Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Oct, 2021

By Hailey Ross and Jason Woleben

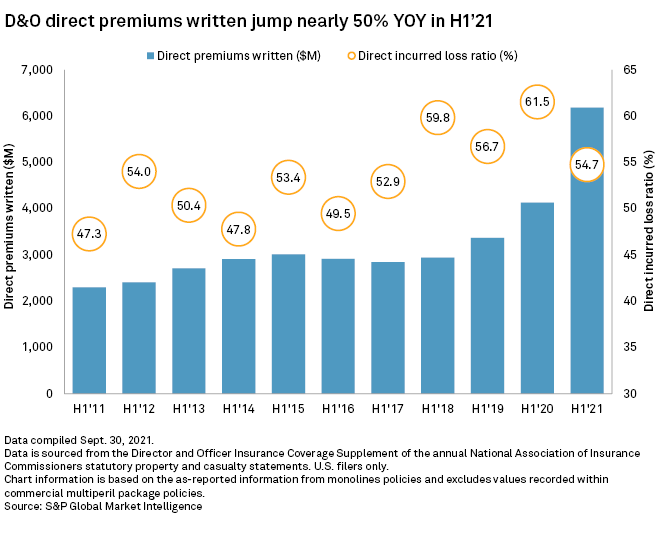

Directors and officers insurance premiums continued to climb in the first half of 2021 as elevated litigation persisted in several areas of evolving risk.

Among the segments experiencing high levels of legal action involving D&O insurance are cybersecurity, IPOs involving special purpose acquisition companies and COVID-19 related lawsuits. Environmental, social and governance concerns are also becoming increasingly important to shareholders and now represent an emerging risk of heavy litigation with which insurers must contend.

D&O insurance is liability coverage that protects the directors and executive officers of a company, as well as the company itself, for losses and other costs stemming from lawsuits alleging wrongdoing against those entities.

D&O is now becoming "the most important" insurance for large companies because it is leveraged against a wide range of risks, according to Shanil Williams, global head of financial lines at Allianz.

"It's not just about financial misconduct, it can have implications for any event," Williams said.

Premiums up across the board

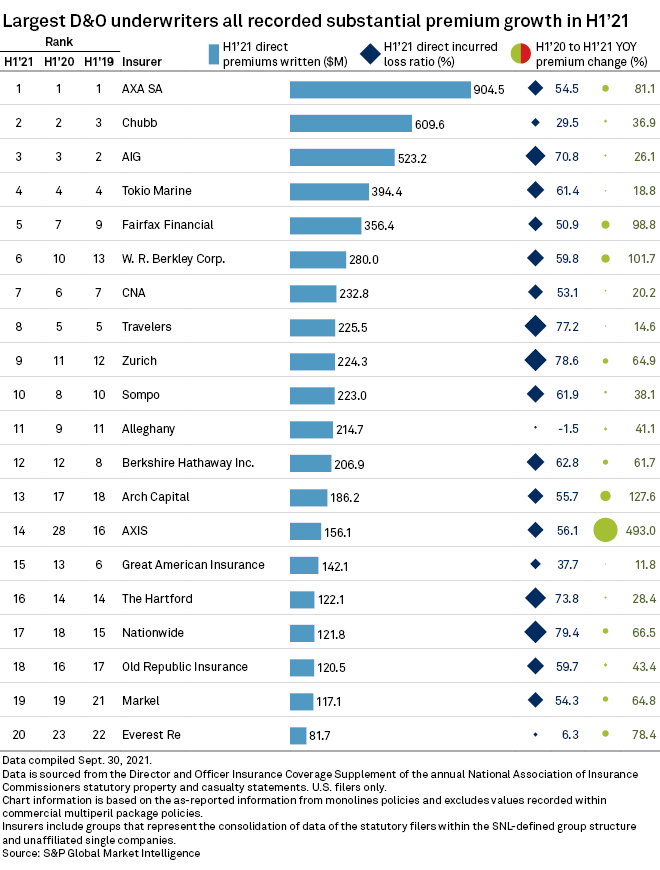

All of the top 20 D&O insurance underwriters saw direct premiums written increase in the first half of 2021, according to an S&P Global Market Intelligence analysis. AXIS Capital Holdings Ltd., Arch Capital Group Ltd. and W. R. Berkley Corp. logged some of the most significant premium growth figures at 493.0%, 127.6% and 101.7%, respectively.

The top four underwriters of D&O insurance in the first half of 2021 — AXA SA, Chubb Ltd., American International Group Inc. and Tokio Marine — retained the same spots they held in the same period in 2020.

Growing concerns for D&O

Several factors are contributing to the increase in D&O prices, according to Allianz's Williams, including new exposures and the late development of some older claims that are taking longer to get through the court system because of delays related to pandemic-induced closures.

Roughly 10% of the securities class-action lawsuits filed in 2020 were related to COVID-19, and many of them will still take some time to resolve, said Priya Huskins, senior vice president of management liability at insurance brokerage Woodruff Sawyer. There may also be litigation consequences as the pandemic persists and companies run into trouble with supply chain and other macroeconomic factors, producing results that may disappoint their shareholders, Huskins added.

Cyberrisk for companies continues to rise as many white-collar corporate employees who were initially forced to work from home because of the pandemic may now choose to stay there indefinitely.

"That obviously puts pressure on the board of directors to think about the company strategically post-pandemic, to move to more of a digital world," Allianz's Williams said.

Woodruff Sawyer's Huskins said she continues to see litigation related to things like workplace discrimination, harassment and other social issues.

Environmental concerns are also pressing, as the U.S. SEC has been clear that public companies will need to provide enhanced climate-related disclosures. Huskins said the Biden administration will not look the other way when it comes to "greenwashing or otherwise misleading shareholders" about their actions related to climate change.

Huskins said the recent successful campaign of a minority shareholder to get activist investors onto the board of Exxon Mobil Corp. was "astonishing," and something she expects will be replicated.

Although D&O premiums continue to rise across the industry, Huskins said there is some stabilization in the litigation environment for mature public companies compared with newer ones.

"Carriers are starting to reach an equilibrium that is much more sustainable," Huskins said.

Christine Williams, CEO of the Financial Services Group at Aon Risk Solutions, echoed Huskins, saying 2021 has been a "more stable" year than 2020 was for the majority of the group's clients. Williams also pointed out that there has been some new capacity in the market, with at least 12 new entrants over the past 18 months, most of which are excess insurers in the D&O space.

ESG issues are likely to remain an extant risk for the foreseeable future and will force insurers and other companies to remain vigilant.

"To the extent that a company is asleep at the switch when it comes to some of the social issues, that will be a concern for insurance carriers," Huskins said.