Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Jul, 2022

By Corey Paul

| A liquefied natural gas tanker docks at an import terminal in the Netherlands. Source: Mischa Keijser/Getty Creative via Getty Images |

A wave of recent contracting announcements has kicked off the next cycle of building multibillion-dollar U.S. liquefied natural gas export facilities. The surge shows little sign of slowing in the second half, as two projects advanced to construction on the Gulf Coast.

The country's largest LNG exporter, Cheniere Energy Inc., commercially sanctioned a midscale expansion of its Corpus Christi LNG terminal in late June that will add roughly 10 million tonnes per year of LNG production capacity to the Texas facility.

Weeks earlier, Venture Global LNG made a final investment decision to build its second U.S. LNG export facility — the 20-Mt/y Plaquemines LNG project in Louisiana. These projects alone reflect a major buildout of U.S. export capacity, adding up to roughly a third of the existing U.S. capacity. But sector experts widely believe that these will not be the last U.S. LNG projects that advance to construction over the next year.

The question is who will be next among the backers of a dozen or so other projects trying to build sufficient commercial support to secure financing.

"You are still in an environment where you can get things done — it's constructive, but it's competitive," said Michael Webber, an independent LNG analyst and managing partner of investment research firm Webber Research & Advisory. "A lot of these will have to stick around for the next cycle."

