S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

31 Aug, 2021

By Yuzo Yamaguchi

The private sector in Japan is unlikely to rush into the domestic social bond market following the government's plan to standardize disclosure for debts tackling issues such as childcare and local revitalization.

To meet the funding needs of social issues, the private sector may instead turn to plain corporate bonds or sustainability bonds where issuers have the flexibility to allocate the proceeds between green and social projects, analysts said.

Japan's Financial Services Agency, or FSA, plans to unveil the final voluntary process guidelines on locally sold social bonds as early as September. The guidelines will be the nation's latest push to encourage the private sector to focus more on sustainability and societal impact, after setting long-term goals on hiring more women leaders in listed companies and reducing investments in fossil fuels, among other things.

The move is also in response to growing pressure from activist investors, as well as rising demand from domestic investors hungry for higher returns while looking for standards to minimize so-called "social washing," where not all proceeds go to the social causes that issuers claim.

"Addressing social issues such as saving poverty groups or giving female workers maternity leave are like volunteer activities or corporate efforts," said Mana Nakazora, a strategist focusing on environmental, social and governance issues at BNP Paribas in Japan. "How can [companies] put such issues into projects to be funded through the [bond] issuance?"

Weak link

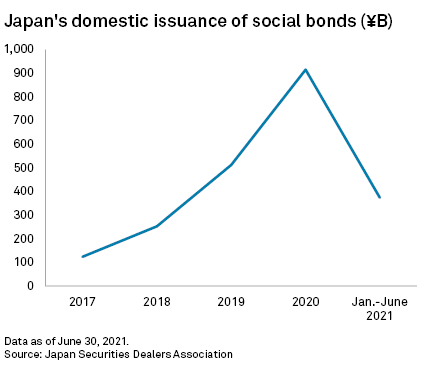

Domestic social bond issuance in Japan jumped almost 80% in 2020 from the previous year, driven by pandemic-related projects. However, the private sector remains a weak link in Japan's push to achieve global goals in fighting poverty and inequality under the 2030 Agenda for Sustainable Development, which was adopted by all United Nations member states, including Japan, in 2015.

The private sector, predominantly financial institutions, accounted for only 6% of all social bonds issued domestically between January 2016 and March 2021, according to the Japan Securities Dealers Association. Most of the social bonds sold in Japan were issued by quasi-government organizations or local governments.

An unnamed official at Keidanren, Japan Business Federation, added that promoting diversity and empowering women that the FSA defines as examples of social projects "may be hard for investors to understand."

Unfavorable pricing

Despite challenges in identifying projects suitable for social bond financing, the private sector is facing another issue: pricing.

Mitsubishi UFJ Financial Group Inc., for instance, issued a 10-year social bond with a 2.847% coupon in 2019 to raise $90 million for the restoration from natural disasters for hospitals in and outside Japan. That rate was above that of green bonds, which were usually around 1% for a comparable tenor.

"Unless issuers can get the premium from the social bond issuance over corporate bonds, they won’t be active in issuing the [social] bonds," Takahide Kiuchi, executive economist at Nomura Research Institute, said.

The FSA had said pricing is an issue that holds back some of the social bond issuance by the private sector.

"There is currently no unified view on whether it is possible for companies to raise funds [in social bonds] under more favorable conditions," the regulator said in the proposed social bond guidelines released in July, citing the "relatively short history" of social bonds as an asset class.

BNP Paribas’ Nakazora said: "Sustainability bonds may be appealing more to investors than social bonds because of the usability."

In the first quarter of 2021, ¥254.6 billion of sustainability bonds were issued in Japan, 53% more than the issuance of social bonds which totaled ¥166.5 billion.

As of Aug. 31, US$1 was equivalent to ¥109.98.