Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Jul, 2021

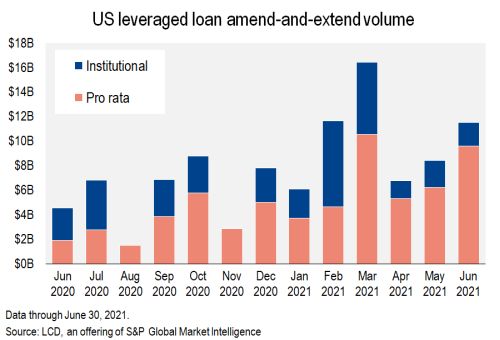

Amend-and-extend activity in the U.S. leveraged loan market heated up in June, with the volume of loan extensions rising to $11.5 billion, from $8.4 billion in May, courtesy of 15 borrowers, according to LCD. The volume of 2021 amend-and-extend deals, through June, reached $60.9 billion, topping the volume recorded during the first half of 2020 by more than $18 billion.

The 15 borrowers included four institutional transactions — an extension of Environmental Resources Management Ltd.'s $526.5 million term loan B, Milk Specialties Co.'s extension of its $439 million first-lien term loan, Certara Inc.'s extension of its term loan B alongside an extension of its revolver, and an extension of CryoLife Inc.'s term loan B and revolver. Institutional loans are non-amortizing term debt, the kind bought by CLOs.

Some of the larger pro rata extensions included Pacific Gas and Electric Co.'s $4 billion and $500 million revolvers, ABM Industries Inc.'s $650 million term loan A and $1.3 billion revolver, and Booz Allen Hamilton Inc.'s $1.29 billion term loan A and $1 billion revolver. Overall, pro rata deals represent the lion's share of extension activity, accounting for about $40.1 billion of the $60.9 billion extension volume for the first half of 2021. Pro rata debt typically entails amortizing term loans or revolving credit facilities.

Stepping back and looking at extensions overall, borrowers this year with pro rata loans have been looking mostly down the road, focusing on maturities coming due in 2023 and 2024, extending $17.8 billion and $11.8 billion of debt, respectively. In 2020, borrowers with pro rata loans focused more on upcoming maturities, extending $14.2 billion due in 2021, $15.8 billion due in 2022 and $9.4 billion due in 2023. On the institutional side, borrowers have been focusing on loans coming due in 2024 or later, extending $15.8 billion of that debt. Last year, borrowers with institutional debt also primarily focused on 2024 and beyond, extending $16.8 billion of debt.

Turning to upcoming maturities, the volume of loans coming due in 2021-2023 fell by $6.8 billion between May and June, to about $66 billion, against the backdrop of about $1.2 trillion in outstanding loan paper. The volume of loans coming due in 2021-2023 was about $209.3 billion less at the end of June than it was at the end of 2019. Meanwhile, the volume of loans coming due in 2024 and 2025 shrank by about $157.3 billion between the end of 2019 and June 2021, while the par amount outstanding due 2026 or later grew by about $424 billion.

Covenant-relief activity also picked up in June, with three covenant-relief transactions recorded in the month versus the lone transaction recorded in May. Those three covenant-relief deals included Learfield Communications LLC, which extended the covenant waiver period under its revolver, which was also extended; ABM Industries, which modified the financial covenants under its pro rata facility alongside an extension; and US Ecology Inc., which also extended a covenant-relief period alongside an extension.

Overall, year-to-date covenant-relief activity has been down significantly compared to last year. During the first half of 2021 there have been 19 covenant-relief transactions, versus 121 during the same time period in 2020,

Looking at specific sectors, borrowers in Real Estate, Services & Leasing, and Manufacturing & Machinery have seen the most — three covenant-relief transactions — amid this sample of 2021 covenant-relief transactions.

Of course, one of the fundamental differences in the covenant-relief landscape today, compared to the Great Recession, is that most current deals are pro rata, comprising revolving credits and amortizing term debt taken on by banks and financial institutions. A decade ago covenant-relief activity tilted toward institutional issuers, whose debt is primarily bought by collateralized loan obligations and retail/mutual funds and exchange-traded funds.

In 2009, the volume of institutional and pro rata covenant-relief activity was about $140 billion and $97 billion, respectively. Fast forward to 2020, and institutional deals accounted for just $20 billion of the $161 billion in covenant-relief volume, according to LCD.

As usual, we will note that because more than three-quarters of the approximately $1.26 trillion in outstanding U.S. leveraged loans are covenant-lite (and pro rata deals are required to have covenants), it stands to reason that most of today's covenant-relief activity is for pro rata deals. For the record, in June, the covenant-lite share of the S&P/LSTA Leveraged Loan Index was at 86%, up from 82% in June 2020. For reference, at the end of 2008, before the peak of covenant amendment activity during the last financial crisis, the covenant-lite share was just 15%.