Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Sep, 2021

South Korea's KakaoBank Corp. will be able to tap into millions of loyal users of Kakao Corp.'s messaging app once it starts to expand beyond its home market.

KakaoBank, the banking affiliate of the Korean internet giant, has plans to grow overseas after raising $2.2 billion in an IPO in August. Some sale proceeds will be used for international growth, along with the acquisition of financial technology companies, according to the prospectus.

KakaoBank could target Thailand and Indonesia in its international plans, as these fast-growing economies are already the largest overseas markets for Kakao Corp.'s instant messaging platform, KakaoTalk, according to Celeste Goh, a fintech analyst at S&P Global Market Intelligence. The app's popularity in South Korea has helped KakaoBank sign up more than 14 million monthly active users in the country, as well as make a profit just two years after its launch in 2017.

"Southeast Asia could be an appealing destination for KakaoBank, given the growth prospects of the region," said Singapore-based Goh, who believes the company could be particularly interested in Thailand and Indonesia.

The lender will pursue growth in Asia in the longer term, once it has become the top retail bank in South Korea, a company spokesperson told S&P Global Market Intelligence. When it begins this drive, local joint ventures will be a likely route.

"A combination of finance and big-tech, such as KakaoBank, could be an appealing partner for companies in Asia," the spokesperson said.

Digibank rush

Other technology companies have already followed a similar path. Messaging provider Line, which is owned by South Korean-based Naver Corp. formed a digital bank in Thailand with Kasikornbank PCL and another in Indonesia with PT Bank KEB Hana Indonesia.

Other Asian technology companies have also pushed into digital banking. Singapore-based Grab Holdings Ltd. and Indonesian unicorn PT Aplikasi Karya Anak Bangsa, which operates as Gojek, have both added banking services alongside their main ride-hailing businesses. Digital entertainment platform Sea Ltd. and Chinese Internet giant Tencent Holdings Ltd. have also gone into banking, along with Alibaba Group Holding Ltd. and its affiliate Ant Group Co. Ltd.

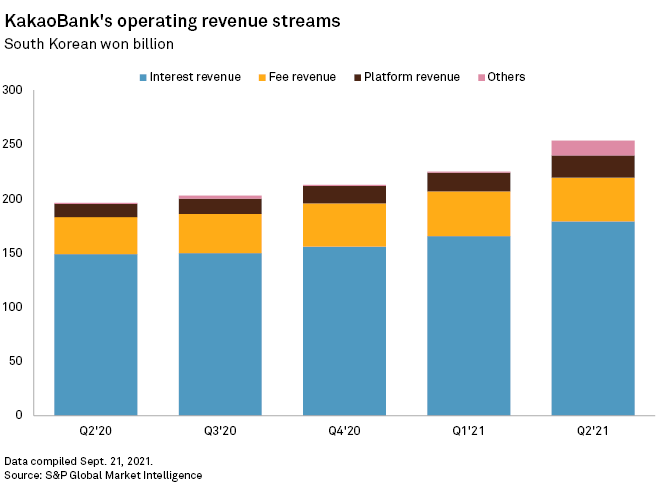

Explosive growth

KakaoBank's explosive domestic growth was aided by the fact that KakaoTalk is used by about 90% of South Koreans, according to the company. The app's penetration is lower in other markets, which suggests matching these growth rates overseas will be challenging, said S&P's Goh.

As of September 24, US$1 was equivalent to 1,181.27 Korean won.