S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

2 Feb, 2021

By David Feliba and Mohammad Abbas Taqi

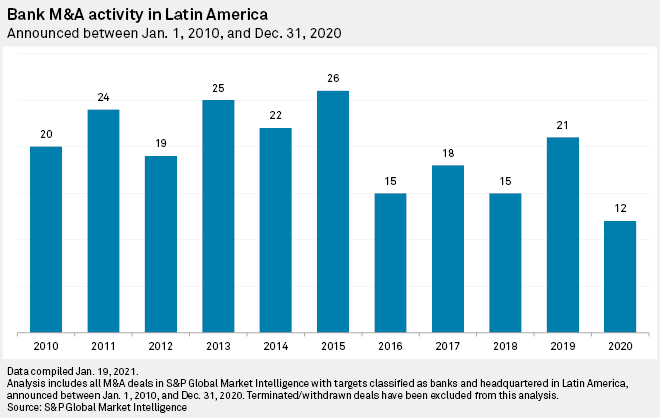

Deal-making across banks in Latin America hit a 10-year low in 2020 as lenders scrambled to contain credit risk and built buffers for upcoming loan losses.

The Latin American bank sector saw just 12 deals announced during the year, S&P Global Market Intelligence data shows, marking the slowest pace of deal-making in a decade.

"2020 was a very quiet year," Alfredo Calvo, a bank director with S&P Global Ratings, said. "There were very good opportunities in the market, with favorable financing conditions and all, but uncertainty was just too high."

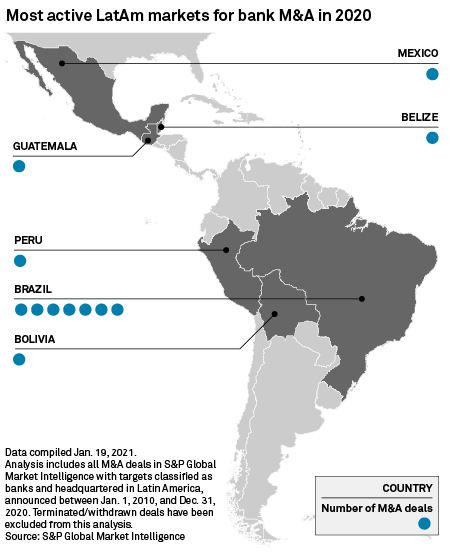

One of the major deals reported was Bancolombia Panamá SA's $289 million acquisition of Grupo Financiero Agromercantil SA, while Canadian banks' retreat from Central America continued with Scotiabank (Belize) Ltd.'s sale to Belize Bank Ltd. Brazil remained a major source of M&A deals, with Credit Suisse scooping Banco Modal SA and several digital players gearing up for competition through medium-sized transactions.

The drawback in deals is set in a context in which broader M&A activity also fell, though less severely. Total M&A in Latin America dropped by as much as 9.4% year over year as deal flow ebbed to 1,509 from 1,665. But during the COVID-19 pandemic, banks faced industry challenges of their own.

Met with prospects of mounting losses, lenders strained during the crisis to manage loan risk. Hard and prolonged lockdowns throughout Latin America severely affected borrowers' capacity to repay, prompting the granting of widespread forbearances across portfolios. In the meantime, banks put up huge provisions in anticipation of defaults to come.

"Even with strong financial conditions, banks decided to privilege their own liquidity," Calvo said. "It was simply not the right time for them to get distracted [with M&A deals]. What they did was go all out to contain the damage in their balance sheets."

The result was a pile of provisions for loan losses that, due to forbearance and flexibility measures, have not materialized yet. Although a rise in delinquencies is expected this year, most bankers now concur that it might not be as bad as initially expected.

For that reason, banks might end up freeing up capital that was initially immobilized. Analysts expect major lenders might come back to the market in 2021 once the crisis stabilizes and belly-up assets can be easily snapped.

Big banks in Latin America likely will find possibilities in medium and smaller sized lenders that have struggled to meet regulatory requirements. "Those are the kind of opportunities that might arise for players that wind up in a solid position," Calvo said. The analyst pointed to strong portfolios of highly-stressed institutions as a major asset for heavyweight lenders to target in 2021.

In crisis, an opportunity for Brazilian fintech

But with the second outbreak of COVID-19 at the door, an uptick in bank M&A remains subject to vaccine progress and market sentiment. In the meantime, other players have moved forward off their own bat.

Although major lenders such as Banco Santander (Brasil) SA, Banco Bradesco SA and Itaú Unibanco Holding SA have taken a defensive approach, reporting no major deals in 2020, fintech players in Brazil that carry a lighter loan portfolio have plowed ahead with acquisitions.

XP Inc., one of the fastest-growing investment platforms in Brazil, led the pack with as many as three acquisitions in the financial services space. It purchased insurance broker DM10, M&A advisory firm Riza and asset manager Augme Capital.

Also in the financial technology sector, payments fintech StoneCo Ltd. made a major acquisition of software company Linx, a move that was praised by analysts as a way to marriage its acquiring operation with software.

"This will become the dominant narrative for the financial sector," Ricardo Lacerda, CEO of BR Partners, a Brazil-based investment bank that specializes in M&A, said in an interview. "The market is moving in that direction."

"For largest banks, it is mostly regroup," he said. "Banks are facing a lot of competition from smaller digital players that attack their markets, so they are trying to defend themselves and anticipate where problems are going to come from."

In that light, challenger banks have made steadfast progress in enhancing a somewhat limited array of products. Nu Pagamentos SA, one of the largest digital banks in the region, bought Easyinvest in order to incorporate investments into its banking offering. Other deals from neobanks included Banco C6 SA purchasing Banco Ficsa SA and Social Bank SA's purchase of Banco Capital SA. Banco Neon SA, in addition, announced it would acquire Consiga Mais Serviço e Cobrança LTDA.

"It was a very hot pipeline in 2020 and I believe it is going to be the same in 2021," Marcelo Flora, a partner with BTG Pactual, said. "We still see a lot to be done in this scene, it is just a question of pricing."

"Sometimes it is easier to disrupt in crisis than it is in booming markets," Paulo Passoni, an investment partner with Japanese group SoftBank, said in a recent interview. "Crises make incumbents go into defensive mode. If you have a strong background and capital, you can be aggressive and differentiate yourself while others are worried about macroeconomy."

However, BR Partners' Lacerda noted that it is yet to be seen how soon big banks, which remained cautious last year, will react. "They recovered quite a lot in terms of valuation and they come out strong of this [crisis]. I believe we are probably going to see the [M&A] flow opening back for them this year."

"I would expect them to fight back, and very strongly," he said.