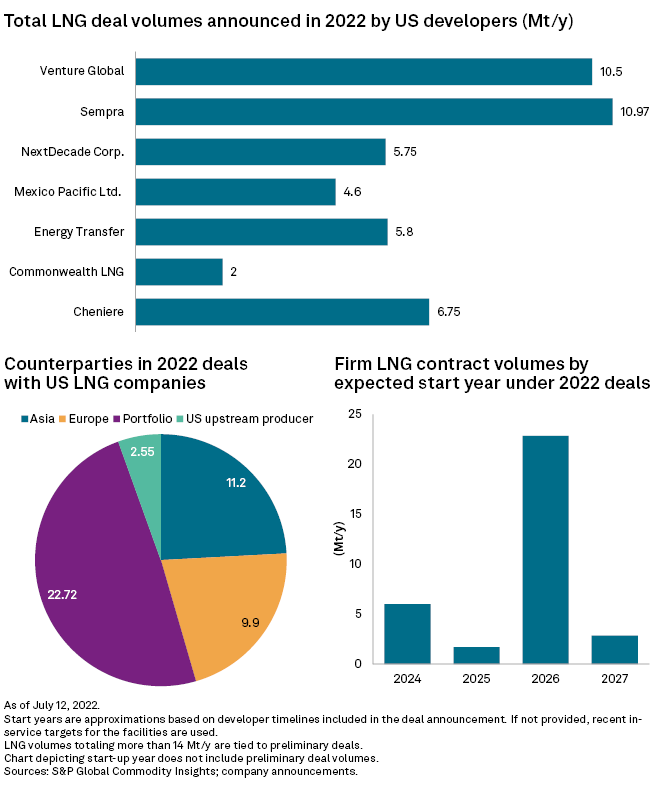

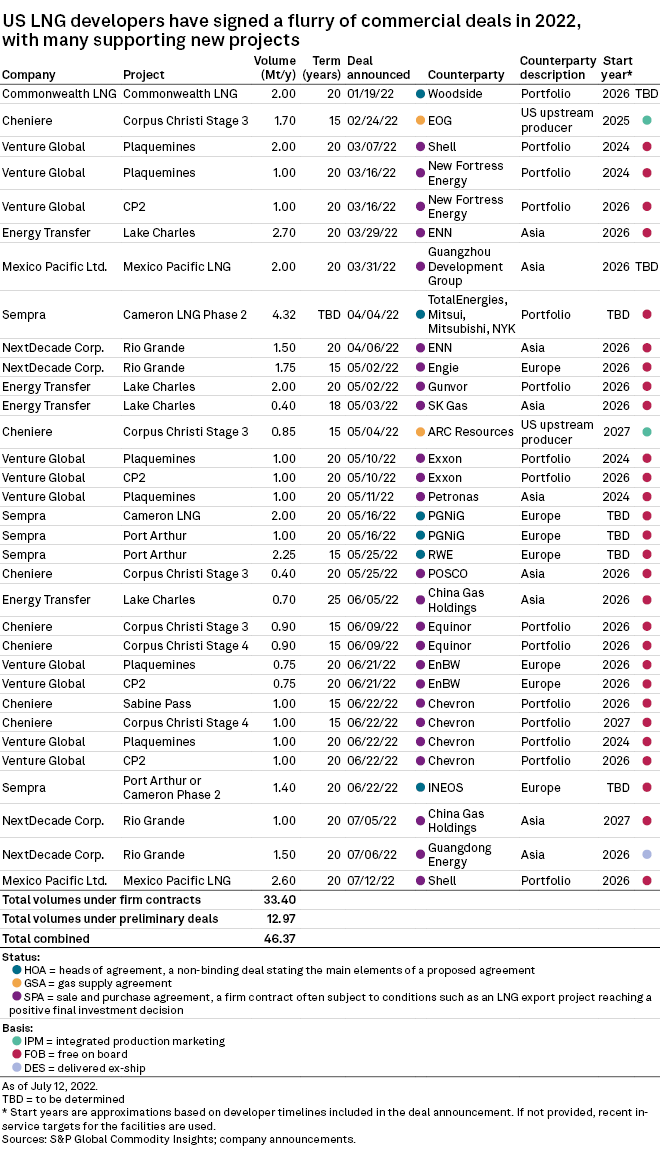

Cheniere and Venture Global secured long-term contracts to advance to construction as surging natural gas prices abroad spurred increasing buyer demand for American gas supplies, especially as the war in Ukraine raised fears of supply disruptions. Several other U.S. LNG developers also benefited from the high volume of commercial activity in 2022. More than 33 Mt/y worth of binding long-term agreements tied to U.S. LNG projects have been signed since Russia invaded Ukraine on Feb. 24. U.S. developers have secured about another 13 Mt/y worth of preliminary deals in 2022.

The invasion prompted a scramble by European buyers to shore up new LNG volumes. High prices and security supply concerns also spurred other buyers to commit to new long-term supplies in 2022, including volumes from proposed U.S. projects that investors had considered dead just a year earlier. Customers in Asia and large portfolio traders have accounted for most of the contracting activity with U.S. developers year-to-date.

Webber's research firm expects that two or three additional U.S. projects have a good chance of getting commercially sanctioned during this construction cycle. But the firm has also cautioned about emerging construction risks because of factors such as inflationary pressures on global supply chains and a potential contractor crunch.

S&P Global Commodity Insights analysts recently predicted that U.S. LNG export capacity will reach 21.7 Bcf/d by the end of 2027, an 84% increase from existing levels. How quickly new projects can come online will be a key issue for a global gas market facing a supply shortfall headed into the mid-2020s.

An early June fire at the Freeport LNG Development LP export terminal in Texas highlighted the fragile state of global gas supply and jolted market participants. U.S. LNG exports had averaged about 12.5 Bcf/d before the Freeport shutdown but will likely average closer to 11 Bcf/d as long as the facility is offline.

The following is a compilation of updates to major U.S. LNG export projects in recent months.

Cheniere eyes further expansion

Cheniere Energy accumulated a series of long-term contracts to support the Corpus Christi expansion. This includes some deals with LNG tied to Cheniere commercially sanctioning a potential further expansion of the Texas facility beyond the seven trains that recently advanced to construction. Cheniere also operates the Sabine Pass LNG terminal in Louisiana, the country's biggest export facility.

Venture Global pursues low-cost approach

Venture Global has taken a similar approach with its other LNG projects, including the Plaquemines project that it expects to start shipping LNG in 2024.

Besides Calcasieu Pass and Plaquemines, Venture Global has applications pending at FERC for two additional Louisiana export terminals: the up to 28-Mt/y CP2 LNG project and the up to 24-Mt/y Delta LNG project.

New Fortress pitches 'fast' floating LNG units

New Fortress Energy Inc. filed permit applications in March for a pair of 1.4-Mt/y liquefaction units that the LNG developer wants to build off the coast of Louisiana. The company said the construction timeline for the facilities from engineering to commissioning is between 18 and 20 months — much faster than new onshore export facilities — and that the projects could serve LNG demand as soon as 2023.

