S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

25 Feb, 2021

By Tom Jacobs and Kris Elaine Figuracion

Insurers in Texas and surrounding states in the U.S. south are facing losses comparable to hurricane totals in the aftermath of unprecedented winter weather that recently swept across the region.

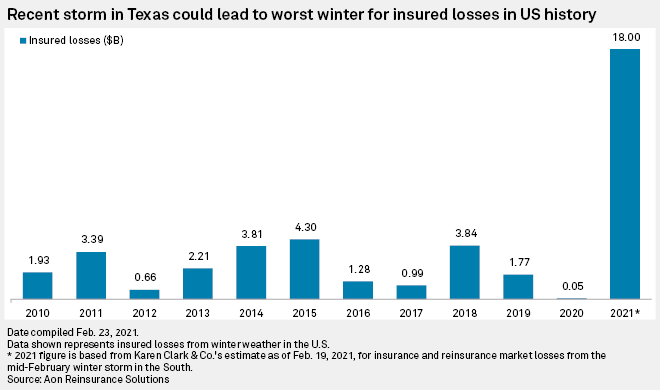

Catastrophe modeling firm Karen Clark & Co. estimates insurance and reinsurance losses of at least $18 billion from the storm and the record cold temperatures that followed.

AccuWeather Inc. founder and CEO Joel Myers came in with more extreme numbers, estimating total damage and economic loss of between $45 billion and $50 billion. In comparison, AccuWeather's estimate for the 2020 hurricane season was $60 billion to $65 billion.

Should either of the estimates hold, the storm would be the costliest winter event in U.S. history, surpassing the superstorm that struck the Eastern Seaboard in mid-March 1993, which produced insured losses of $3.64 billion and total losses of $9.1 billion in 2021.

The losses from the recent storm could also push insurers' first-quarter catastrophe losses to record levels, far above the $10 billion average that Wells Fargo analyst Elyse Greenspan cited in a recent note.

Texas was the hardest hit among the 20 states affected by the arctic weather that decimated the Lone Star State's power grid. State Farm Mutual Automobile Insurance Co. reported that 28,900 of the 37,790 claims generated by the storm as of Feb. 22 were filed in Texas, with the highest concentration coming from the Houston and Dallas-Fort Worth areas.

State Farm spokesman Chris Pilcic said in an email that the majority of those claims are property related, mostly for frozen and burst water pipes.

Liberty Mutual Holding Co. Inc. President and CEO David Long said during the company's fourth-quarter 2020 earnings call that there have been approximately 20,000 claims reported so far, but it was a little early to frame what the total loss could be.

Long said losses will be "easily in the sort of mid-range hundreds of millions of dollars," adding that it will be "ugly, but not ugly enough to have reinsurance kick in."

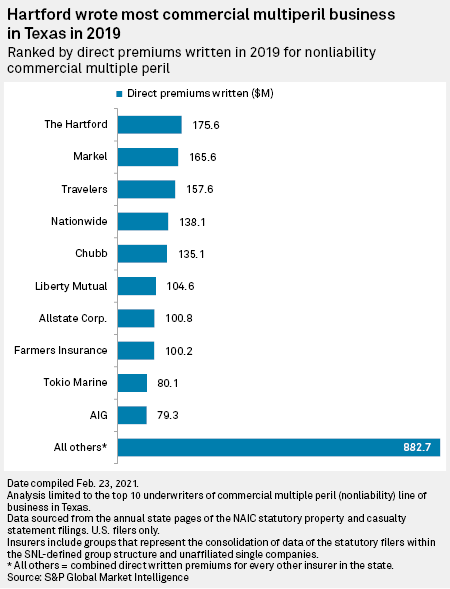

Insurers in Texas are used to dealing with large storms, such as Hurricane Harvey in 2017 or Hanna in 2020, said Greg Murphy, executive vice president, North America, for INSTANDA, a cloud-based insurance software provider. Murphy said the snowstorm and cold outbreak was unique in the way that it caused statewide chaos and left Texas, the second-largest property insurance market in the U.S., dealing with hundreds of millions of dollars in insurance claims.

Karen Clark, co-founder and CEO of Karen Clark & Co., said several factors figured into the severity of the event, including extremely cold temperatures that lasted longer than expected, as well as significant amounts of snow and ice. Above those factors is a level of unpreparedness due to the rarity of such an event occurring in the southeastern and southwestern U.S.

Clark said properties in those areas are not weatherized to the extent that they are in the northern parts of the U.S. because the building codes do not put a lot of emphasis on winterizing things.

"Many homes have pipes in their attics, and they're not insulated so it takes much less of a temperature anomaly to cause water pipes to burst and cause water damage than it would in the northeast," Clark said in an interview.

Karen Clark & Co.'s recently published U.S. Winter Storm Model has three subperils — freezing, snow and ice and wind — and different events have different combinations of those subperils. Clark said the Texas storm was a freeze event, by far the costliest because the dominant damage is from water pipes bursting and the ensuing damage caused by the water.

Clark expects the fallout from the storm to include discussions over changes in building codes and a "minor amount of retrofitting" that would include enhanced insulation for water pipes.

"Water damage claims are very frequent every year for insurance companies and it's one of the largest contributors to average annual losses, so I think you will see some discussion on this," Clark said.

Above all, Clark said there can be no complacency in the aftermath of the event.

"I think it's important that the industry realizes that while this was an extreme event, it's not that extreme and it's likely to happen again within the next 10 to 20 years," she said. "So they shouldn't come to look at this as something that isn't going to happen again. That's a very dangerous belief."