Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Feb, 2022

By Tom Jacobs

Lemonade Inc.'s stock slumped during a week that saw it post wider fourth-quarter and full-year 2021 earnings losses than it did a year ago.

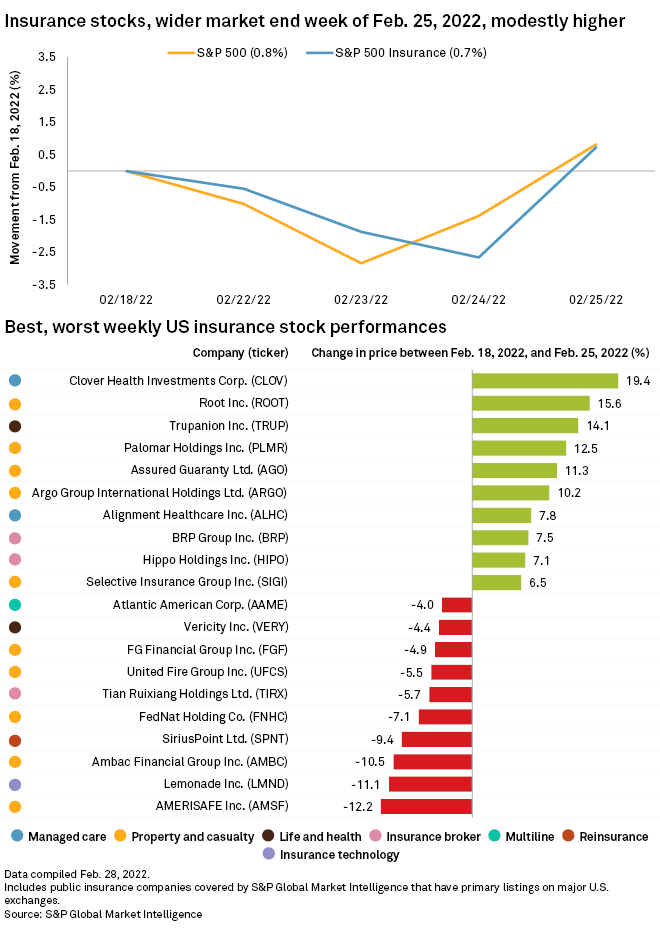

Geopolitical tensions amid the conflict between Russia and Ukraine sent equity markets on a rollercoaster ride for the week ending Feb. 25. The S&P 500 closed up 0.83% to 4,384.65, while the S&P 500 Insurance Index rose 0.73% to 565.21.

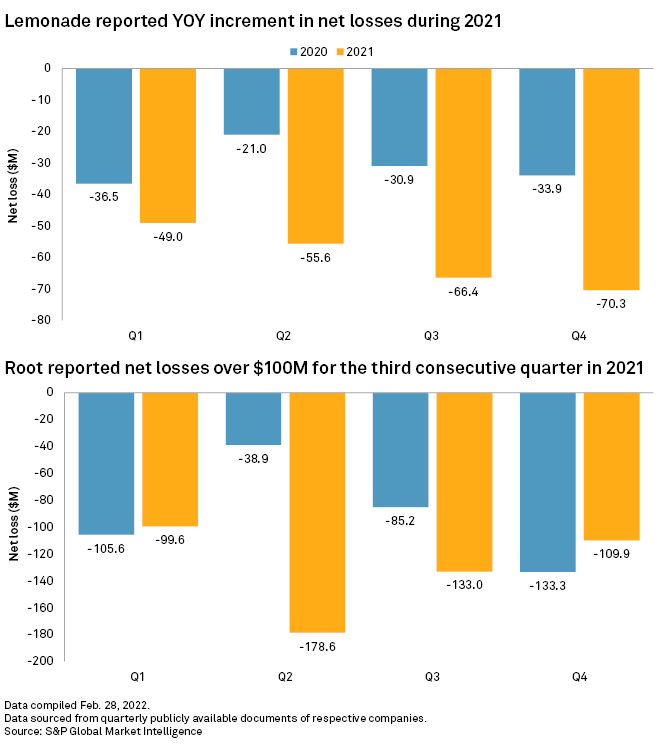

Lemonade's shares tumbled 11.06% for the week as the company reported a net loss of $70.3 million in the fourth quarter of 2021, more than doubling the $33.9 million loss reported a year ago, and a net loss of $241.3 million for full year 2021 that was almost twice the $122.3 million loss in 2020.

The company's fourth-quarter 2021 net loss ratio jumped to 98% compared with 76% in the prior-year period, which CEO Daniel Schreiber during the company's earnings call said was driven by "a handful of older, large losses for which, in retrospect, we under-reserved."

Insurtech Advisors analyst Kaenan Hertz said Schreiber's explanation is difficult to understand given that the losses occurred in the company's rental market. Hertz said the cause is more "systemic," rather than one or two large liability claims and that it seems the company had a challenge in "adequately understanding insurance."

"This, to me, is what has become self-evident this year," Hertz said in an interview.

Fellow insurtech Root Inc. also reported a steep fourth-quarter 2021 loss of $109 million, but that was an improvement from a loss of $133.3 million a year ago. However, its full-year 2021 loss rose to $521.1 million from a loss of $363 million in 2020.

Despite the negative numbers, Hertz said Root, which ended the week up 15.63%, is in a "slightly better place" than Lemonade.

Hertz said Root has taken decisive financial actions, such as laying off employees and reducing its marketing expenses. It has more cash on hand to cover an extended period of "burn rate" than Lemonade does now, Hertz said.

"I think that is going to force Lemonade to make very strategic decisions that will alter their trajectory," he said. "I'm not sure that it will alter it enough that they will be able to have a window to profitability in any reasonable period of time."

The insurtechs' woes will lead to an acceleration of M&A within the space, like The Travelers Cos. Inc.'s acquisition of Trov Inc., announced on Feb. 23, Hertz added.

Reserve issues for Argo

Argo Group International Holdings Ltd. during its conference call addressed the $132 million reserve charge it recently incurred. CEO Kevin Rehnberg said the charge was generated by the company's U.S. operations and runoff lines and that $77 million of the total was driven by construction defect claims.

Rehnberg said the bulk of those defect claims were connected to businesses that have either been discontinued or have been "significantly remediated," and that the remediated portion was previously underwritten by Argo's casualty business.

Argo was one of the top movers for the week among property and casualty insurers, finishing up 10.25%. Palomar Holdings Inc. and Assured Guaranty Ltd. were up 12.49% and 11.26%, respectively, while AMERISAFE Inc. fell 12.16%.