Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Campaign

By Camellia Moors and Kip Keen

The Sierra Gorda copper mine in Chile, which is majority owned by KGHM Polska Miedz SA. |

This story is the second in a two-part series. In part one, we looked at how underinvestment in new copper mines could lead to a long-lasting shortage of the base metal required for the energy transition.

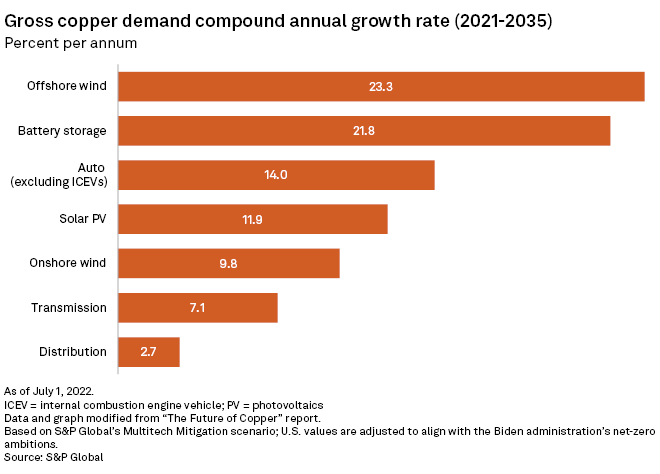

A looming copper deficit will force a rapidly electrifying world economy to explore multiple strategies to meet its needs for the red metal.

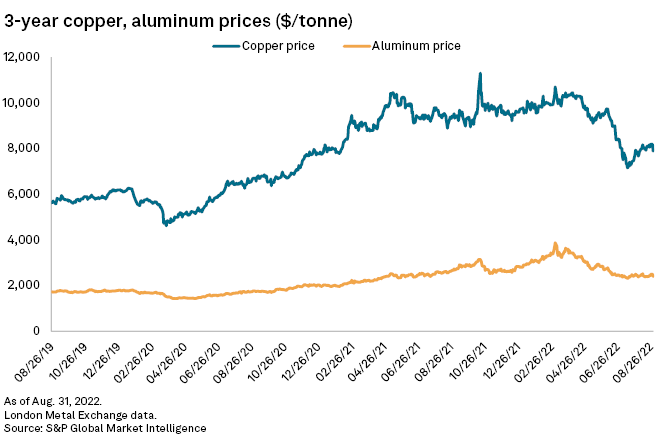

By 2026, mean cash copper prices are expected to reach $9,750/tonne, exceeding the relatively high $9,317/tonne annual average established in 2021 amid reduced output by some major producers. That number could explode if the supply shortfall reaches the 9.9 Mt level in 2035 predicted by the most pessimistic scenario outlined in S&P Global's recent "Future of Copper" report.

High prices will enable companies to extract more copper from lower-grade resources, and implement new technology to extend the productive life of their projects. Recycling will likely increase as it becomes more valuable to do so. And some copper end users will replace the metal with aluminum or other materials, or seek ways to cut down the amount of copper they require.

Observers agree that none of these solutions will work on their own to meet global demand, but together they may reduce the shortfall to manageable levels, as characterized in the most optimistic projections from the "Future of Copper" report.

"Price is obviously an incredible motivator. And so there will be a focus on innovation, certainly, and ... substitution, recycling and more efficient use of copper," said Daniel Yergin, vice chair of S&P Global. "But all of that takes time and toil. It's a pretty amazing thing to want to change the energy foundations of a $88 trillion world economy in 28 years. And a lot of physical stuff has to be done in about 12 years."

Price push

Facing the looming supply gap, copper prices will inevitably rise, experts told S&P Global Commodity Insights. In turn, higher copper prices will play a central role in spurring new mine supply, though it remains to be seen if that can happen quickly enough or to the extent demand will require.

"What we're looking at over the course of the latter part of just this decade is probably record prices again," said John Mothersole, director of nonferrous metals, economics and country risk at Commodity Insights. "This market is going to tighten under any scenario, and that's going to be reflected in pricing. Is that going to be enough to stimulate a supply-side response? That is the open question."

Minex Consulting managing director Richard Schodde said to expect mining companies to ultimately lower cut-off grades at their mines, should copper prices go and stay higher.

