S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

19 Sep, 2022

By Yuzo Yamaguchi and Yizhu Wang

A landmark law by Japan will make it tougher for foreign issuers of stablecoin to enter the local market and promises greater regulatory oversight following upheavals in the stablecoin market earlier this year.

Only entities that are locally chartered will be allowed to issue stablecoins in Japan under the new regulation that comes into effect in June 2023, according to the Financial Services Agency, or FSA.

The issuance of stablecoins — typically pegged to reserve assets such as fiat currencies — will also be restricted to banks, trust companies and certain licensed money transfer agents.

"There should be a high hurdle for the entry of foreign players," said Yuichiro Saka, an attorney at law at Tokyo Godo Law Office and a member of the working group at the FSA involved in stablecoin regulation. “We should not compromise on the evaluation standards for foreign issuers.”

The proposed Japanese law is in line with developments in the U.S. and Europe, where deliberations are advancing in favor of limiting stablecoin players to regulated financial institutions.

Providing a safety net

Japan is among the first major economies to introduce a legal framework on stablecoins and to ensure that investors are protected.

Stablecoins have drawn the attention of financial regulators globally for their potential to be a medium of payments or store of value. The call for more oversight emerged after the prices of stablecoins terraUSD and luna plummeted to near zero within weeks in May. That, in turn, triggered the bankruptcy of hedge fund Three Arrows Capital and several other cryptocurrency lenders.

Japan’s proposed legislation requires stablecoins to be linked to the yen or another fiat currency and a guarantee that holders can redeem the tokens at face value.

The Japanese regulator is keen to ensure stablecoin transactions remain within local control, said Noritaka Okabe, CEO of JPYC Inc., a Japan-based issuer of yen-backed stablecoin used in prepaid payment instruments such as digital wallets.

Japan does not have any locally-issued stablecoin that can be fully redeemed in yen as of now, an FSA spokesperson told S&P Global Market Intelligence.

The FSA is expected to issue further regulations on stablecoins in coming months.

Foreign issuers wary

Some foreign stablecoin issuers plan to stay on the sidelines until the Japanese regulator unveils more details, such as the tradability and convertibility of stablecoins.

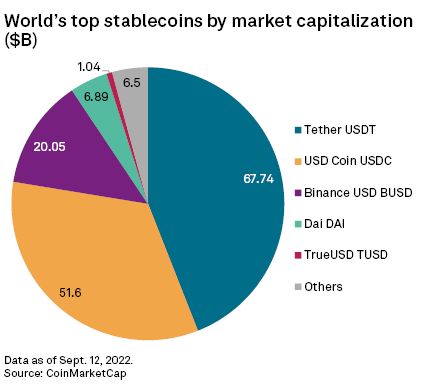

Circle, which operates USDC, one of the largest stablecoins in the world by market value, is currently not focusing on Japanese expansion, a spokesperson told Market Intelligence.

Since the new law presents more of a high-level legal framework instead of actionable guidelines, there is too much uncertainty at this point, said Ken Nakamura, CEO of GMO Trust, a U.S.-based stablecoin issuer. GMO Trust is a subsidiary of Japanese financial and IT conglomerate GMO Internet Group Inc., and one of the few issuers of a yen-backed stablecoin named GYEN.

Whether fiat currency-backed stablecoins can be traded on Japanese cryptocurrency exchanges remains to be seen, Nakamura said. Stablecoins should be permitted to trade on Japanese exchanges to ensure their circulation, and until that happens, GMO Trust would not be able to justify an entry into Japan, the CEO added.

Consumers in Japan can only buy GYEN on international exchanges. GYEN, issued in the U.S., can be converted back to yen. GYEN tokens are fully backed by cash, with a reserve of yen under custody of the U.S. division of BMO Harris.

Japanese regulators approved 31 locally-headquartered cryptocurrency exchanges including GMO Coin, a subsidiary of GMO Internet Group, as of Aug. 31. However, they are not permitted to trade in stablecoins as of now.

Overall, the new rules will make operating in the country costly for foreign issuers of stablecoin, said Yosuke Shiraishi, head of the stablecoin department at the Japan Cryptoasset Business Association.

Continuing scrutiny

Local financial institutions have shown some interest in participating in the stablecoin market.

Mitsubishi UFJ Financial Group Inc., Japan’s largest financial group by assets, introduced a stablecoin platform in February called Progmat Coin, a blockchain-based system for stablecoins pegged on a 1:1 ratio to the Japanese yen. The group also reportedly plans to launch a stablecoin when regulations are introduced.

Rising interest in stablecoins, dominated by coins pegged to the U.S. dollar on a one-to-one basis, is prompting regulators worldwide to consider tougher regulations amid concerns about potential risks to wider financial stability.

“We know some are afraid the regulations will shut off overseas issuers,” an official at the FSA said, declining to be named. “But the key question is whether issuance can be secure and safe here and we won’t favor foreign issuers.”