Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Apr, 2021

By Corey Paul

|

An LNG tanker entering Rotterdam harbor to dock at an LNG terminal. |

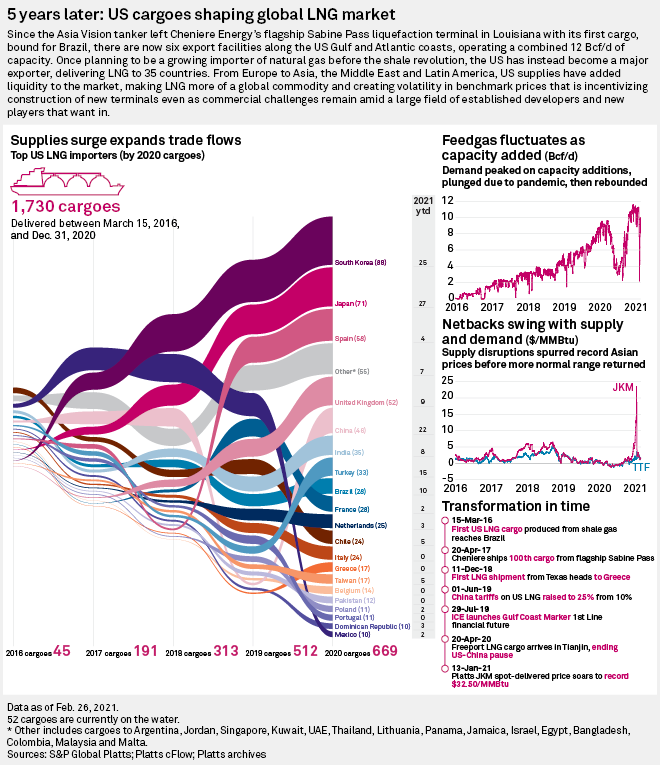

Some U.S. LNG developers expressed a renewed optimism in recent months that growing interest among world buyers in signing long-term supply deals will boost the prospects for commercially sanctioning new LNG export projects in 2021, following a year marked by a lack of final investment decisions.

More than a dozen LNG developers in North America are competing to advance their projects to construction amid a strong rebound in LNG demand. But so far this year, the pool of potential U.S. LNG projects has already gotten smaller, with Exelon Corp.-backed Annova LNG's recent decision to cease development of its proposed export facility in Texas, citing "changes in the global LNG market." Analysts expect more projects will fall by the wayside.

"There is room for two, three or four projects in the U.S.," Jason Feer, head of business intelligence at Poten & Partners, said in an interview. "What that means is, you are going to have to be one of the most competitive."

In 2020, only a single liquefaction project reached a final investment decision, or FID — Sempra Energy's Energía Costa Azul terminal on the West Coast of Mexico. Other developers, especially those with greenfield projects that would be built from the ground up, have struggled to build sufficient commercial support to secure financing for their projects.

The challenges include pressure from buyers to be flexible on pricing and contract terms as well as pressure to bring down project costs. Developers also face mounting concerns over the supply chain emissions associated with U.S. LNG. And then there is Qatar Petroleum's recent FID announcement on an expansion capable of producing 33 million tonnes of LNG per year, a development that could crowd out rival projects in the U.S.

