S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

3 Aug, 2023

By INGRID LEXOVA and Umer Khan

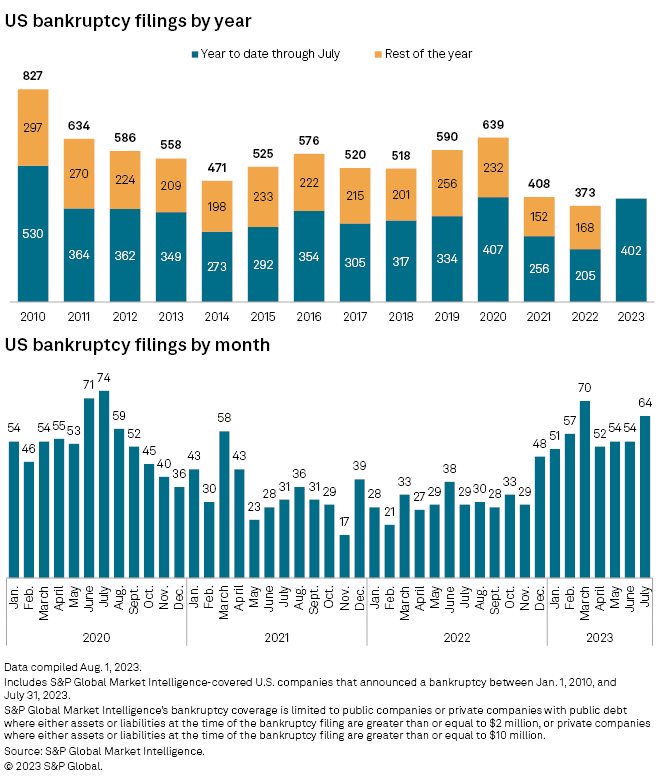

US corporate bankruptcies rose again in July as high interest rates and a challenging operating environment continue to push US companies over the brink.

S&P Global Market Intelligence recorded 64 corporate bankruptcy filings in July, the largest monthly total since March and more filings than in any single month in 2021 or 2022. Filings in the first seven months of 2023 surpassed total filings for the previous year and were nearly on par with 2021's full-year tally.

Notable filings

Voyager Aviation Holdings LLC sought bankruptcy protection on July 27, concurrently announcing a sale agreement with Azorra Explorer Holdings Ltd., an affiliate of Azorra Aviation Holdings LLC. The commercial aircraft leasing company plans to continue normal business operations as it conducts the sale process.

– Download the charts in Excel format.

– Check out the monthly Retail Market series for retail-specific bankruptcy data.

ViewRay Inc. also filed for bankruptcy on July 16, with plans to sell its business and assets. The company, which manufactures magnetic resonance imaging radiation therapy systems, has already received $6 million in financing to support its operations and existing customers during the bankruptcy process, according to a statement.

Only one company with over $1 billion in liabilities filed for bankruptcy in July, down from four in June. The additional bankruptcy brought the 2023 tally for such filings to 16.

Sector breakdown

While the consumer discretionary sector still led with the most companies filing for bankruptcy in 2023, the industrial sector saw both the highest number of filings and the single largest filing in July.

Companies in the consumer discretionary sector accounted for three filings in July, raising the sector's total to 48. The industrial and healthcare sectors rose by eight to 45 and by seven to 39, respectively, in July.

This Data Dispatch is updated on a regular basis. The last edition was published July 6.

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. S&P Global Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion.