S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 Nov, 2021

By Cheska Lozano

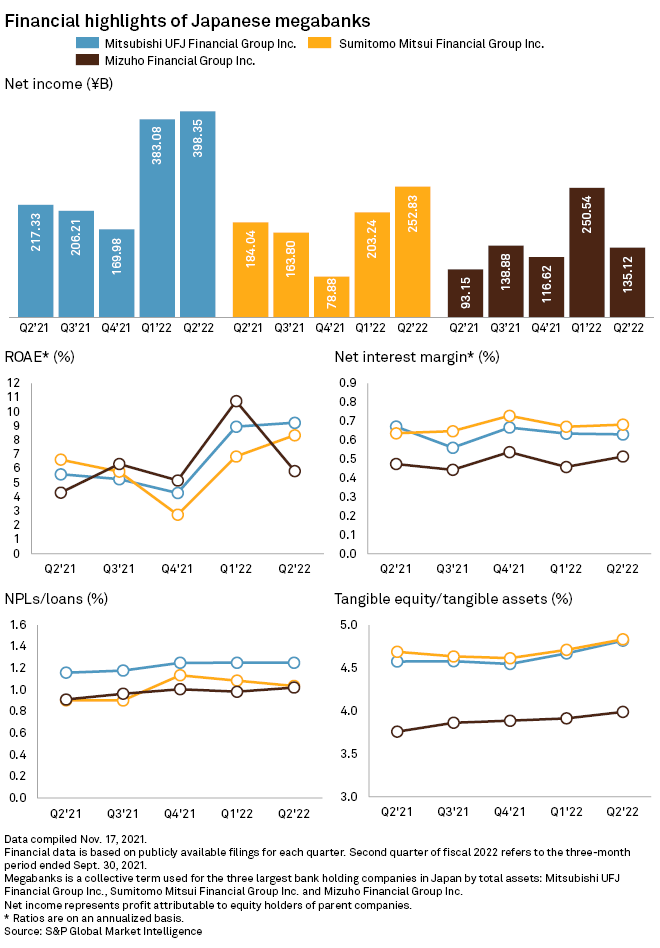

Bad loans at Japan's three megabanks may rise further as many borrowers, still struggling with the aftermath of the pandemic, will be forced to start paying interest on their loans after a government subsidy program ended.

Japanese banks offered no-interest, no-warranty loans to companies struggling with the COVID-19 pandemic for up to five years under a government support plan that started in May 2020. Applications for the subsidy program closed in March 2021 and the interest holiday will end for many companies in the coming months.

"The chances are high that non-performing loans will rise to hit [the megabanks]," said Takahide Kiuchi, executive economist at Nomura Research Institute, adding that more companies may go bankrupt after the government ends its rescue program.

All three megabanks reported higher net profit in the fiscal first half of the year that ended on Sept. 30 and raised their full-year income forecasts, helped by easing provisions for bad loans. However, bank executives are cautious about the outlook even with the pandemic losing momentum in Japan. The services sector, especially the hospitality and leisure industries, are especially vulnerable as their business remains slow.

"The economic outlook remains uncertain," Sumitomo Mitsui Financial Group Inc. CEO Jun Ohta told a press conference Nov. 12. "We're still dealing with companies with excessive debt."

Bad loans

Sumitomo Mitsui Financial Group's nonperforming loans ratio rose to 1.04% at the end of the September quarter, from 0.90% a year ago, according to data from S&P Global Market Intelligence. Mitsubishi UFJ Financial Group Inc. had its NPL ratio climb to 1.25% from 1.16% a year ago, while Mizuho Financial Group Inc. saw a rise to 1.02% from 0.91% a year ago.

NPLs at the megabanks will rise slightly because of higher default risk, said Shunsuke Oshida, head of credit research at Manulife Investment Research Japan. However, bad loans will not likely become worrisome unless the ratio jumps above 2%, Oshida said.

Lending to small and midsized businesses by the three megabanks accounted for nearly 60% of their overall loans.

"We can't be optimistic [about the economic outlook] given an impact from the coronavirus on businesses such as the service industry," Tatsufumi Sakai, Mitsubishi UFJ Financial Group's CEO, said at the Nov. 12 press conference. "We'll consider making an investment into companies, not just extending loans to them."

Bankruptcies in Japan declined for the fifth consecutive month, falling 16% year over year to 525 in October, according to data from Tokyo Shoko Research. Pandemic-induced bankruptcies in the month, however, jumped 50% from a year ago to 159. The downward trend in bankruptcies is likely to reverse as companies may lose steam after financial support for them abates, Tokyo Shoko said in a report.

As of Nov. 19, US$1 was equivalent to ¥113.81.