Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Jun, 2022

| A dispute between railroad companies and labor unions threatens an already fragile U.S. supply chain. Railroads are crucial to a variety of industries including coal and crude oil. Source: Mike Danneman/Moment via Getty Images |

The question of a national rail shutdown may be up to Congress this fall, as tensions mount between railways and unions, even as legal remedies fail.

Unions and railroad carriers have been locked in negotiations over wages, benefits and workplace rules since a collective bargaining round kicked off in January 2020. While the railroads indicated a willingness to enter arbitration, the coalition of unions said binding arbitration circumventing a vote by their membership would not be acceptable. The deadline for accepting arbitration passed at 5 p.m. ET on June 16, sending the dispute into the first of three 30-day windows aimed at finding an agreement.

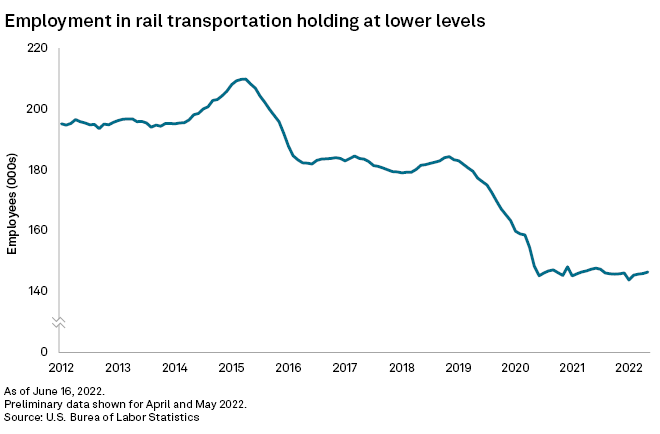

Though mostly profitable, railroads have already been struggling with service disruptions, and efforts to hire staff to replace workers laid off during the pandemic have been difficult. Global supply chains have become snarled, exacerbating rising inflation in the U.S., and the president and Congress may be quick to act, especially with midterm elections so soon.

"If we reach the point of that second cooling-off period and no agreement is reached, unless Congress steps in on a preemptive basis, there is a likelihood there could be a shutdown that could affect much of the country and major freight railroads that are involved in these negotiations," said Charlie Woodcock, a senior labor relations consultant with F&H Solutions Group.

The first 30-day window started June 18, according to materials from the Association of American Railroads. The first window is a cooling-off period, after which the U.S. president is expected to appoint an emergency board that has 30 days to develop solutions. Another 30-day cooling-off period follows and, if no resolution is reached, a work stoppage could lock up U.S. rails for an indefinite period — or until Congress passes a law setting a new agreement.

The White House did not return a request for comment.

The railway unions appeared ready for Congress to step in, saying in a collective statement they have mobilized their legislative departments to lobby on the issue.

History suggests Congress would not allow a lengthy stoppage, said Woodcock, a former Amtrak executive who led the organization's labor relations. However, the upcoming midterm elections could create some sensitivity around potential legislative actions.

"I don't believe Congress, with the state of the economy and the past precedent, will permit any kind of strike of any kind of duration, other than very brief," Woodcock said.

'Insult' to rail unions

An oft-forgotten transportation network in the public mind, railroads are still a critical player in interstate commerce. Measured in ton-miles, which is a ton of freight shipped one mile, freight railroads account for about 40% of U.S. long-distance freight volume, more than any other mode of transportation, according to the American Association of Railroads. The organization said Class I railroads account for about 68% of freight rail mileage, and trains are critical for U.S. coal producers trying to move their products to market.

The National Railway Labor Conference, or NRLC, is an association of all U.S. Class I freight railroads and some smaller freight and passenger lines. Within the NRLC is the National Carriers Conference Committee, or NCCC, which includes the chairman of the NRLC as well as senior labor relations executives of BNSF Railway Co., CSX Transportation Inc., Kansas City Southern, Norfolk Southern Corp., Union Pacific Railroad Co. Inc. and a representative of U.S. railroads owned by Canadian National Railway Co.. The NCCC represents most of its members in national, multi-employer negotiations with the 12 major rail labor organizations and more than 30 railroads involved in the current bargaining round.

Individual railroad companies either did not respond to a request for comment or referred the request to an industry trade group.

On the other side are bargaining coalitions representing 115,000 employees. Guiding the talks is the federal Railway Labor Act, a law first enacted in 1926 to avoid the disruption of interstate commerce.

