S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

16 Aug, 2021

By Jon Rees

JPMorgan Chase & Co.'s acquisition of Nutmeg and Lloyds Banking Group PLC's takeover of Embark may spur further purchases of wealth management-focused financial technology firms as U.K.-based banks seek to cut costs and reach new customers.

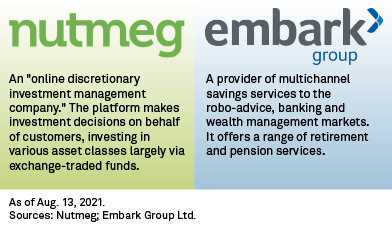

JPMorgan in June acquired Nutmeg Saving and Investment Ltd., a so-called robo-adviser, or online investment service in which customers answer a series of questions before being allocated a risk profile and guided to a suitable basket of investments. A month later, London-based Lloyds said it would buy Embark Group Ltd., a tech-based business-to-business supplier of administration services to investment firms.

Big banks, which have gathered huge levels of deposits during the coronavirus pandemic, are seeking ways to bring down costs associated with their large, complex distribution networks and more effectively reach certain markets such as millennials, according to Fahed Kunwar, an analyst at equities broker Redburn. Subsuming these newer platforms means that banks can retain their deposit-gathering but allow their distribution networks to go digital, Kunwar said in an interview.

|

"From a bank's point of view, you can either build the technology infrastructure yourself or you can buy a firm that's already established, take that intellectual property and build it into your own business model," Jason Hollands, managing director of wealth advisory firm Tilney Smith & Williamson, told S&P Global Market Intelligence, adding that this is the driver for Lloyds' Embark deal. JPMorgan's Nutmeg acquisition is likely more about being able to target a wider section of the population, Hollands said. Both Nutmeg and Embark bring technology to the U.K.'s highly fragmented £1.7 trillion retail savings market, which has 5,400 advisory firms, 90% of which have five advisers or fewer. This market has previously underinvested in technology, according to Hollands.

Another major U.S. bank, The Goldman Sachs Group Inc., plans to open its own robo-advisory firm, Marcus Invest, later this year as part of its U.K.-focused Marcus retail banking brand.

Loss-making

Nutmeg's most recent set of accounts, for 2019, show it made a pretax loss of £22 million on £9.2 million turnover and it is not alone, said Hollands.

"All the robo-advisory firms are loss-making," Hollands said. They have had to spend huge sums on marketing and there is a long payback because most of them are using exchange-traded funds where the margins are very thin.

Scalable Capital, a rival to Nutmeg, closed its retail investing business in the U.K. at the start of the year while another robo-adviser, Wealthify Group Ltd., was fully acquired by its majority shareholder, Aviva PLC, a year ago.

Such firms may be struggling to make a profit but that is not likely to make them less attractive to banks, said Ben Richmond, CEO of Cube, which provides regulatory intelligence to banks.

Richmond said there was a large market of middle-income people and younger investors who wanted an app-based, bespoke wealth management service. Acquisitions in this sector would ultimately build market share for banks, the Cube CEO told S&P Global Market Intelligence.

"There are very likely more deals to come and the big banks are relying on scale and unit economics to make money from these acquisitions — if they put their weight behind them then they can be profitable whilst also keeping the competition at bay," Richmond said.

For banks, too, wealth tech firms allow them to reenter the market for personal savings products, where banks have often previously fallen foul of misselling issues due to poorly incentivized sales staff, Hollands said.

"The attractions of these firms is that it is a lower-risk way back into that mass market space to service an underserved part of the population, where banks have greater line of sight on who has excess cash that could be invested than the rest of us," according to Hollands.

William Chalmers, Lloyds' interim CEO, said the bank would use Embark in part to staunch an outflow of assets. On a first-half earnings call, Chalmers said Lloyds loses more than £10 billion of assets under management each year to rival providers.

UK fintech regulation

|

|

JPMorgan, meanwhile, is using the U.K. as a test case to expand globally by offering products digitally without the cost of branches, according to CEO Jamie Dimon.

Cube CEO Richmond noted that the U.K. is a leader in fintech, with the regulator encouraging innovation in financial services.

"The Financial Conduct Authority works hand-in-hand with fintech companies: their 'sandbox' allows businesses to test innovative propositions in the market with real consumers. As well as this, open banking is no longer just a pipe dream in the U.K., but a reality thanks to [directives] that came into force in 2018," Richmond said.