Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Nov, 2022

By Zoe Sagalow and Zuhaib Gull

Some bank deals are still enjoying a quick closing period despite a recent trend of prolonged closing time frames, particularly among larger deals.

While the size of a bank transaction appears to be one of the main components leading to an extended closing timeline, a number of different factors play into why some bank deals experience timely regulatory approval and a subsequent quick closing period while others do not.

Some factors that impact the pace of regulatory approval and closing include the size of the companies and if they are public or private, the purchase consideration, regulatory exam timing and if approval remains at the Federal Reserve regional bank level, according to banking regulatory attorneys.

Fastest closing deals

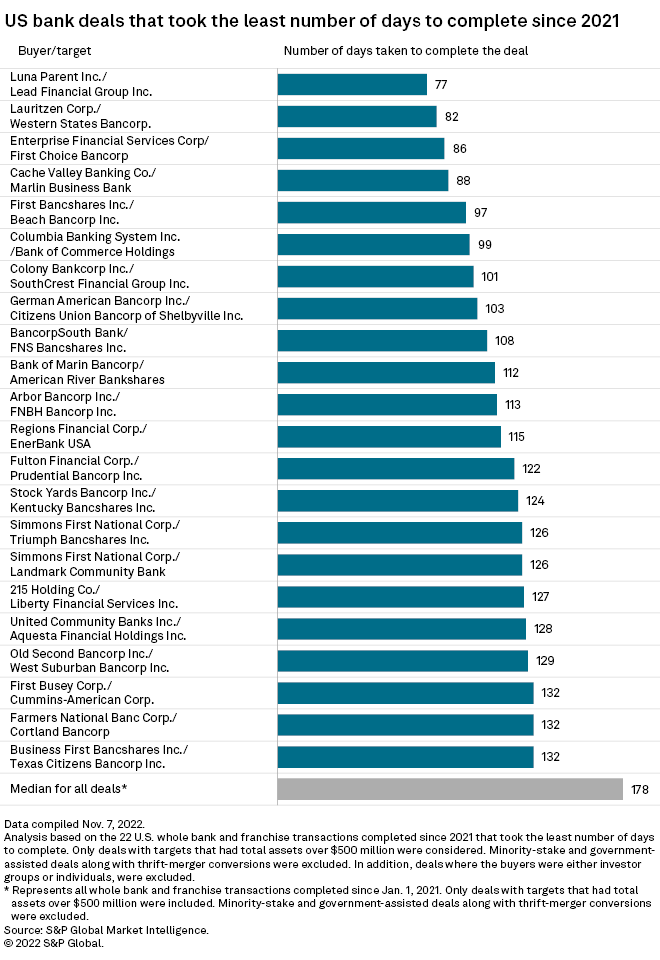

The median number of days to close for all U.S. bank deals announced since Jan. 1, 2021, involving bank targets with at least $500 million in assets was 178, but some deals have closed much faster than that, according to an analysis by S&P Global Market Intelligence.

Four U.S. bank deals in the analysis took less than half of the 178-day median to close, and six deals took under 100 days.

The fastest-closing deal among those was Luna Parent Inc.'s acquisition of Lead Financial Group Inc., which closed in 77 days. The second fastest was Lauritzen Corp.'s purchase of Western States Bancorp., which closed in 82 days.

Michael Summers, CFO and executive vice president of buildings and finance at First National of Nebraska Inc., the banking subsidiary of Lauritzen, told Market Intelligence in a statement that one of the reasons the acquisition of Western States Bank closed quickly was knowledge of the company.

"We knew Western States' shareholders and had banked this bank, so we were working with people we trusted, and were familiar with both their geography and loan portfolio," Summers said. "At the same time, we have a good relationship with our regulators."

Why some deals close faster

Conducting extensive due diligence on your merger partner to become familiar with their businesses and be aware of any potential issues that could arise is one way to help ensure a quick deal closing, banking attorneys said.

"Both the acquirer and the target should do their homework, and conduct diligence on each other to identify any potential hotspots," John Geiringer, a partner in the Financial Institutions Group at Barack Ferrazzano Kirschbaum & Nagelberg LLP, wrote in an email. "Proactively addressing issues in advance with the regulators, such as asset concentrations, compliance weaknesses, and consumer complaints, can help smooth the path to approval."

Another factor that plays into closing times is the purchase consideration, according to Matthew Veneri, head of investment banking and managing director of the Financial Institutions Group at Janney Montgomery Scott.

Cash transactions tend to close sooner because deals involving publicly traded stock require a review process with the U.S. Securities and Exchange Commission. Further, deals involving public banks buying other public banks require documentation that can lead to delays compared to private deals, Veneri added.

If a bank's exam schedule coincides with a deal and there are unresolved topics from the exam, that might slow down approval, experts said. However, banks are unlikely to delay deals based on exam timing, said John Gorman, a partner at Luse Gorman PC whose focus areas include M&A.

"You don't delay a deal for that," Gorman said in an interview. "When deals come, and they're ripe, and the parties are ready, you strike."

But timing could come into play during one specific time of year when regulators tend to slow down.

"It's a little bit of a hit or miss," Gorman said. "Don't file between Thanksgiving and Christmas."

One factor out of banks' control that could lead to a prolonged closing period is if approval decision is kicked up to the Fed Board of Governors from the Fed regional bank level. An application may be sent to the Board level for reasons such as difficulty getting necessary information from applicants, receiving adverse public comments or an examination or ratings issue, experts said.

Drawbacks of a prolonged close

Banks prefer to close deals in a timely manner for many reasons. When a deal pends for an extended period of time, it increases the risk involved with the transaction and could open the door for renegotiations, experts said.

"There's the old adage that time kills all deals," Veneri said in an interview. "One of the key components of that is market risk."

If a deal is still pending around the companies' merger agreement expiration date, companies typically have to mutually agree to extend the agreement's outside date. In some cases, that opens the door for a price renegotiation or a termination.

"The longer the approval process takes, the more likely, for example, there could be a material adverse change that would allow, for example, an applicant to redetermine or renegotiate a transaction," Scott A. Coleman, a partner at Ballard Spahr LLP who works on bank M&A, said in an interview. "So in general, I think whether you're a buyer or seller, you probably appreciate an early approval."

That dynamic played out in two bank deals terminated this year.

Fed approval for First Internet Bancorp and First Century Bancorp.'s now-terminated merger came through on April 29, but the companies were forced to renegotiate their merger agreement, which was set to expire April 30, in order to keep the deal together through the customary waiting period that follows Fed approval. However, the deal fell apart over pricing disagreements during renegotiation.

In a more recent bank deal termination, OceanFirst Financial Corp. and Partners Bancorp decided to terminate their merger agreement as the Nov. 4 expiration date approached and the outlook for regulatory approval remained murky.