Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Apr, 2022

By Komal Nadeem and Husain Rupawala

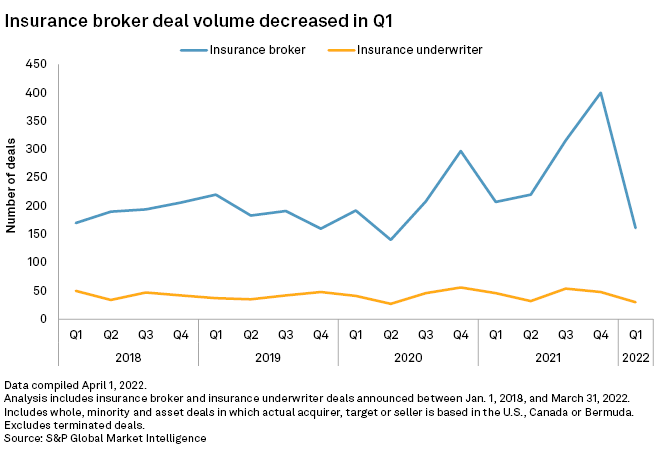

Transaction activity across the insurance industry slowed year over year in the first quarter, according to an S&P Global Market Intelligence analysis.

M&A volume down, values mixed

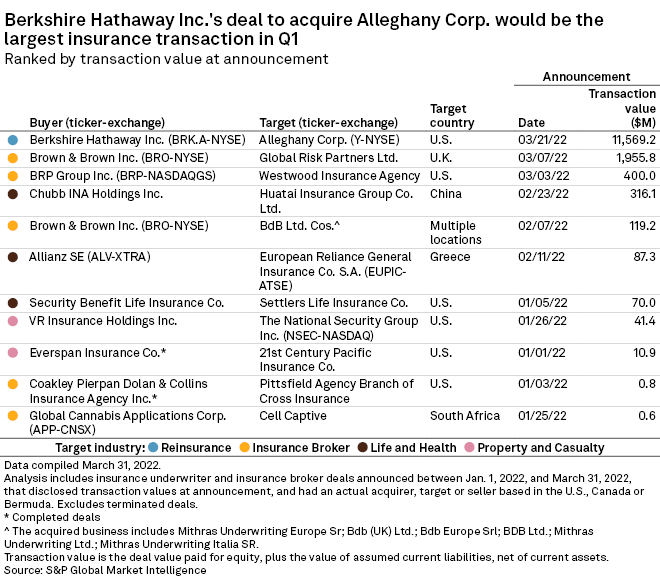

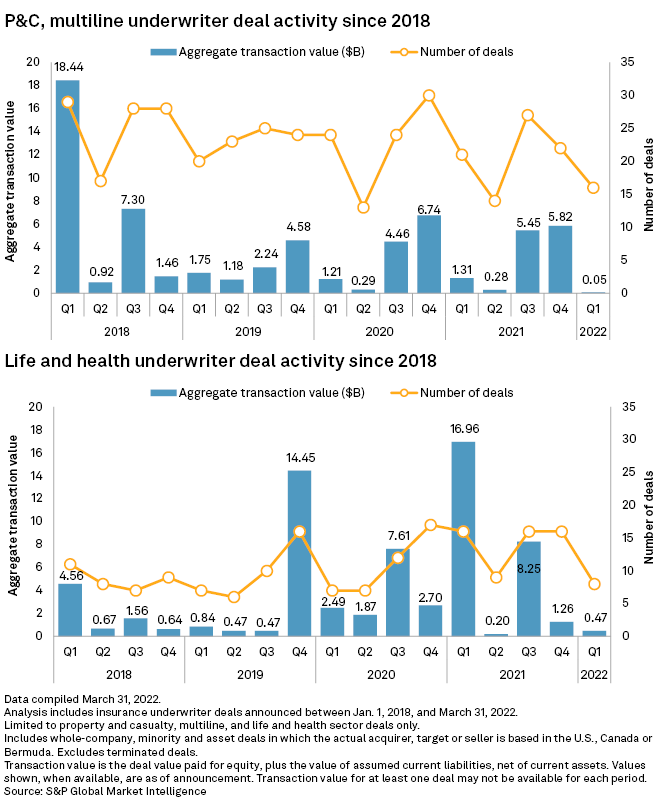

There were a total of 30 deals involving insurance underwriters announced in the first quarter, with an aggregate value of $12.09 billion. That was down from 46 transactions with a combined value of $22.72 billion in the year-ago period.

The analysis showed 161 insurance broker deals announced in the period, with a combined transaction value of about $2.48 billion. That compared to 207 broker deals disclosed in the first quarter of 2021, which had an aggregate value of $618.0 million.

Berkshire's deal for Alleghany tops list

The largest deal announced during the first quarter was Berkshire Hathaway Inc.'s planned purchase of all of Alleghany Corp.'s outstanding shares at a price of $848.02 apiece, representing a total equity value of approximately $11.6 billion.

The Alleghany transaction is the second-largest insurance deal in Berkshire's history, trailing only its $24.59 billion acquisition of General Re Corp., announced in June 1998. Berkshire's quota share agreement with Alleghany likely provided a sense of familiarity, as the company is led by a former General Re CEO.

The second-largest deal announced in the period came on the broker side, with Brown & Brown Inc.'s proposed acquisition of Global Risk Partners Ltd. Searchlight Capital Partners LP placed the latter on the block less than two years after acquiring the business.

P&C most active in Q1

M&A activity in the property and casualty and multiline sectors declined year over year to 16 deals in the first quarter, from 21 deals in the first quarter of 2021. The life and health segment recorded eight deals, down from 16 a year earlier, while the managed care space recorded only one deal, down from four a year ago.