S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

1 Mar, 2021

Telecoms transactions accounted for 35% of total private equity infrastructure deal value in 2020, up from 15% a year earlier, as the COVID-19 pandemic accelerated the growth in aggregate value these transactions have shown over the past few years, Preqin data shows.

Telecoms deals, such as those involving assets including towers, fiber and data centers, are included in the alternative assets research firms' infrastructure data, which also includes transactions in the transport, energy and utilities sectors.

Demand drivers

Private equity interest in telecoms and technology is a result of two trends shaping several markets — companies spending more on technology, and receding risk, according to 451 Research, which is part of S&P Global Market Intelligence.

Six in 10 IT buyers and users surveyed in October 2020 by 451 Research's "Voice of the Enterprise: Digital Pulse" agreed that the coronavirus has made technology more of a spending priority at their organization. 451 Research expects private firms to snap up technology companies, including platform and bolt-on acquisitions, at a rate that will at least match, if not top, the record number of acquisitions in 2020.

On the second point, a Leveraged Commentary and Data-tracked index of the distress levels in the leveraged loan market had dropped to a two-year low by the end of January after spiking in spring, 451 Research said.

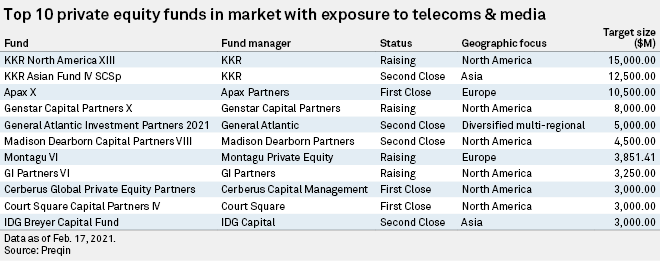

As at Feb. 17, KKR & Co. Inc.'s North America-focused KKR North America XIII is the largest private equity fund in market that will invest in the telecoms, media and technology sectors, with a fundraising target of $15.00 billion. KKR Asian Fund IV SCSp, which is targeting $12.50 billion, is the second largest.

As of the same date, a total of 528 funds with exposure to the sectors are in the market to raise a combined targeted capital of $155.1 billion.

Geographic focus

The U.S. and Europe account for the lion's share of TMT-focused private equity investments as the number of opportunities for large-scale asset purchases are greater in those geographies, Dave Lowery, head of research insights at Preqin, said.

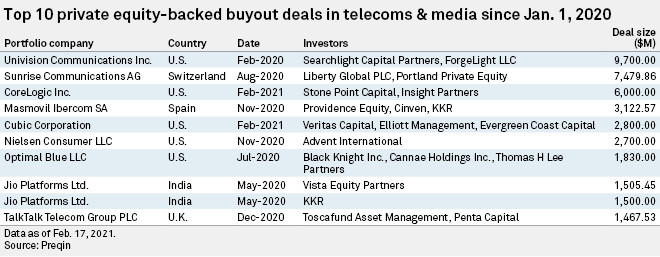

Five of the top 10 private equity-backed telecoms and media deals in 2020 targeted U.S. assets, and a further three deals involved assets in Switzerland, Spain and U.K.

"Telecoms firms have been selling off their tower portfolios and data center assets, and there has been significant interest from private market investors. This is unlikely to change, as banks have also begun to sell data center assets, for example," Lowery said.

It will take time for the same trend to emerge in Asia, where mobile network operators choose to retain assets and fund investment through debt, which is cheap and readily available, according to Lowery.

But the technology sector is of significant interest at present among both limited partners and general partners that Preqin has spoken to, Lowery said, adding that Asia increasingly on the radar of investors.

"The digital infrastructure space benefits from a long-term secular growth story, the creation of and need to process data, which has been positively impacted by the pandemic. These long-term demand drivers are unlikely to go away, so there is likely to be ongoing interest in the digital infrastructure space," Lowery said.