New Fortress said in May that it planned to file permit applications soon for six gas liquefaction facilities off the Texas coast that would use the same 1.4-Mt/y design.

Freeport seeks late 2022 restart

Freeport said it hopes to resume full operations of its three-train 15-Mt/y facility in late 2022 after getting the necessary approval from federal regulators. In the meantime, the company said it is still marketing LNG tied to a proposed fourth 5-Mt/y train, which it expects to commercially sanction in early 2023.

Sempra signs early deals

Sempra has signed a series of preliminary deals supporting a 6.75-Mt/y single-train expansion of its Cameron LNG terminal in Louisiana and its up to 13.5-Mt/y Port Arthur LNG export project in Texas. The company's most recent investor presentation in early May said the timeline for completing the projects has yet to be determined.

Sempra's top priority among LNG projects remains to build its $2 billion Energía Costa Azul terminal on the west coast of Mexico both on time and on budget. The company planned for the 2.5-Mt/y facility to start producing LNG in 2024.

Mexico Pacific Ltd. lines up contracts

Mexico Pacific Ltd. LLC has continued to line up binding 20-year off-take agreements tied to its proposed export terminal on the Sea of Cortez in Mexico as the company nears its September target for commercially sanctioning the first two trains of the project, with a combined 9.4-Mt/y production capacity. The project would use U.S. feedgas, and the company has also proposed a third 4.7-Mt/y train.

NextDecade builds commercial momentum

NextDecade Corp.'s Rio Grande LNG export project remains in the FERC permitting process on several fronts, including a request for a two-year extension of a November 2026 deadline for completing the project. But regulatory hurdles have not prevented NextDecade from signing long-term contracts with LNG buyers, including coveted customers in China.

The developer said in a June investor presentation that it is targeting a final investment decision by the end of 2022 on the first phase, which would include two trains capable of producing 11 Mt/y before an expansion of up to 27 Mt/y.

Lake Charles LNG makes contracting strides

Energy Transfer LP announced a series of firm off-take deals tied to the Lake Charles facility after a two-year lull in commercial activity that followed Shell PLC's decision in March 2020 to pull out of the project.

The developer has described these commercial strides as supporting its goal of reaching a positive final investment decision on the project in 2022, with first LNG deliveries expected as early 2026. Energy Transfer said it might reduce the size of the project from a three-train, 16.45-Mt/y facility to a two-train, 11-Mt/y facility.

Tellurian in financing talks

Tellurian Inc. said it is in financing talks after securing enough commercial support to reach a final investment decision on Driftwood LNG in Louisiana, which could produce about 11 Mt/y before expanding up to 27.6 Mt/y. The developer in late March gave the go-ahead to its contractor to start limited construction of the first phase of the LNG project.

Tellurian advancing Driftwood to construction would mark a new approach for developing a U.S. LNG project. The company's strategy of using 10-year customer contracts to cover the first phase of the project is a departure from the traditional approach to project financing for LNG projects, which have typically had a repayment period exceeding 10 years.

Golden Pass tries to ramp up construction

The 18.1-Mt/y Golden Pass LNG Terminal is under construction in Texas and scheduled to start operations in 2024. The developer has expressed concerns that federal permitting snags could delay the project, while a request to bring in more workers to build the facility is pending.

Delfin announces deal

FERC in January 2022 granted the developer of the Delfin LNG LLC terminal a one-year extension to construct connected onshore facilities after it struggled to secure sufficient commercial support. Delfin said July 13 that it signed a long-term contract with Vitol Inc. covering 0.5 Mt/y of capacity.

Commonwealth LNG awaits permit

Commonwealth LNG LLC hopes to commercially sanction its 8.4-Mt/y project in Louisiana in 2023. The developer applied for a federal Natural Gas Act permit in August 2019, and the project is progressing through the FERC approval process.

Alaska LNG project in limbo

The proposed 20-Mt/y Alaska LNG export terminal has faced persistent difficulties that include trouble securing customers and a high price tag of about $38.7 billion, even after cost-cutting efforts.

The state-run Alaska Gasline Development Corp. has worked to shore up the credentials of the project, which the state would turn over to private interests after getting a federal loan guarantee that could lower the cost of debt.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.