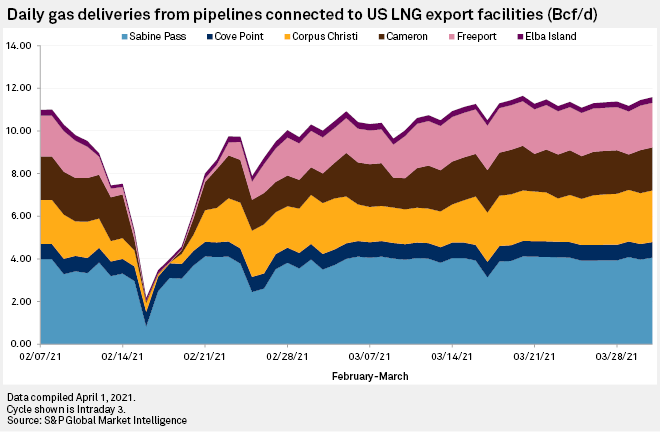

U.S. developers have nonetheless pointed to significant volatility in benchmark gas prices over the past year as prompting a greater sense of urgency among LNG buyers to secure new supplies. The six major LNG terminals that are already operational in the U.S. have seen a sharp recovery from a weather-driven plunge in February to record-level utilization, with feedgas deliveries remaining above 11 Bcf/d since mid-March as global gas prices continue to support shipments of the fuel headed into the summer, according to pipeline flow data from S&P Global Market Intelligence.

The following is a compilation of updates to major U.S. LNG export projects in recent months.

Cheniere sees competitive advantage in emissions tagging

Cheniere Energy Inc., the biggest U.S. LNG exporter, is betting that the rebound in global markets, demand from major Asian consumers and making its carbon footprint more transparent will help its commercial efforts, which include a midscale train expansion at its Corpus Christi LNG facility in Texas that could produce up to 10 Mt/y.

Cheniere recently announced plans to start providing customers with greenhouse gas emissions data for each of its cargoes, from wellhead to delivery point, starting in 2022.

The company is getting closer to completing the last of its already-sanctioned LNG infrastructure. Cheniere recently completed a third liquefaction train at the Texas facility and said another liquefaction unit at its flagship Sabine Pass LNG facility in Louisiana could start producing LNG by the end of the year.

Sempra's Mexico LNG project advances

The estimated $2 billion Energía Costa Azul terminal is expected to start producing LNG in late 2024. Beyond that project, Sempra is the main owner of the Cameron LNG terminal in Louisiana. It is also the developer of the roughly 11-Mt/y Port Arthur LNG export terminal in Texas, which has an FID target in 2021.

Sempra's President and CEO Jeffrey Martin said in late February that Sempra is considering funding part of the Port Arthur project by taking on equity investors in the project if needed, but the goal is for Sempra Infrastructure Partners, a new unit announced in late 2020 encompassing its LNG arm and the operator of gas and power assets in Mexico, to self-fund Sempra's LNG growth plans. Sempra on April 5 said it had agreed to sell a noncontrolling, 20% interest in the infrastructure unit to KKR & Co. Inc. for $3.37 billion in cash.

Construction continues on 2 US LNG terminals

The developers of the two U.S. LNG terminals under construction — Venture Global LNG's 10-Mt/y Calcasieu Pass terminal in Louisiana and the 18.1-Mt/y Golden Pass LNG Terminal backed by Qatar Petroleum and Exxon Mobil Corp. — have reported continued progress advancing their projects.

Venture Global said in a March 17 filing with the Federal Energy Regulatory Commission that Calcasieu Pass could be ready to ship its first LNG cargo in late 2021, a year ahead of schedule. The developer also told the top U.S. energy regulator on March 31 that it is ready to start flowing gas on the pipeline that will supply Calcasieu Pass, saying it needed the initial gas supply to commission the LNG terminal's power generation facilities.

Venture Global expects full operations at Calcasieu Pass, which will be the country's seventh major LNG export plant, to begin in mid-2022.

Golden Pass plans to have the first of three trains operational in 2024.

Besides Calcasieu Pass, Venture Global is developing other projects that include the proposed Plaquemines LNG export facility in Louisiana, which would have a production capacity of up to 20 Mt/y. Venture Global has delayed its target for closing financing until mid-2021, after previously planning to make an FID in late 2020.

NextDecade pursues carbon capture

Annova LNG's March 22 announcement that it had canceled the development of its 6.5-Mt/y export facility left two remaining LNG projects proposed for the Brownsville Ship Channel in South Texas. Only one — NextDecade Corp.'s up to 27-Mt/y Rio Grande LNG project — has announced any firm long-term contracts, a single deal for 2 Mt/y with Royal Dutch Shell PLC.

