S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 May, 2021

Regulators across the U.S. continued to sign off on rate-increase requests from long-term care, or LTC, insurers during the first quarter.

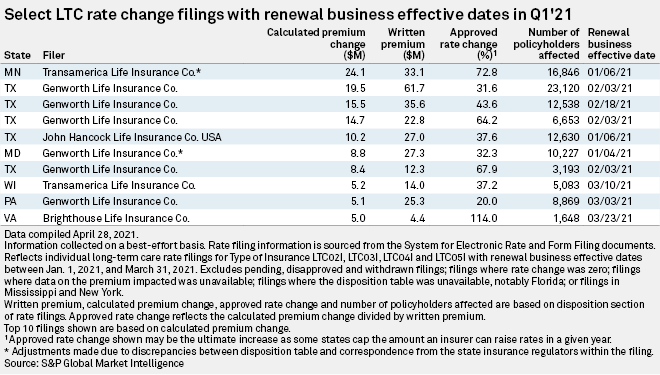

The most impactful rate increase on in-force blocks of business took place in Minnesota where Aegon NV's Transamerica Life Insurance Co. could see its annual calculated premiums increase by $24.1 million once the full 72.8% hike is fully implemented. The increase will be phased over three years and stands to impact roughly 16,840 policyholders.

Transamerica affiliates received approvals to raise LTC rates in at least 11 states during the first quarter, and those increases could boost the insurer's annual premiums by $39.3 million.

Genworth Financial Inc.'s calculated annual premium increase of $101.8 million was the biggest aggregate total for the first quarter. Roughly 57% of the calculated increase, or $58.1 million, will impact Genworth policyholders in Texas. Lone Star State regulators approved four separate filings for Genworth, the nation's largest LTC underwriter, during the quarter. All four landed on the 10 most impactful rate increase list in this S&P Global Market Intelligence analysis.

Manulife Financial Corp.'s John Hancock Life Insurance Co. (USA) also received approval to boost its LTC rates in Texas. The insurer's annual calculated premiums could increase by $13.8 million due to two rate filings approved during the quarter. When combined, almost 17,300 of John Hancock's policyholders in Texas can expect to pay more for their LTC coverage.

John Hancock affiliates also received approval to hike rates in Virginia, North Carolina and Alabama.