S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

15 Nov, 2022

By Peter Brennan and Chris Hudgins

Large corporations have become increasingly dominant in the public markets, according to an S&P Global Market Intelligence analysis of the market capitalization of publicly traded, U.S.-based companies.

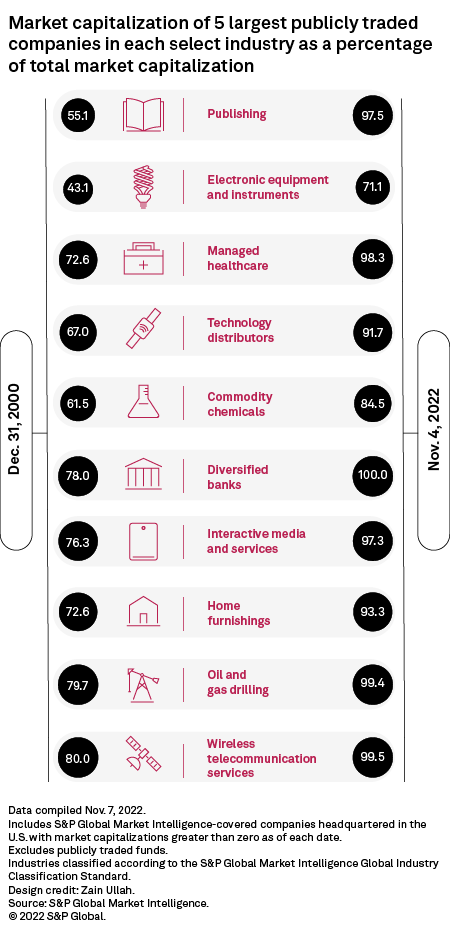

As of Nov. 4, the top five companies in 101 of the 157 primary industries tracked by Market Intelligence account for between 80% and 100% of the total market capitalizations of respective industries. That compares to similar concentration in 93 industries in 2010 and just 89 in 2000.

Fewer companies, greater dominance

Since 2000, the total market capitalizations of publicly traded companies tracked by S&P has grown 167.7% to $39.135 trillion from $14.618 trillion. By contrast, the number of publicly listed companies has declined by 20.7%, to 7,251 from 9,147 over that same time period.

|

The five largest public U.S. companies — Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com Inc. and Tesla Inc. — account for 18.4% of the total market capitalization of publicly traded companies. In 2000, the top five consisted of General Electric Co., Exxon Mobil Corp., Pfizer Inc., Cisco Systems Inc. and Walmart Inc. Together they accounted for a more modest 10.8% of total market capitalization.

The increased weightiness of the biggest stocks means that in 22 industries, the top five most valuable companies account for 100% of market cap. That is up from 12 such industries in 2000.

Currently, only one U.S. public company is in the reinsurance space, Reinsurance Group of America Inc., down from six in 2000, while the number of public brewers is down to two from eight.

Some industries that were already dominated by a small number of players at the turn of the 21st century have become even more so.

Kohl's Corp., Sears, Roebuck and Co, May Department Stores Co., Macy's Inc. and Old COPPER Co. Inc. combined for 88.6% of the market capitalization of the 13 listed department store companies in 2000. Today just the industry has just five listed companies.

The most dramatic decline in the number of companies was the multisector holdings industry, which was reduced from 43 in 2000 to just nine today. The top three, led by Warren Buffett's Berkshire Hathaway Inc., dominate that group.

Biggest increases in concentration

A number of industries that may not be completely dominated by the top five companies still have experienced dramatic increases in concentration in the last 22 years.

The market capitalizations of the largest five publishers is up to 97.5% from 55.1% in 2000. Just 11 listed companies remain, led by News Corp., The New York Times Co. and John Wiley & Sons Inc., in an industry that had 48 public competitors in 2000.

The top-five electronic equipment and instruments companies increased to 71.1% as the number of companies has slimmed to 90, with Keysight Technologies Inc., Teledyne Technologies Inc. and Trimble Inc. coming to dominate. The top-heavy share is up from 43.1% in 2000, when the industry had 159 companies.

There are just seven industries where the top five companies have a combined market share of less than 50%. Regional banks is the lowest at 25.9%, with 530 businesses competing in specific areas across the country, followed by thrifts and mortgage finance, where the market cap of the top five has declined from 79.2% in 2000 to 29.4% today, even as the number of listed companies has fallen to 119 from 317.

Sectors

On a broader level, six of the 11 top-level sectors are less concentrated today than they were in 2000.

Communication services, consumer discretionary and information technology have led the way with increasing concentration. The top five communication services companies now account for 68.3% of the market cap of 359 companies. Much of this is due to Alphabet, which on its own accounts for 41.2%. In 2000, the world was still four years away from the company, then known as Google, hitting the public market. AT&T Inc. was the biggest player at the time and had just 12.1% of the sector's total market capitalization.

Industrials is now far less concentrated as a sector than it was in 2000, with the top five companies accounting for 18.2% of market capitalization, down from 49.9% in 2000. The industry as a whole has seen the number of companies fall to 833 from 1,124.

The market capitalization of General Electric has fallen to $76.7 billion from $475 billion since 2000. The company, once one of the titans of industry, accounted for 34.7% of industrials market capitalization 22 years ago. Today's sector leader, United Parcel Service Inc., has a market cap of $139.3 billion, or 4.1%.