S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

18 May, 2023

Big Tech is largely fueling the S&P 500's positive performance in 2023, with investors buying just seven stocks and selling pretty much everything else.

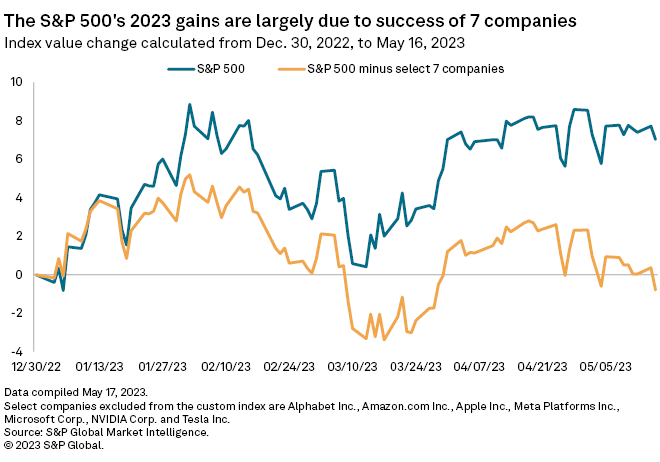

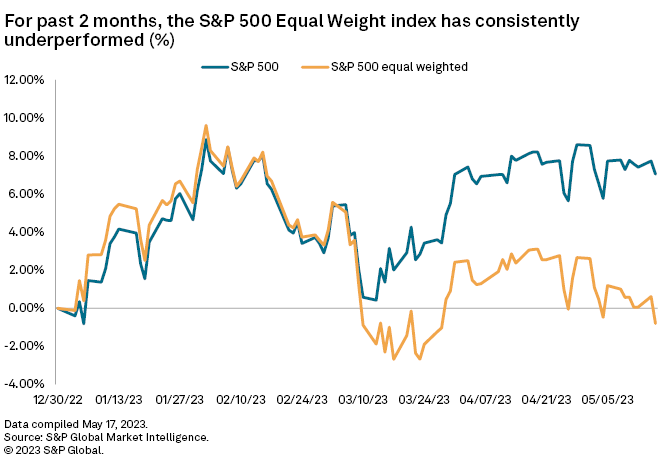

Those seven stocks — Apple Inc., Alphabet Inc., Meta Platforms Inc. Microsoft Corp., NVIDIA Corp., Amazon.com Inc. and Tesla Inc. — have seen significant gains after a bleak 2022, and the collective gains have kept the S&P 500 in positive territory in 2023, with the overall index rising about 7% since the start of the year. Without these seven stocks, which make up nearly 26% of the large-cap index's total weight, the S&P 500 would be down 0.8% on the year, through May 16.

These seven mega-cap stocks have all significantly outperformed the rest of the index as investors have moved to the relative safety of Big Tech amid ongoing interest rate hikes, stubbornly high inflation, the persistent threat of a recession, and the debt ceiling drama in the US.

"There is a long list of uncertainties … and they are taking a toll on most of the equity market outside of the 'Magnificent Seven,'" said Michael O'Rourke, chief market strategist with JonesTrading. "The seven continue to garner flows, support, and buying while the rest of the market is sold."

Outperforming

The seven stocks account for more than 110% of the S&P 500's 2023 gains, O'Rourke said.

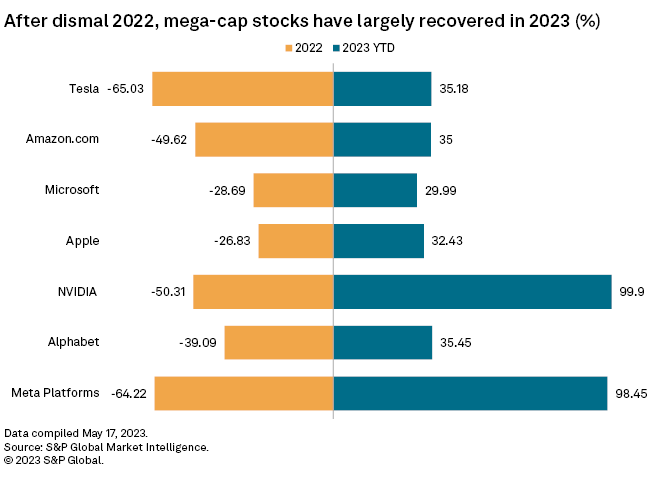

These stocks have seen significant rallies, led by NVIDIA, which has climbed nearly 100% after falling more than 50% in 2022.

Meta Platforms, which lost more than 64% in 2022, is up nearly 98.5% so far in 2023.

"It's not hard to see why these so-called Big Tech companies are doing so well, given how many of them got clobbered so hard last year," said Michael Hewson, chief market analyst with CMC Markets.

Now that the Federal Reserve has potentially ended its rate hike cycle, with the market expecting rate cuts late in 2023, investors have returned to these stocks, said Paul Schatz, president of Heritage Capital.

"Investors' love affair wasn't fleeting," Schatz said. "It was just on vacation in 2022. Each has a great fundamental story that remains. And I think the 7 continue to get more attention and money."

The S&P 500 Equal Weight Index, where all constituents are given the same weights, has persistently underperformed in 2023 and is down about 1%, said O'Rourke with JonesTrading.

Mega rally end may be near

While it is yet unclear how the debt ceiling fight and path of Fed rate hikes will play out in 2023, it is likely that the extreme outperformance of the mega-cap stocks currently leading the S&P 500 will not last, O'Rourke said.

A debt limit resolution can potentially trigger a risk-on move, lifting the whole S&P 500. Or, if the US enters a recession, these top seven stocks are likely to see losses, potentially on pace with those in 2022.

"As those uncertainties start to resolve in one direction or the other … the broad tape will be due to outperform since they have already been pricing in risk," O'Rourke said. "I expect the current trend will reverse as more certainty emerges, regardless of whether the direction of the developments is positive or negative."