S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

2 Mar, 2021

By Calvin Trice and Husain Rupawala

Litigation costs and difficulty raising capital have added to the deteriorating market conditions driving Florida-focused P&C insurance companies toward mergers or market exits, according to a consultant who state legislators tapped to compile an industry report.

Insurers that specialize in Florida property coverage have hiked premium rates to cover litigation costs that swell and often multiply insurance liabilities well past the cost of the original claims. The litigation environment has become as bad a loss hazard for insurers as major hurricanes, risk consultant Guy Fraker, who wrote the report, said in an interview.

Recently, companies have also faced higher barriers to capital as investor returns steadily declined with profit margins, according to Fraker's report. CEOs have gone through challenging but ultimately successful capital raises, but one told Fraker that investors have not been taking his calls, he said.

"It's embarrassing for the state brand not to have anybody want to come near it from an investment perspective," Fraker said.

The value of a $1 million investment in a Florida insurer in 2014 would have slumped below that amount in 2017 and would have been worth just $567,816 by the third quarter of 2020, according to Fraker's report.

The corrosive claims litigation environment is not the fault of any person or group, not even the state's plaintiff's bar, which often reacts quickly with litigation after any court rulings or state legislation, Fraker said. The problem arose from the unintended consequences of a cluster of laws and state Supreme Court decisions that opened up loopholes for contractors, lawyers or insureds to grow the size of claims settlements, he said.

"This came about by accident, and everybody's just leveraging the rules of the game," Fraker said.

The laws and court rulings unintentionally clear the way for property owners to add home repairs onto storm damage claims years after the storm has passed and for generous attorney compensation rules that make it easy to enhance the rates for legal fees that insurers pay when plaintiffs prevail. The result is that roof replacement, one of homeowners' priciest bills, can be added onto a claim from a hurricane that occurred up to three years prior to the roof problem appearing. The 2019 assignment of benefits reform law helped, but property claims litigation and insurance losses endured, Fraker wrote in his report.

One of the most ominous

The result is that the litigation threat has become as bad a loss hazard as a Category 5 hurricane, Fraker said in his report. The ongoing storm of lawsuits accounts for an outsized portion of all earned premiums and is now hitting the capital base.

"Litigation is not only eating away at the bottom line, but bleeding surplus," the consultant said in his report. Florida insurers have been taking rate in their property lines to make up for the elevated loss costs, but that expected earn-in has already been offset by double-digit increases in reinsurance premiums the state saw at Jan. 1 renewals.

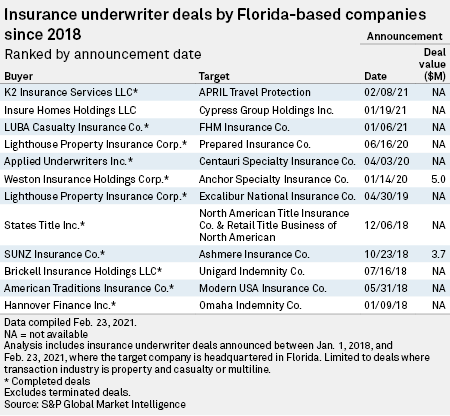

Exits and M&A might be the only salvation for some companies, and Fraker expects that the state could lose as many as seven carriers in the spring. Five underwriters in the state were buyout targets since the start of 2020, including two announced in 2021, S&P Global Market Intelligence data shows.

A December 2020 report from Fitch Ratings forecast that limited scale and concentration in the volatile Florida property market could lead to more acquisitions or insurers closing their doors. If capital levels become too depleted for companies to write new business, the only rescue could be a buyer, Fitch analyst Christopher Grimes said in an interview.

"Whether it's books of business or entire companies, it's something that we expect given the way that losses have mounted in recent years," he said.

Holding company capital levels will be one of the areas of focus for regional insurance rating specialist Demotech as it takes over annual statutory submissions for review.

"How close are you to being able to infuse capital if we think you need new capital?" Demotech President Joseph Petrelli said in an interview.

Even if the legislative environment in Florida were ideal, companies' attritional non-cat ratios should be about 20%, Demotech analyst Robert Warren said in an interview.

"That ratio has been probably north of 40% for some time now," Warren said.