, Hashim said. Most venture capitalists are based in non-Muslim countries like the U.S., the U.K. or Singapore, where Islamic finance does not have a strong presence, Hashim added.

“Unfortunately, Islamic finance is not huge in these markets. So, the people who are interested in technology are not exposed to this world of finance," Hashim said.

As a result, Malaysia has yet to see funding rounds beyond the hundred-million-dollar ticket size for Islamic fintech companies.

Product paucity

Islamic fintech companies have also focused mainly on the consumer market with lower transaction volumes and do not offer a full spectrum of services and products, said Othman Abdullah, CEO of Islamic banking at software company Silverlake Axis.

The potential for growth exists, Abdullah said. Technology could be utilized, for example, to effectively manage the collection and distribution of waqaf, or voluntary charitable donations, and zakat, an Islamic religious obligation for all qualified Muslims to donate a certain portion of wealth each year to charitable causes. This presents an opportunity for Islamic fintech players to come up with Sharia-compliant solutions, Abdullah said.

In Southeast Asia, most of the 62 Islamic fintech companies were involved in equity crowdfunding, deposits and lending and alternative finance, according to the Global Islamic Fintech Report 2021.

Companies also require market access to expand their coverage through collaborations with local and international Islamic financial institutions, Abdullah added.