Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Dec, 2021

By Matt Smith

|

A crane at a skyscraper construction site, Nairobi, Kenya. |

Kenyan banks' exposure to real estate has led lenders to demand more collateral from customers amid worries of a property sector slump.

A dozen Kenyan banks hold real estate collateral totaling $37.1 billion, according to a recent report by Egyptian investment bank EFG Hermes that warns lenders are among the most exposed to a property price correction.

Banks have now asked borrowers to provide more collateral should the value of their existing collateral depreciate, Dr. Samuel Tiriongo, director of research and policy at the Kenya Bankers Association, told S&P Global Market Intelligence.

"The frequency of the revaluations would vary from one bank to another, based on respective bank internal policy," Tiriongo said. "In most cases, and from experience, the revaluations would happen every two to three years."

'Stagnant' property market

Land prices have dropped significantly from a 2017 peak as a lack of potential buyers and tenants for both commercial and residential property depresses valuations. Nairobi's office vacancy rate more than doubled from 2011 to 2020 to reach 22.3%, EFG notes.

"Structural changes are needed to improve the outlook, which looks stagnant at best," EFG wrote, adding that banks were especially exposed.

Real estate loan collateral is probably around 50% to 70% of the asset value, according to Eric Musau, head of research at Nairobi-based Standard Investment Bank.

Banks want borrowers to increase collateral following declines in property and land valuations to ensure it still exceeds the value of the loan, providing sufficient cushion for their facilities, Musau said.

"If banks have a headroom of about 30% to 40%, and then the value declines so that this buffer falls below, say, 10%, that becomes a worry for them — especially when you consider that interest can ramp up the total amount payable quite quickly," Musau said.

Loan moratoriums to help borrowers during the pandemic have reduced banks' interest income, adding to their concerns about falling property prices, especially with slower sales in certain market segments.

Stock investors will go overweight on banks that obtain sufficient additional collateral from borrowers to cover real estate loans, and will cut their exposure to any banks that fail to reduce the risk associated with their real estate lending, said Ann Wacera, a senior investments analyst at Cytonn Investments in Nairobi.

"The bigger banks are better able to do this so they should benefit, and the smaller banks will be in a lose-lose situation," she said.

As of Sept. 30, 16% of Equity Group Holdings PLC's assets were in real estate, while KCB Group PLC's real estate, building and construction loans made up 25% of its total book at the end of 2020, according to EFG Hermes. Equity Group and KCB are Kenya's two biggest banks by asset size.

It is difficult to say that banks have over-lent to the real estate sector, according to Musau.

"It's on a case-by-case basis, and there is still room for lending to the sector to grow," Musau said.

KCB and Equity Group did not respond to requests for comment.

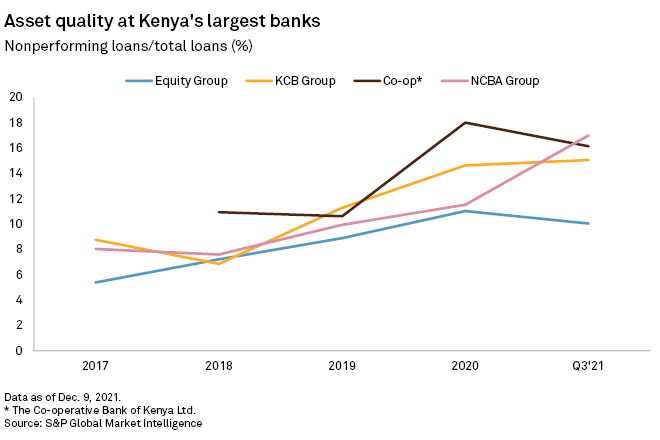

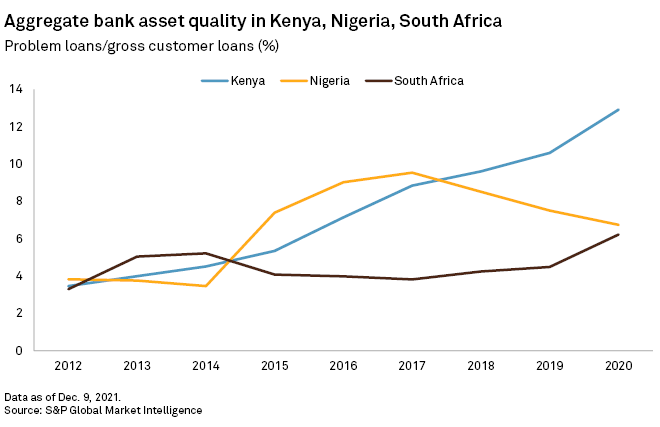

Problem loans at Equity Group Holdings PLC, KCB Group PLC, The Co-operative Bank of Kenya Ltd. and NCBA Group PLC made up between 10.05% and 17.01% of total loans at the end of the third quarter of 2021, with the sector-wide nonperforming loan ratio having risen from 3.46% to 12.91% between 2012 and 2020. The increase in bad loans is partly due to tougher accounting standards, including the IFRS 9 global accounting standard, which forced banks to reclassify more loans as nonperforming, as well as COVID-19, according to Musau.

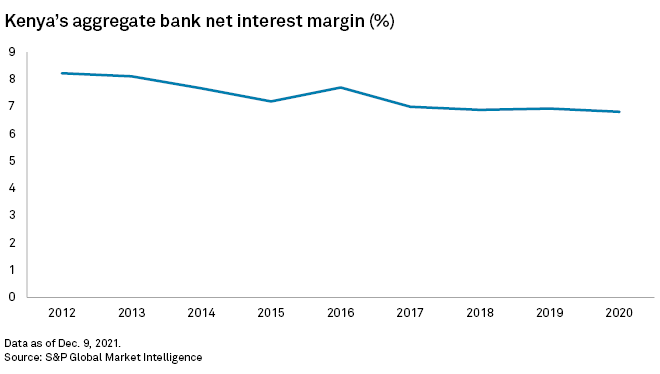

Meanwhile Kenyan banks' aggregate net interest margin — the difference between interest income generated and interest paid out to depositors — declined to 6.81% in 2020 from 8.22% in 2012, according to Market Intelligence data. Aggregate return on average equity — a measure of profitability — declined to 10.72% from 24.72% over the same period.

The banks' revenues recovered in the third quarter of 2021 as Kenya's economy recovered. Net interest income at Equity Group increased to 48.48 billion Kenyan shillings from 39.31 billion shillings a year earlier. KCB's net interest income increased to 56.44 billion shillings from 47.86 billion shillings in the prior year, and that of The Co-operative Bank of Kenya grew to 28.7 billion shillings from 23.6 billion shillings.

KCB said in its third-quarter earnings statement on Nov. 17 that it was anticipating "a stronger 2022 and a more sustained recovery."

NCBA Group PLC and The Co-operative Bank of Kenya Ltd. also did not respond to requests for comment.

As of Dec. 17, US$1 was equivalent to 113.05 Kenyan shillings.