S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 Apr, 2021

By Calvin Trice and Jason Woleben

Life insurance companies increased their unaffiliated investment assets in cash and other short-term positions in 2020 as the coronavirus pandemic and subsequent economic downturn clouded longer-term outlooks, an S&P Global Market Intelligence analysis shows.

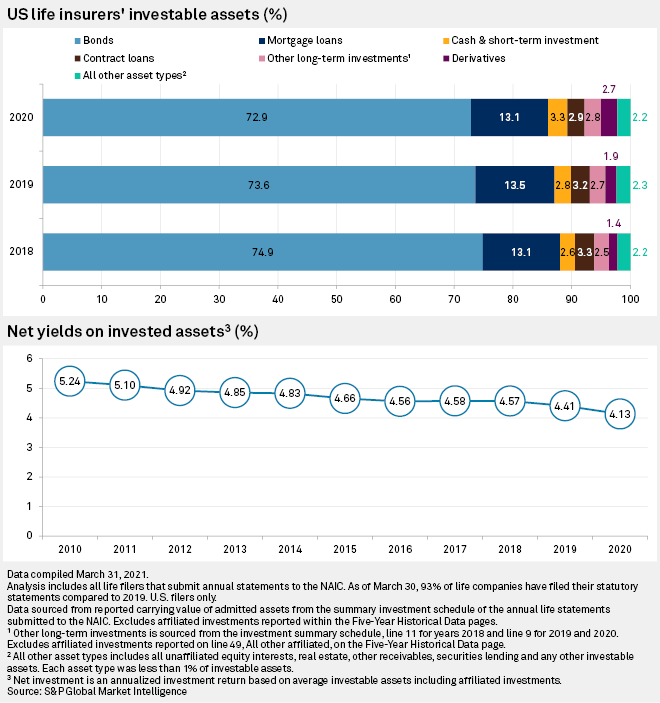

The cash portion of unaffiliated investments grew to 3.3% of the industry total by the end of 2020 from 2.8% in 2019. The industrywide position in derivatives also expanded as a portion of unaffiliated investment portfolios, rising to 2.7% of assets from 1.9% the previous year, continuing a growth trend seen since at least 2018.

Affiliates of Manulife Financial Corp.'s John Hancock held the most significant allocation to derivatives, on a percentage basis, among the largest U.S.

As interest rates have remained persistently low globally, bonds have become a smaller portion of unaffiliated investments, dropping 2 percentage points as a portion of the industry portfolio since 2018. With yields declining steadily for a decade, life insurance investment managers have had to adjust allocations to deliver better returns.

A robust economic recovery expected as the world reopens from COVID-19 restrictions could offer an opportunity in the space, said Rich Sega, global chief investment strategist at Conning. Investors shied away from credit allocations in pandemic-battered sectors such as airlines and hospitality, but those companies might offer bargains now, Sega said in an interview.

"That's something portfolio managers will be looking at — where are those underpriced credit opportunities for companies that could do well in the recovery," Sega said. Credit metrics look good overall, and Conning has maintained a slightly overweight position in the asset class, Sega noted.

Another potential source of yield could be tax-exempt municipal bonds if corporate tax rates are increased to 28% under a federal infrastructure proposal, Sega said.

Fidelity & Guaranty Life Insurance Co. in January appointed co-chief investment officers to manage the company's portfolio in partnership with Blackstone Insurance Solutions. The arrangement with the arm of the alternative asset manager positions Fidelity & Guaranty to underwrite assets that can boost returns without significantly increasing risk, Leena Punjabi, part of the new Fidelity & Guaranty Life investment duo, said in an email. Blackstone's expertise will help the insurer generate yields without venturing into higher-yield but higher-risk credit investments with struggling companies, partner David Martin said.

"We have consciously taken on liquidity and complexity risk instead of additional credit risk," Martin said in an email.

Sun Life Financial Inc. touted the growth of its alternative asset management companies as a source of yield becoming more popular among insurers searching for returns in areas such as real estate and alternative credit.

"Because many insurance companies don't have these investment capabilities in-house, we have seen a trend toward outsourcing allocations in these categories to third-party alternatives managers," Stephen Peacher, president of SLC Management, said in an interview.

Sun Life Chief Investment Officer Randy Brown during SLC Management's investor day presentation in March said some $13 trillion in bonds globally are trading at prices that would produce negative yield when adjusted for inflation.

"That's not sustainable globally, and it creates a headwind for long-term investors," Brown told the online audience.

The company has allocated about $2 billion, about 1% of its assets, to the alternative strategies offered at SLC Management, Brown said. Sun Life had been shedding risk even before the pandemic, so capacity opened up to allocate to classes like commercial real estate and infrastructure equity.

"This is a move on the margins to increase the returns for our policyholders and shareholders," Brown said.