S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

9 Jun, 2021

By Joseph Williams and Stefen Joshua Rasay

May continued to a near-frenetic drumbeat of M&A activity in the information technology sector.

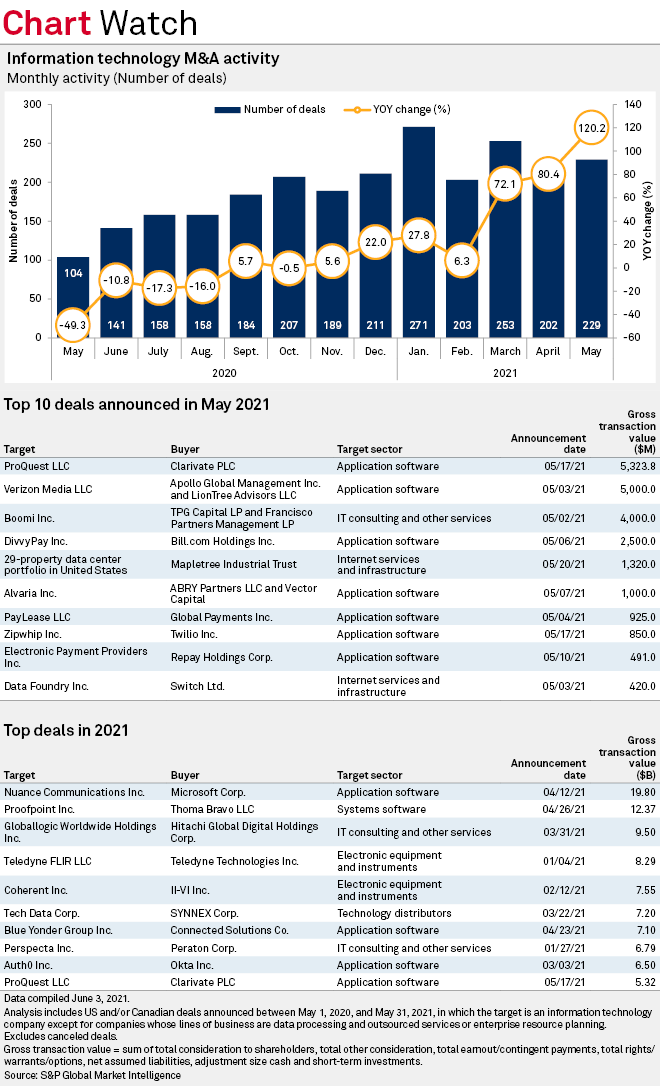

Deal volumes were up 120.2% year over year for the month, at about 229 transactions, according to data from S&P Global Market Intelligence. The same month in 2020 was particularly depressed, with deal markets reeling from the shock of the pandemic. However, the 2021 month also registered above 2019 deal volumes.

For transactions with deal values announced, several made their way into the billions, with two cresting $5 billion.

The most expensive handshake of the month was Clarivate PLC's $5.32 billion acquisition of ProQuest LLC, but Apollo Global Management Inc.'s $5.00 billion acquisition of Verizon Media LLC seemed to catch the most headlines.

Verizon Communications Inc., through a series of acquisitions in the mid- to late 2010s, had put together a portfolio of brands under Verizon Media that included AOL, Yahoo, TechCrunch and Engadget. But more recently, Verizon has focused more on the expansion of its 5G network and less on its media unit, and analysts say the sale to Apollo will allow Verizon to hone that strategic focus.

Focusing on their core

The transaction marks a perennial shift for telecom companies away from non-telecom assets, 451 Research analyst Scott Denne said in a note on the transaction. 451 Research is an offering of S&P Global Market Intelligence.

"Every few years, telcos tire of the telecom business and make adventurous acquisitions beyond it. And every few years, they unwind those deals at a loss," Denne said, noting that the transaction value registers at barely half of what Verizon paid for the Verizon Media portfolio.

Notably, the Verizon Media sale came just two weeks before another telco, AT&T Inc., made a similar decision to spin off its own Warner Media LLC business and combine those assets with Discovery Inc. Under the agreement, AT&T will receive $43 billion, subject to adjustment, in a combination of cash, debt securities and Warner Media's retention of certain debt.

As for the future of Verizon Media, Apollo will be able to provide support, focus and financial resources to the business, and further advance its consolidation of media and technology companies.

Apollo's portfolio holds about 15.3% in tech, media and telecommunications equities, with a total market value of $2.81 billion for that industry, the third-largest industry holding for the firm behind industrials and financials.

The Apollo-Verizon Media deal adds to a private equity buying spree that pushed the first quarter to a five-year high for entry value. Big private equity firms like Apollo and Thoma Bravo LLC have been scooping up media and tech assets with a sizable appetite, landing multibillion-dollar transactions throughout 2021 and making up for a stall in transactions in 2020. Private equity funds available for M&A reportedly sat at about $404.3 billion at the end of the first quarter, according to Preqin Pro data as at April 22.

LionTree's share

Deal advisers are also cashing in on the trend. Apollo announced a wide catalog of global advisers helping it with the Verizon Media transaction, with LionTree Advisors LLC acting as lead and co-investing in Verizon Media alongside Apollo. Other advisers for the private equity firm include Barclays PLC, BMO Capital Markets, Deutsche Bank AG, Mizuho Securities (Singapore) Pte. Ltd. and Royal Bank of Canada

Incidentally, LionTree advised Verizon when it initially acquired Yahoo in 2017 and before that in 2015 when Verizon acquired AOL. No fees were disclosed on Apollo's acquisition of Verizon Media or Verizon's acquisition of Yahoo, but LionTree registered a $40.9 million fee for its services on the AOL deal.

For its part, Verizon counted just two financial advisers on its Verizon Media sale: Evercore Inc. and Goldman Sachs & Co. LLC. Goldman's participation advances the firm in the league tables for one of the most active tech, media and telecom advisers in 2021.

Further boosting both LionTree and Goldman Sachs, the two firms also served as financial advisors to AT&T on the Warner Media/Discovery combination.

ProQuest

Goldman Sachs and Evercore will also advise parties in the month's top deal, in which educational and technical data software developer Clarivate will acquire ProQuest. ProQuest provides information software, specifically for libraries, publishing houses and other book-based services.

Goldman Sachs is lead financial advisor to ProQuest, with support from UBS Investment Bank and Morgan Stanley. Clarivate tapped Evercore.

Adviser fees were also not disclosed for the Clarivate transaction, but for comparison, JPMorgan Chase & Co. collected $21.0 million in fees along with a $3.0 million fairness opinion fee when it advised Instructure on its sale to Thoma Bravo in 2019. At $2.01 billion, that deal size was smaller than Clarivate's transaction, but it consolidated the same educational-tools sector.