S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Sep, 2021

By Rica Dela Cruz and Ali Shayan Sikander

Loan-to-deposit ratios continued to decline at U.S. banks in the second quarter thanks to a surge in deposits from government relief efforts and a rise in the savings rate.

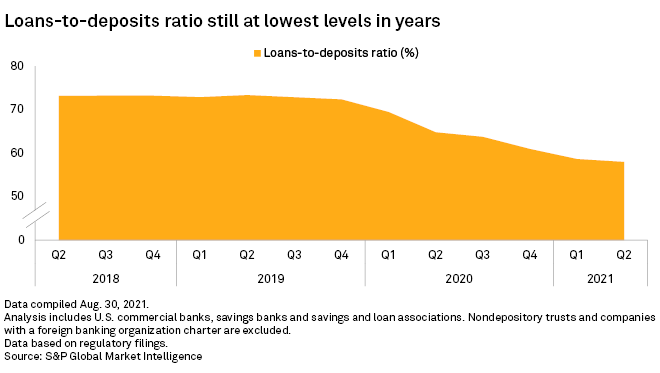

The aggregate loan-to-deposit ratio at U.S. banks has fallen dramatically since the onset of the COVID-19 pandemic and reached 58% in the second quarter of 2021, the lowest level in S&P Global Market Intelligence's database, which goes back to 2003. Bank margins drifted even lower in the second quarter due to persistently low rates and excess liquidity as loan growth remains hard to find with borrowers holding surplus cash.

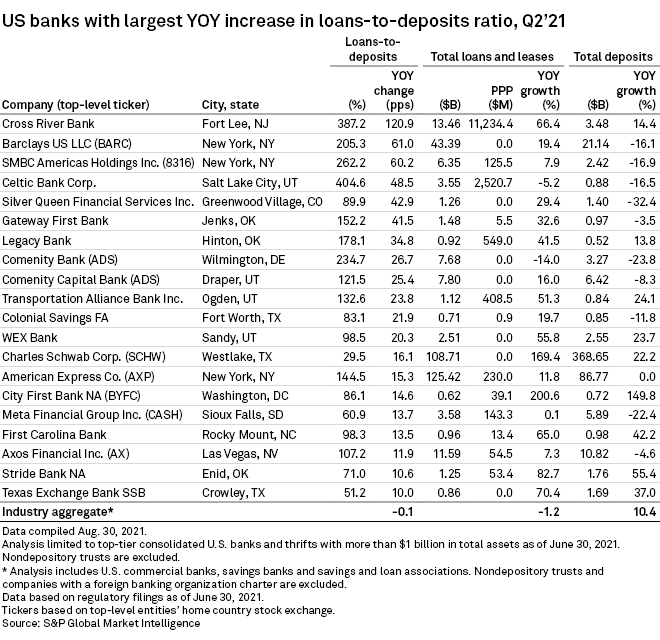

Fort Lee, N.J.-based Cross River Bank and Salt Lake City-based Celtic Bank Corp., which partner with financial technology lenders to originate loans, were among the few banks to post a year-over-year increase in their loan-to-deposit ratios. Cross River's loan-to-deposit ratio rose 120.9 percentage points, and Celtic Bank's ratio increased 48.5 percentage points.

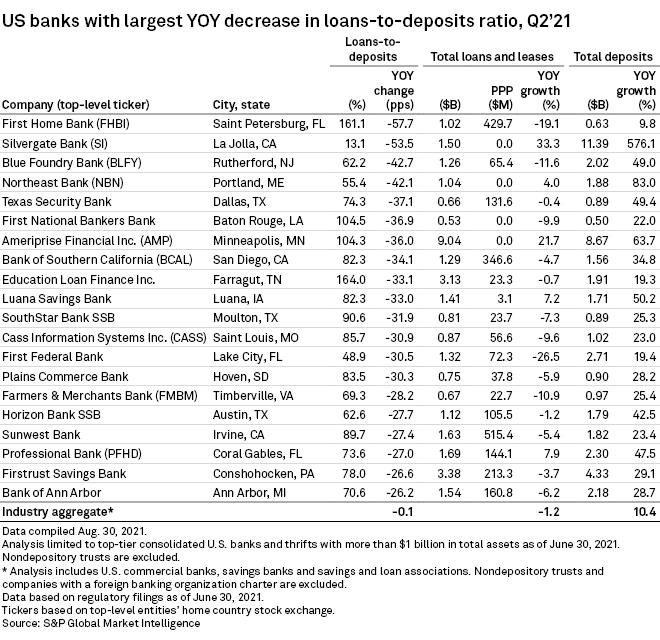

Several banks increased lending only to see an even greater rise in deposits. La Jolla, Calif.-based Silvergate Bank's deposits rose 576.1% year over year, exceeding its 33.3% growth in total loans and leases and driving a decrease of 53.5 percentage points in its loan-to-deposit ratio. Management for the bank's parent, Silvergate Capital Corp., said on an earnings call that the deposits were from digital currency exchanges, institutional investors and digital assets and other fintech-related customers, as well as higher client activity.

First Home Bank reported the largest decline among banks with at least $1 billion in assets with a drop of 57.7 percentage points. The Saint Petersburg, Fla.-based bank's loans fell 19.1% while deposits grew 9.8%.

Most management teams are anticipating a modest improvement in loan growth during the second half of the year, though some bankers expect excess liquidity to continue building, wrote analysts at Hovde Group.

Hovde analysts also wrote that despite improved underlying core loan growth trends, overall deposit growth is still surpassing total loans, which "further [adds] excess funding to a banking industry already awash in liquidity."

Loan growth figures have been complicated by noise from the forgiveness of Paycheck Protection Program loans. Still, many PPP borrowers have not yet applied for loan forgiveness despite encouragement from banks and government efforts to streamline the process.

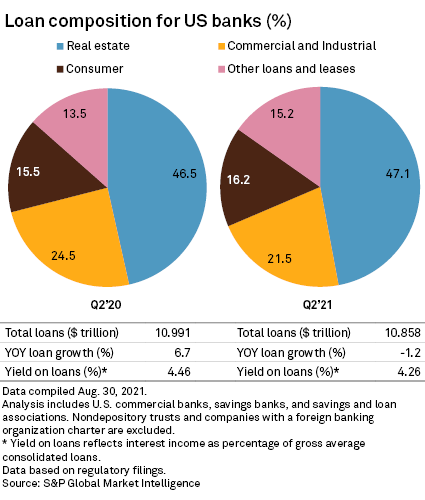

"While core loan growth...has picked up the last few weeks, reported results continue to show sluggish trends as the net result of PPP forgiveness casts a significant shadow on positive momentum," the Hovde analysts wrote in an Aug. 18 note. C&I loans in the second quarter declined quarter over quarter and year over year, although many institutions say demand is picking up.

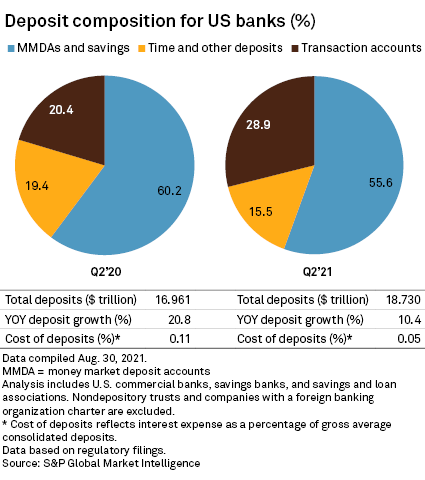

Meanwhile, deposits across U.S. banks rose in the second quarter, showing significant growth that has kept loan-to-deposit ratios lower. The growth was entirely driven by transaction balances, offsetting declines in savings and time deposits. A drop in time deposits and increase in transaction balances has pushed already-low funding costs even lower.