S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

24 May, 2023

By Ben Dyson and Hassan Javed

Lemonade Inc.'s progress building out its European business since launching in June 2019 has been relatively slow.

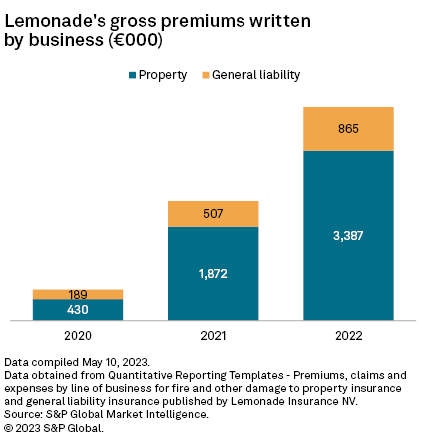

The insurance technology company wrote €4.3 million of gross written premium in Europe in 2022, its third full year of underwriting on the continent, according to the solvency and financial condition report for Lemonade Insurance NV, the Netherlands-based carrier that writes all of Lemonade's European business.

While the European operation showed significant growth in 2022, with gross written premium soaring 78% from the €2.4 million written in 2021, volumes are small relative to its home US market. Overall, Lemonade wrote $116 million of gross written premium in 2019, its third full year in operation, compared to $555.7 million in 2022.

Driving forces

Lemonade's European rollout is similar to how it began in the US, when it initially focused on low-premium renters' insurance. The insurtech now offers renters cover in France, contents and liability cover in the Netherlands and Germany, and contents insurance in the UK.

Other European full-stack insurtechs have made more progress than Lemonade across similar timeframes. Gross written premium at Wefox Insurance AG, the Liechtenstein-based underwriting arm of German insurtech Wefox Germany GmbH, was €45.5 million in 2021, its third full year of underwriting. That figure jumped to €195.9 million in 2022.

Luko Insurance AG, the Germany-based underwriting arm of French insurtech Luko Cover SAS, wrote €5.9 million of gross written in 2021, also its third full year.

Lemonade's "homegrown" European competitors "understood the local pain points and ultimately got first-mover advantage," said Kaenan Hertz, managing partner at Insurtech Advisors.

Another factor at play is the limited extent to which Lemonade uses artificial intelligence in Europe. In the US, Lemonade sees AI as a key differentiator and uses two AI-powered bots: Maya for customer experience and Jim for claims. But its use of AI is "not yet material" in Europe, the company said in its latest regulatory filings.

Low premium volume makes it tough to turn an underwriting profit, particularly since Lemonade is ceding a majority of its premium to reinsurers and has high costs. Lemonade Insurance NV reported a combined ratio of 248.9% in 2022, according to S&P Global Market Intelligence calculations. The main driver of its underwriting losses is the expense ratio, which was 161.8% in 2022, while the loss ratio was 87.1%.

Underwriting performance

Lemonade's European operation also lags behind its US business on underwriting. The US segment produced a combined of 121.5% in its third full year of underwriting. The comparison with other European full-stack insurtechs is more favorable, however. Lemonade's ratio is lower than the 272.6% Wefox Insurance produced in its third year and only slightly higher than Luko Insurance's third-year combined ratio of 239.2%.

While Lemonade Insurance NV is still a long way from underwriting profitability, the situation is improving as the company grows. Its combined ratio was 373.6% in 2021 but was 2,521.3% in 2020.

"As the book matures and further scale is reached, the loss ratio will follow a similar improvement trajectory as observed in our US renters portfolio," the insurer said in its 2022 solvency and financial condition report.

Filings also show that Lemonade is gaining more traction in some European markets than its rivals. Gross written premium in its launch market of Germany totaled €651,000 in 2022. The company wrote more than €2 million of premium in France and more than €1.5 million in the Netherlands, both of which launched later. It is unclear how the company will fare in the UK, as it wrote just €22,000 of premium in 2022 after launching in October of that year.

Lemonade could have more inroads if it follows its US model and starts offering higher premium business, such as motor, homeowners and pet insurance, to the customers it attracted with cheap renters and contents cover.

"That's where the real value of the business is," said Thomas McJoynt-Griffith, a director at KBW's equity research team.

Muted ambitions

Given the need to improve performance at group level, Lemonade's patience with its fledgling European operation might be tested. The company was quite vocal about its European ambitions on 2021 earnings calls.

Daniel Schreiber, the group's CEO, told analysts on a second-quarter 2021 call that Lemonade had started investing more meaningfully in Europe in response to improving conversion rates and "steadily declining loss ratios." Co-CEO Shai Wininger said a quarter later that the insurtech planned to reallocate some advertising spend from its US life business to Europe.

Europe has barely been mentioned since then; Lemonade declined to comment on the performance of its European operations.

At the moment, business in Europe is "certainly a secondary focus for them," McJoynt-Griffith said in an interview.

While Lemonade is mostly prioritizing its far larger US operations, McJoynt-Griffith said there is a "low probability" of Lemonade pulling out of Europe, given the work it has put into obtaining licenses. Losses in Europe are a "drop in the bucket" relative to the overall group, the KBW analyst said, and long-term opportunities are available from retaining a presence on the continent.