S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

27 Mar, 2023

By Peter Brennan and Umer Khan

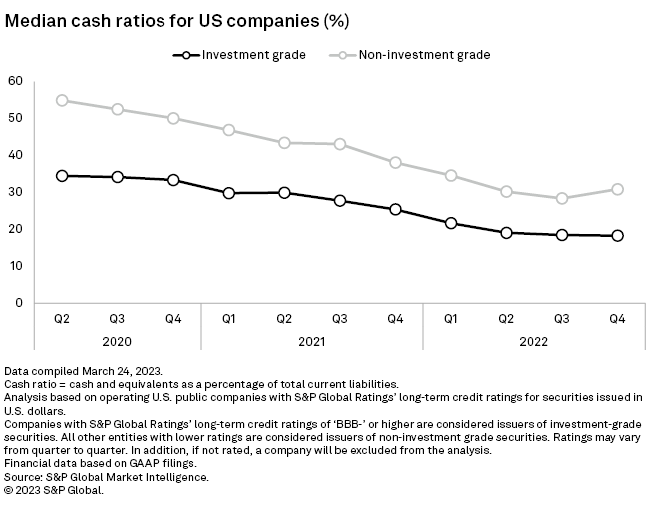

The median cash ratio of non-investment-grade-rated companies in the US rose at the end of 2022, breaking a chain of nine consecutive quarter-on-quarter declines.

For those speculative-grade companies, the median measure of cash and equivalents as a share of total liabilities rose to 30.8% in the fourth quarter, up from 28.4% in the prior quarter, according to the latest data from S&P Global Market Intelligence. The improvement is a sign that companies rated below BBB- by S&P Global Ratings are looking to improve liquidity as interest rates move higher and economic growth slows.

The cash ratio measures the ability of companies to cover the short-term obligations on their debt using cash and cash equivalents. The median ratio for companies covered by Ratings has been steadily declining since the second quarter of 2020 when companies undertook a dash for cash to bolster balance sheets during a global pandemic.

In the higher-rated investment-grade space, the ratio continued to fall in the fourth quarter of 2022, dipping to 18.3% from 18.5%. That level is slightly lower than the pre-pandemic ratio of 19.5% in the fourth quarter of 2019.

Sector breakdown

The materials sector, in particular, saw strong increases in cash ratios with the median ratio for non-investment-grade companies jumping to 41.8% from 27.3%. The most recent figure is the highest for the sector since the first quarter of 2021. The median investment-grade ratio for materials companies also jumped to 24% from 18.6% in the third quarter of 2022.

Meanwhile, the real estate sector went in the opposite direction, with the median ratio for companies rated BBB- and above dropping to 15.7% from 22.8% and the lower-rated companies declining to 45.3% from 57.4%.