The railroads indicated they were open to the National Mediations Board's arbitration offer, while the unions rejected the option.

"All of the carriers' proposals to date serve as an insult to our collective membership," said a collective June 15 statement from 12 rail unions. "These essential employees carried the railroads to their record profits throughout the last several years."

Greg Regan, president of the Transportation Trades Department, which is part of the American Federation of Labor and Congress of Industrial Organizations, described the offers from the railroad companies as a "net pay cut" with unacceptable health care concessions.

"After more than three years of bad faith negotiations by the railroads, it is unfortunate but not surprising that contract agreements were not achieved through voluntary mediation," Regan said in a June 15 statement.

Not seeing eye to eye

The National Mediation Board ended mediation between the two sides on June 14, and the NCCC, the group representing railroads, said at the time the best outcome would be to settle the dispute between workers and rail companies and "provide for prompt pay increases for all rail employees and prevent rail service disruptions."

"Because railroads touch most parts of the U.S. economy, a rail shutdown would hurt Americans, slow supply chains, and worsen inflation," said materials provided by the American Association of Railroads.

The railroads say they have offered pay increases consistent with labor market benchmarks that provide employees with some of the highest pay and benefits available in the nation. According to materials from the industry-led National Railway Labor Conference, the average Class I railroad employee covered under the bargaining round received $130,000 in total annual compensation in 2021.

Some of the unions are also disputing with railways over the implementation of technology that would reduce crew size. A voluntary agreement between parties serves both rail companies and employees best, the Association of American Railroads said in an emailed statement.

"The industry must modernize to compete and support both our economy and the proud men and women who keep our nation moving forward," the association said.

Rail service already troubled

The looming threat of a stoppage hangs over a rail industry that has been struggling to service some of its customers.

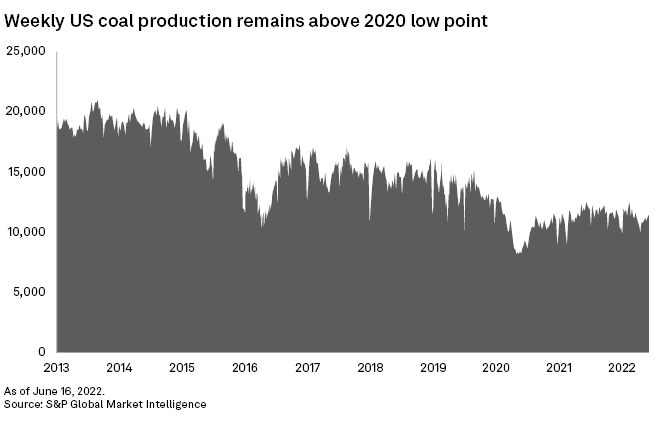

Over the past several months, the U.S. coal industry has lamented a meltdown in rail service capability. According to the U.S. Energy Information Administration, an estimated 67.1% of the coal shipped by producers in the U.S. traveled by railway in 2020. That same year, coal accounted for about 27% of the originated tonnage for U.S. railroads, more than any other commodity, according to the Association of American Railroads.

Railroads take about 91.5% of that coal to companies that use it to generate electricity, and supplies have been tight in recent months. Coal-fired power plants accounted for about 21.8% of U.S. power generation in 2021, according to the EIA. While a rail stoppage could disrupt the flow of coal, utilities also generally stockpile coal at their power plants to avoid service disruptions. Power units that use bituminous coal, and are largely located in the eastern U.S., had an average of 98 days worth of coal to burn as of March 2022 while the subbituminous units that are generally located in the western U.S. held about 105 days of worth of coal in stockpiles, according to the EIA.

"While we have seen overall improvement in the availability of coal, the U.S. railroad delivery network remains fragile," Mauricio Gutierrez, president and CEO of Houston-based power generator NRG Energy Inc., said on a May 6 earnings call.

On June 13, the U.S. Surface Transportation Board issued an order directing BNSF Railway, CSX Transportation, Norfolk Southern and Union Pacific to correct deficiencies in previously ordered rail service recovery plans.

"We are in the middle of a rail service crisis, and the board continues to receive reports about persistent, acute, and dramatic problems in rail transportation, disrupting critical supply chains and shutting down companies," Surface Transportation Board Chairman Martin Oberman said in a June 13 statement.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.