Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Mar, 2023

By Zoe Sagalow

Banking system under pressure: Join us as we navigate through the turmoil in the sector during two special events. We'll host a panel discussion featuring leading banking industry advisers on the implications of these historical events and where the industry is headed. 2 p.m. to 3 p.m. ET on March 16.

Regulators already have the tools they need to prevent the kind of turmoil that rocked the banking industry following a string of closures, but they must improve their supervision, according to several industry experts.

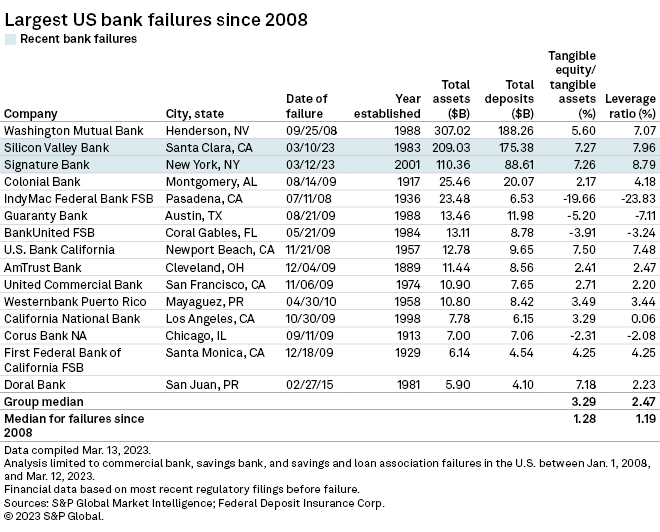

After facing various headwinds like liquidity challenges and deposit runs, regulators recently closed SVB Financial Group's bank unit, Silicon Valley Bank, and Signature Bank. Those moves came just a few days after Silvergate Bank announced that it would liquidate itself. The Silicon Valley Bank and Signature Bank shutdowns rank as the second and third largest bank failures in U.S. history, respectively.

In light of those failures, new questions are being asked about regulatory oversight of banks' liquidity and deposit mixes.

"I don't think we need overall changes in these areas," Jim Adkins, managing partner at Artisan Advisors, said in an interview. "Just follow what's on the books. Apparently no one did."

Federal Reserve Vice Chair for Supervision Michael Barr in a statement acknowledged that a review of the supervision and regulation of Silicon Valley Bank would make sense. The Fed will lead the charge in that review.

"We need to have humility, and conduct a careful and thorough review of how we supervised and regulated this firm, and what we should learn from this experience," Barr said.

Looking at liquidity

The rapid increase in interest rates over the past year created a "perfect storm" that pushed banks' bond books underwater, said Gary Bronstein, partner and a leader of Kilpatrick Townsend & Stockton LLP's financial services team.

Regulators have grown increasingly worried that banks would have to sell those securities at a loss in the event of a liquidity crunch; that fear has recently come true for some.

Two days before regulators shut down Silicon Valley Bank, the bank announced capital raise plans, which included selling $21 billion in securities for a loss of $1.8 billion. That disclosure sent the bank's customers into panic, which spurred a run on deposits. Customers pulled $42 billion in deposits on March 9, according to the California Department of Financial Protection and Innovation's order taking possession of Silicon Valley.

"When you're required to announce that type of activity, it just adds to the liquidity problem because people lose confidence in the future of the bank," Bronstein said in an interview.

Industry experts agreed that regulators want to avoid any similar situations in the future. They did not, however, have a consensus view as to whether regulators will implement stricter capital requirements or keep the same rules in place and step up their liquidity oversight.

The potential for increased capital requirements "is certainly greater today than it was last week," according to James Stevens, partner and co-leader of Troutman Pepper Hamilton Sanders LLP's Financial Services Industry Group. But the most likely outcome, Stevens said, is that regulators will not put any new requirements in place and instead increase their scrutiny under existing procedures.

Others disagreed, saying recent events will cause regulators to push even harder for tougher capital requirements as the Fed works through its ongoing review of bank capital requirements. The Fed may change the scope of that review to be "more like a review of holes in the regulatory framework," said Ian Katz, managing director at Capital Alpha Partners LLC, in a March 12 note.

Given that the largest banks in the U.S. have been unperturbed by the recent volatility, regulators could impose some heightened requirements on regional banks that currently only apply to big banks, Piper Sandler analysts wrote in a March 12 note. More robust stress testing, stricter liquidity requirements and increased use of living wills for regional banks could be on the agenda, they said.

"Such changes would of course take a long time to play out," they added. "But it seems clear to us that what seems to have worked in terms of oversight for the largest banks could easily be pushed down to the rest of the group."

Some banks also expect tougher regulations following the failures. Synovus Financial Corp. believes the recent situations will have "significant regulatory implication on regional banks" in the form of the inclusion of held-to-maturity bonds in regulatory capital levels, increased focus on tangible common equity and more formalized stress testing for smaller banks, executives told Raymond James analysts on March 13.

Avoiding deposit concentration

Regulators will also review their oversight of banks' deposit mixes as deposit concentration was one issue that led to the recent bank collapses. Silvergate was largely concentrated in cryptocurrency deposits, while Silicon Valley's deposit base largely consisted of tech start-up venture capital, most of which was uninsured. Signature Bank also had exposure to cryptocurrency, but was more diversified than Silvergate, according to equity analysts.

"Normal banks that serve communities and that sort of thing are going to be fine, and I think most banks are going to be fine," said Chip MacDonald, managing director of MacDonald & Partners LLP.

Regulators typically advise banks to not have more than 25% of their capital in a particular company or sector, according to Artisan Advisors' Adkins. He said new rules regarding concentration are not needed. Regulators simply need to follow the existing rules.

"That kind of concentration would never have been allowed at your standard community bank or your small regional," Adkins said.

Another area of focus for regulators could be banks' percentage of uninsured deposits. According to an analysis by S&P Global Market Intelligence, Silicon Valley Bank had the second-highest percentage of uninsured deposits among banks with more than $50 billion in assets. Signature Bank ranked fourth in the analysis.

John Gorman, partner at Luse Gorman PC, who has represented financial institutions on M&A and regulation, said regulators could start charging community banks risk assessment premiums based on their levels of uninsured deposits.

One way for banks to avoid running into the problems Silvergate, Silicon Valley and Signature faced is to have diversified deposit bases, both in terms of industry diversification and percentage of uninsured deposits, according to the Piper Sandler analysts.

"Even extending the story to the 'voluntary liquidation' of Silvergate, we still see that same characteristic — a monoline bank with significant turmoil in its particular industry of focus," they wrote. "One clear protection is a diversified, granular deposit base. Though difficult to measure objectively, two worthwhile metrics are the average size of a bank's deposit customer and estimated total uninsured deposits, both of which are available within call report data."