"The copper price will go up, which will incentivize companies to bring new mines and ... go out and explore and find new projects," Schodde said. "It'll incentivize companies to extend the life of their existing operations."

In existing operations, Schodde sees more room to maneuver than some analysts. The higher prices will make currently noneconomic copper deposits financially viable to mine, and miners will do so.

"Doubling the copper price will effectively lead to a doubling in the amount of metal in inventory or in resources in copper porphyry systems around the world," Schodde said, referring to a common type of ore deposit.

Analysts and industry executives say new recovery methods may allow copper in low-grade sulfide deposits to be extracted through innovation in leaching methods.

"The total addressable market alone in sulfide leaching is huge, equal to around 10 years of current mining output," Vanessa Davidson, CRU Group head of base metal research, said June 13 at a Prospectors and Developers Association conference in Toronto.

Higher copper prices may help drive some of this change, experts said.

"Although new technologies supported by high prices provide the most significant upside potential to long-term production," Davidson said. "The results may arrive beyond the requisite timeframe to meaningfully close the supply gap in the second half of this decade."

Substitution junction

Some copper users may be able to substitute aluminum. Aluminum has only 60% the conductivity of copper, which means wires must be thicker to move the same amount of power, and, as a poorer conductor of heat, it sometimes requires more insulation. But it can replace copper in applications such as overhead transmission lines where weight is a major consideration and, in some cases, tubing.

"Copper starts to face inroads from aluminum ... when the price of copper relative to the price of aluminum is about three and a half to four times as high," Mothersole said. "And we've reached into that zone in the last decade. And we will be in that zone looking out over the next decade."

On Sept. 6, copper prices stood at $7,751.00/tonne, approximately 3.4 times higher than aluminum's $2,254.25/tonne.

Even Anthony Lea, president of the International Copper Association that represents copper manufacturers, agreed more substitution of copper is coming.

"You might see some substitution of aluminum in transmission lines because of the weight," said Corby Anderson, a professor of metallurgy and mining at the Colorado School of Mines. "But there's always that lesser conductivity and safety issue that crops up when you try to do it."

Experts doubt aluminum substitution, even with much higher copper prices, will prove a panacea in filling the copper supply gap as it is not suitable to replace copper in many applications, such as in electric motors.

"You're not going to see a lot of substitution of copper because of its unique properties in terms conductivity and recyclability," Anderson said.

CRU's Davidson also said to expect some thrifting, where manufacturers develop less copper intensive products to save on costs, especially if the price of the red metal climbs. Battery-makers have been able to reduce their reliance on high-priced cobalt in recent years, and some users could potentially reduce their need for copper.

"When new applications get developed ... people are less concerned about how much metal they're using," Davidson said. "But as techniques improve, we start to see less and less material being used."

Government intervention

Governments have demonstrated they are willing to step in to encourage the energy transition, and some have already begun to act to increase domestic metals production.

In March, U.S. President Biden invoked the Defense Production Act to shore up domestic critical minerals production, especially for metals used in EV battery manufacturing. This was followed in August by the creation of a new tax break for critical minerals projects under the Inflation Reduction Act. The money and incentives written into these laws are available to producers of lithium, graphite and other commodities, but they provide an opportunity for new copper mining in the U.S. and allied nations.

In countries hoping to cash in on the energy transition, that trend may have already started. Officials in the U.S. and Canada have called for reduced permitting times for some domestic mining projects, while over a dozen countries with major economies have agreed to participate in the Minerals Security Partnership to support the streamlining of minerals supply chains.

A promising avenue for government intervention can be found in copper recycling policy, Yergin and Lea said. The International Copper Association estimates that the global end-of-life recycling rate for copper products was 40% between 2009 and 2018, leaving significant room for improvement.

"I would expect that there will be a much bigger [government] focus on recycling," said Yergin. "I think recycling seems to be the area where you would expect to see public policy to be most forward-leaning."

Government policies encouraging mining need to be consistent to be effective, said Lea.

"What people have to remember is that mining is a very long-term proposition, it's generational in nature," Lea said. "And what the mining industry needs [in order] to respond to this is governmental stability, in terms of regulatory environment [and] in terms of economic policies."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Campaign