S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

6 Apr, 2021

By Eric Oak

Global trade in April is likely to be focused on the recovery from the Suez Canal blockage, as detailed in Panjiva's research of March 29. The pressure on shipping through the canal has waned, but the disruptions to shipping schedules and downstream supply chain operations could last for months.

At the policy level, the International Monetary Fund and World Bank spring meetings are scheduled for April 9 with new outlooks for global trade; elections are scheduled in Peru for the 11th; and Vietnam is scheduled for a trade policy review at the World Trade Organization on April 27.

April 1 marked the deadline for any trade agreement notifications from the Biden Administration before Trade Promotion Authority expires in July, but nothing has been seen so far. That aligns with the Biden Administration's stated plan to put trade deals in the backseat to domestic policy.

The new U.S. Trade Representative, Katherine Tai, was only recently confirmed, and may still be planning the agency's plans for the next four years. One of the next releases for the U.S. Trade Representative is a report on intellectual property protection in foreign countries as part of the Section 301 process. Recent releases, like the National Trade Estimate, have maintained many of the same positions of the previous U.S. Trade Representative as the Biden administration seeks to keep its options open.

High-level talks between the governments of Japan and the U.S. on April 16 may provide more details of the Biden administration's attempts to build a coalition to deal with China's rise as a strategic competitor.

The ongoing shortage of semiconductors will also continue to be in focus with the Biden administration due to meet with industry representatives on April 12. The latter comes against the backdrop of the administration's review of critical supply chains.

With Vietnam involved in many of the events this month, it's worth looking at Vietnam's trade relationship with the U.S.

Vietnam has been in the crosshairs of U.S. trade enforcement for some time, with antidumping and countervailing duty cases on the docket as well as being labeled a currency manipulator in December 2020. The U.S. Trade Representative recently urged Vietnam to address these concerns.

Much of the scrutiny has come from U.S. importers switching from China to Vietnam after the Section 301 duties. Panjiva's data shows that the top two imported product categories from Vietnam in 2020 were electronics and furniture (including bedding) which saw year-over-year increases of 25.8% and 38.0%, respectively. Recent data from the three months to Jan. 31 show growth ramped up with electrical machinery and furniture, increasing 41.2% and 42.5% year over year, respectively.

Part of the concern from the U.S. is that Vietnam is rapidly transitioning up the value chain into products deemed more strategically important to the U.S.

Exports of less technological goods, like knitted apparel, rose substantially less, up 3.0% in the same three months. Imports of non-knitted apparel and footwear fell 5.2% and 22.9% year over year, respectively.

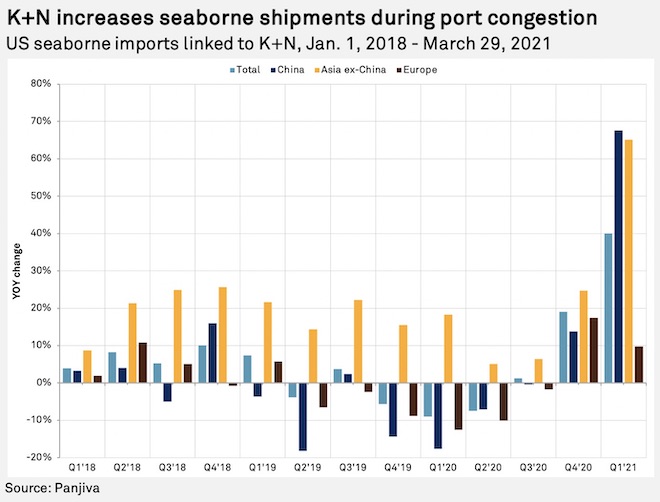

Expected logistics earnings reports in April include freight forwarder Kuehne + Nagel International AG, which is due to report on April 26. The firm may provide some insights into the impact of the Suez Canal blockage as well as ongoing global logistics congestion and elevated rates. Evidence for the elevated shipping volumes can be seen in U.S. seaborne imports linked to the firm. Panjiva's data shows there was a 40.1% year-over-year increase in the first quarter through March 29.

Eric Oak is a researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.