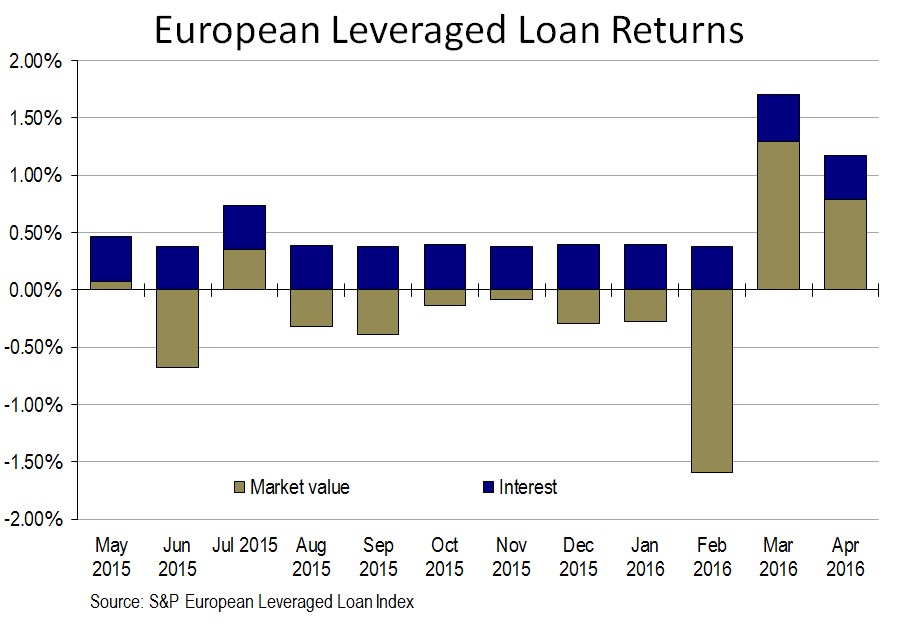

Leveraged loans tracked by the S&P European Leveraged Loan Index (ELLI) gained 1.18% (excluding currency) in April, the second-highest return since January 2013, after March’s 1.7% gain, according to LCD, an offering of S&P Global Market Intelligence.

The market-value component of the return was up 0.79% in April, the second-consecutive positive reading after a seven-month string of losses.

April’s gains put the Index further into the black — up 1.77% in the year to April 30 — but it is still lagging last year, when the ELLI gained 2.95% in the first four months (excluding currency). The difference stems from the market-value component, which has advanced by 0.19% so far in 2016, compared to 1.41% in the same period last year. – Staff reports

![]() Follow LCD News on Twitter

Follow LCD News on Twitter

This story first appeared on www.lcdcomps.com, LCD’s subscription site offering complete news, analysis and data covering the global leveraged loan and high yield bond markets. You can learn more about LCD here.