S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Aug, 2023

By Adrian Jimenea and Cheska Lozano

The majority of large European banks are still growing income from lending even as a period of rapid central bank interest rate hikes appears to be reaching an end.

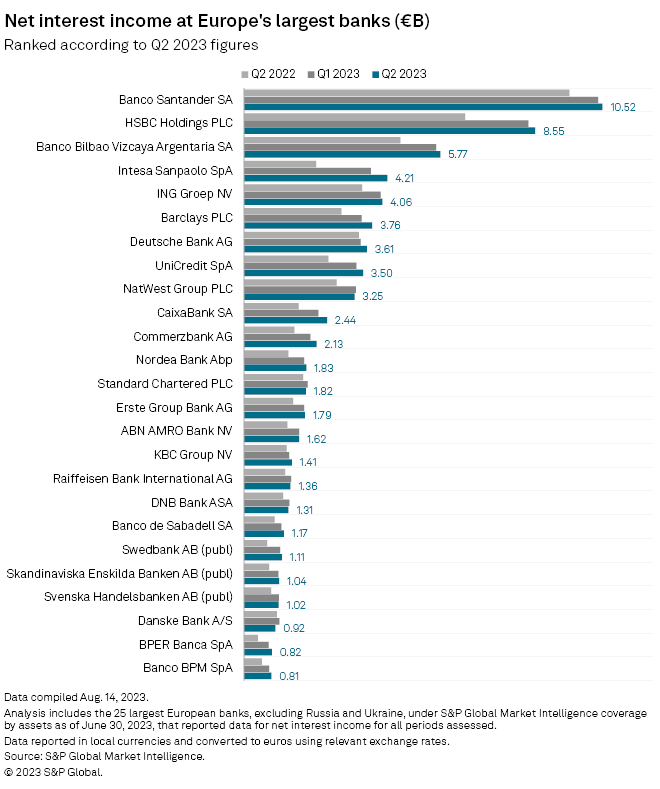

In a sample of 25 of the continent's biggest banks by assets, 19 reported quarter-over-quarter increases in net interest income (NII), S&P Global Market Intelligence data shows. Italy-based Intesa Sanpaolo SpA reported the biggest quarterly increase at 13.0%, followed by domestic peer BPER Banca SpA at 12.8% and Spain's CaixaBank SA at 11.9%.

The outlook for the remainder of 2023 looks strong. Banks including Germany's Commerzbank AG and Spain's Banco Santander SA indicated during their latest earnings calls that their expectations for full-year NII had improved during the second quarter.

The European Central Bank in late July raised interest rates for the ninth consecutive time and the Bank of England has made its 14th consecutive hike, bringing its main interest rate to a 15-year high of 5.25%. These measures to curb persistently high inflation have enabled lenders to increase the spread between the rates they lend at and the rates they pay to depositors.

The rapid expansion of NII has caught the eye of regulators, with Italy the latest country to introduce windfall tax on the banking sector. The move, which hit Italian bank stocks and has been opposed by the ECB, could raise billions of euros and impact lenders' capital distribution plans.

– Access the peer analysis template on CapIQ Pro.

– Pull data on European banks using the screener tool.

– Read more about NII growth in Spain.

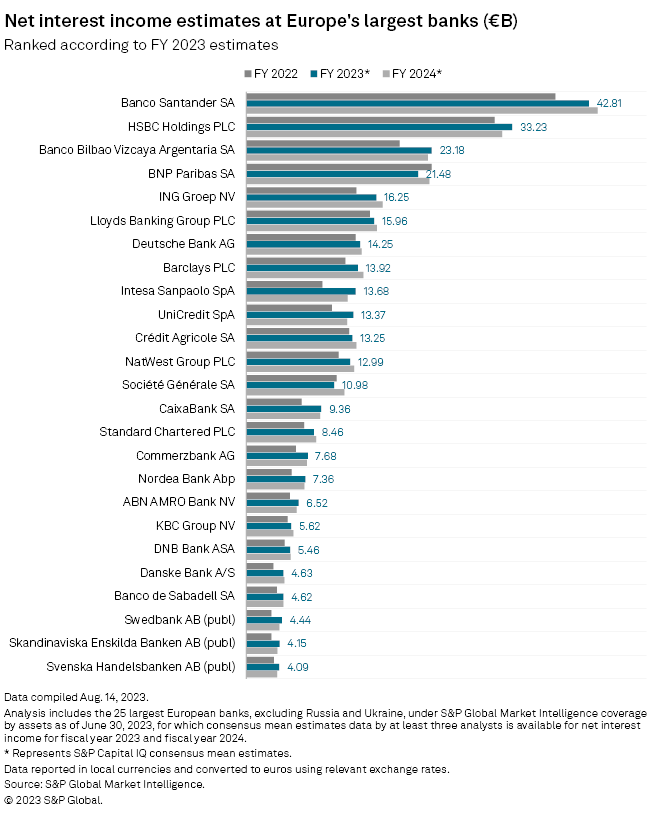

With signs that inflationary pressures are easing and central banks are nearing their final rises of the cycle, the growth outlook for NII in 2024 is more mixed. Among the banks sampled, 11 are projected to report lower NII in 2024 than in 2023, consensus estimates compiled by Market Intelligence show.

Among the banks with the largest projected NII drops in 2024 are Swedish lenders Skandinaviska Enskilda Banken AB (publ), Svenska Handelsbanken AB (publ) and Swedbank AB (publ), along with Intesa and UniCredit SpA.

Groupe BPCE reported the largest quarter-over-quarter increase in net profit at 82.4%, while Danske Bank A/S achieved the biggest year-over-year growth at 178.6%. HSBC Holdings PLC's €6.21 billion second-quarter profit was more than double that of its nearest peer BNP Paribas SA.

The buoyant earnings outlook has raised expectations for European banks' capital distribution plans, so much so that several lenders that did not detail payout plans had share price drops after otherwise solid earnings.

All banks in the sample held common equity Tier 1 ratios well above their requirements at the end of June. France's Crédit Agricole Group, UniCredit and Belgium-based KBC Group NV had the most headroom between their CET1 requirements and ratios.