S&P Dow Jones Indices has announced new daily calculation of the S&P European Leveraged Loan Index. Previously, the Index was calculated on a weekly basis.

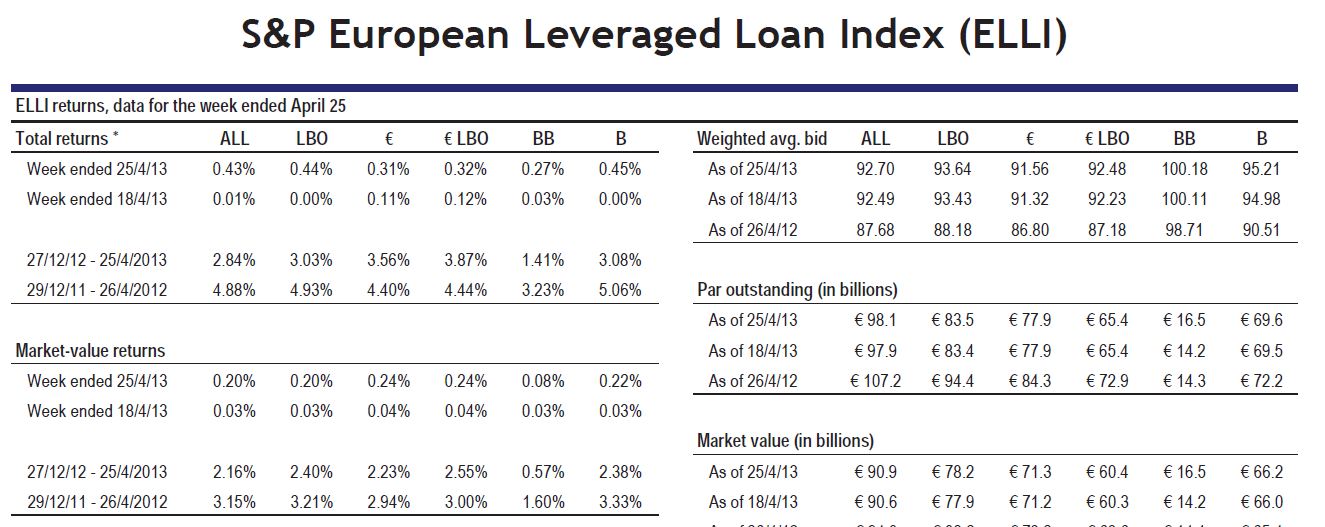

The S&P European Leveraged Loan Index is a market value-weighted index designed to measure the performance of the European institutional leveraged loan market. The Index consists of over 390 loan facilities and represents over €98 billion in par value.

S&P Capital IQ LCD is the source of loan data and the calculation agent. Detailed Index data and analysis is incorporated into LCD’s research tools.

The leveraged loan market consists of loans made to speculative-grade borrowers. The vast majority of loans are senior secured floating-rate paper that the issuer can prepay with little or no restrictions or fees. In this universe, loans are either first-lien or second-lien. As their monikers imply, first-lien loans have a senior claim on collateral, while second-lien loans have a junior claim. In general, loans range in size from €20 million to upward of €9 billion.

For information on sales and research, please contact Marc Auerbach at (212) 438-2703 or Miyer Levy at (212) 438-2714.