Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

6 Jul, 2022

By Nick Albicocco and Darakhshan Nazir

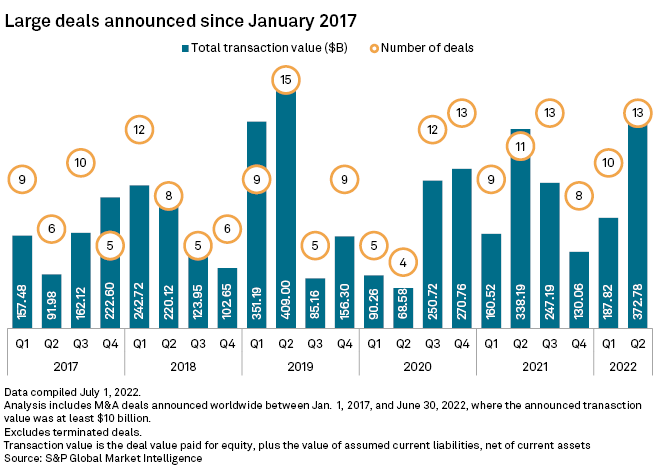

The first half of 2022 was one of the busiest half years for M&A deals worth at least $10 billion in the past five years, despite a dearth of such deals in June.

The 23 worldwide M&A deals worth $10 billion or more in the half had a total transaction value of $560.59 billion. This rivaled the second half of 2020, when there were 25 such deals worth a total of $521.48 billion, and the first half of 2019, with 24 such deals worth a total of $760.19 billion.

Strong April, May

The strong first half of 2022 included 13 deals announced in the second quarter, making the period the most active second quarter since 2019, when there were 15 announced deals. June marked a weak end to the quarter, however. There were no $10 billion-plus deals announced worldwide during the month.

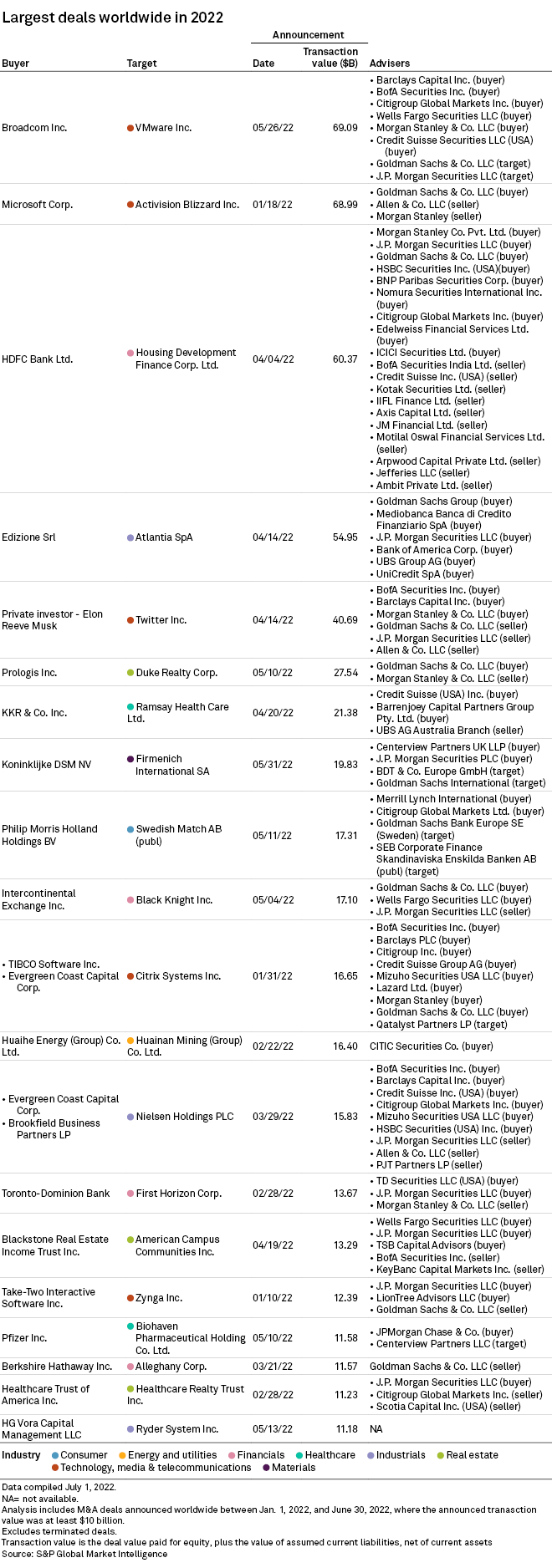

The 13 $10 billion-plus deals announced in the second quarter were worth a combined $372.78 billion, compared to the 2019 second quarter's combined $409.00 billion. The largest announced first-half deal was Broadcom Inc.'s $69.09 billion acquisition of VMware Inc., announced May 26.

* Download a white paper that covers dealmaking trends from the first quarter.

* Read some of the day's top news and insights from S&P Global Market Intelligence.

The combined transaction value of the second quarter's 13 announced $10 billion-plus deals nearly doubled the combined transaction value from the 10 such deals announced in the first quarter. The first-quarter deals had a combined $187.82 billion transaction value, including Microsoft Corp.'s $68.99 billion acquisition of Activision Blizzard Inc.

Top advisers

The Goldman Sachs Group Inc. has stood out as a top adviser on large M&A transactions so far in 2022. Of the 20 largest deals announced year to date, Goldman Sachs has advised on 12, including the six largest deals.

Morgan Stanley has advised on seven of the 20 largest deals of the year, including the three largest deals.