Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Apr, 2022

|

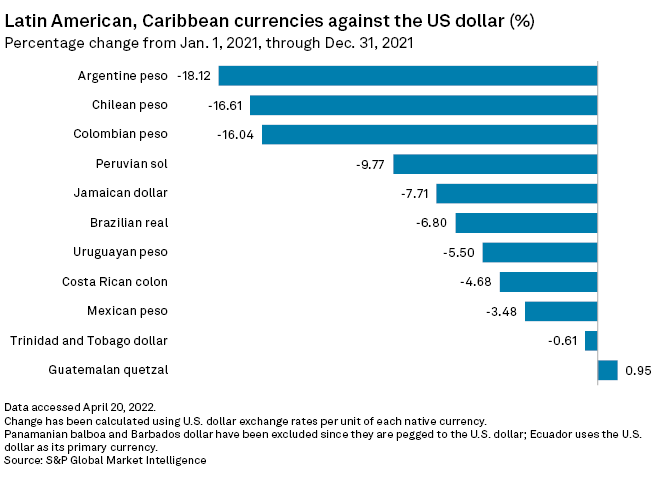

Brazilian banks continued to dominate the list of the top 50 banks in Latin America, despite the negative impact of the depreciation of the real and most domestic currencies against the U.S. dollar on their asset value during the period.

The top six were unchanged from 2020 to 2021. Itaú Unibanco Holding SA, Banco do Brasil SA, Banco Bradesco SA, Caixa Econômica Federal and Banco Santander (Brasil) SA, all Brazilian, comprised the top five by assets. Grupo Financiero BBVA México SA de CV clocked in at No. 6.

Banco Citibank SA was up nine slots to number 27 in 2022, the biggest jump on the list. In January, Moody's said the Brazilian bank's strategy of focusing on wholesale banking strengthened its market position. The rating agency also noted that it has low delinquency ratios supported by conservative risk management procedures, despite a concentrated loan portfolio.

"Citi Brazil's main challenges consist in maintaining a strong pace of earnings generation and diversification towards fees, considering the fierce competition of other foreign banks," Moody's said. Whether the bank manages to climb further in 2022 remains to be seen.

Exchange rate fluctuations dented some banks in 2021. Itaú saw a negative impact of $27.07 billion, representing about 7% of total assets of $371.38 billion, because of currency volatility. But if this year's trend of appreciating currencies continues, 2022 promises to tell a different story.

That said, Itaú has warned that high interest rates increased to counter expanding inflation might halve its credit growth this year, a sentiment echoed by other Brazilian banks.

Three new banks appeared on the list this year: Banco Azteca SA Institución de Banca Múltiple in Mexico, and Banco Santander Río SA and Banco de la Provincia de Buenos Aires in Argentina. The three that fell off the list were Chile's Banco BICE, Peru's Banco de la Nación and Banco Nacional de Costa Rica.