In late 2020, France's Engie SA halted talks over a potential long-term deal for supplies tied to the NextDecade project in what some industry officials interpreted as a potential warning shot that U.S. projects could suffer from concerns over methane emissions.

NextDecade for months has been pursuing ways to reduce the emissions profile of the Rio Grande facility, including an aggressive carbon capture and storage project the developer announced in March. NextDecade said it expects to make a FID on a minimum of two trains in 2021 and commercially sanction the carbon capture project shortly after.

The other Brownsville project is Glenfarne Group LLC's Texas LNG Brownsville LLC facility, which would build 2 Mt/y of capacity in its first phase. The private U.S. investment firm is also developing the proposed 8.8-Mt/y Magnolia LNG export terminal in Louisiana, after acquiring it in May 2020. The developer estimated it could commercially sanction the facilities in the second half of 2021.

Tellurian looks upstream

Tellurian Inc. President and CEO Octávio Simões told S&P Global Platts on March 25 that the company will not sanction its proposed Driftwood LNG project in Louisiana until it has secured sufficient upstream reserves for the 16-Mt/y first phase of the project. Since Tellurian has only a small acreage position in Louisiana's Haynesville Shale, the developer would need to acquire a significant amount of drilling rights to meet its goal.

At full development, about half of the liquefaction terminal's 27.6 Mt/y of approved capacity is expected to be used by the equity investment partners that Tellurian has been seeking. The remaining capacity would be held by Tellurian to market on its own.

Freeport LNG: Commercial talks pick up

Freeport LNG Development LP CEO Michael Smith said in March that the developer has seen renewed interest from buyers in long-term contracts tied to a proposed fourth liquefaction train at its Texas export facility, following significant volatility in benchmark gas prices in 2020 and early 2021.

"There has been an overreliance on spot cargoes in our industry," Smith said at the CERAWeek by IHS Markit energy conference. "We're seeing interest again in long-term contracts for train 4 because of it, and I think others will, too."

Freeport delayed an FID on train 4 in 2020 amid challenges securing long-term contracts, but the developer has said the project could still reach an FID in 2021, depending on market conditions.

Lake Charles LNG continues without Shell

Energy Transfer LP decided to move forward as the sole developer of the proposed Lake Charles LNG export project after partner Shell pulled out of the project in March 2020. But the developer said it would not target an FID until 2021, and it might reduce the size to two trains with a total capacity of 11 Mt/y.

US West Coast projects remain in limbo

The proposed 20-Mt/y Alaska LNG export terminal and Pembina Pipeline Corp.'s proposed 7.5-Mt/y Jordan Cove LNG export project in Oregon still face major headwinds, including a lack of commercial support.

The state-run Alaska Gasline Development Corp. is seeking to revive its struggling effort to develop an LNG export terminal by shifting its focus toward a pipeline project that would deliver natural gas produced from Alaska's North Slope to the central part of the state as a means of de-risking the project. To do that, it said it will seek federal clean energy infrastructure funding to cover about 75% of the pipeline costs and will rely on a private partner to cover the rest of the project's costs while spearheading its development.

Pembina executives said in late February that they "sadly" can no longer predict when the company will be able to commercially sanction Jordan Cove. The project has faced major permitting difficulties at the federal, state and local levels.

Commonwealth LNG charts different path

Commonwealth LNG LLC entered late into the field of U.S. LNG export developers when it applied for a federal Natural Gas Act permit for its 8.4-Mt/y export project in Louisiana in August 2019. The developer is pursuing a different approach to building the commercial support it needs. Whether it works should be evident in short order.

Commonwealth launched a tender process soliciting bids to reserve off-take from its project in January. Bids were due April 2, and the developer said it plans to notify winners by the end of the month before executing contracts by the end of June.

Delfin deadline approaches

The Delfin LNG project off the coast of Louisiana has all major permits but has not received an FID. FERC in July 2020 granted Delfin a one-year extension to construct connected onshore facilities, after the developer told the regulator it needs more time given the "extraordinary circumstances the world economy faces."

S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.

IHS Markit is subject to a merger with S&P Global pending regulatory and other customary approvals.