S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

21 Jun, 2022

By Yuzo Yamaguchi

|

|

A chemical plant in Kawasaki, Japan. The government plans to launch green |

Japan will likely offer higher returns and greater disclosure of the use of funds to draw investors to its planned sovereign "green transition" bonds as it accelerates carbon-neutrality efforts.

Investors will need higher returns to compensate for the poor secondary liquidity of transition bonds due to low issuances. Global issuance of green transition bonds totaled $4.4 billion in 2021, up 33% year over year, although it was less than 1% of the $522.7 billion green bonds issued in the same year, according to Climate Bonds Initiative.

Voluntary disclosure of the use of proceeds, which is not among the recommended guidelines for such bonds in Japan, could also help as it will improve the transparency of decarbonization projects funded by this relatively new class of debt instrument, analysts said.

Prime Minister Fumio Kishida proposed in May to raise about ¥20 trillion in sovereign green transition bonds over the next 10 years for decarbonization initiatives that do not meet green financing requirements. It is not clear when the first batch of bonds will be released, although several government departments and experts are working out the details of the launch.

The government needs to address many issues before the bonds are issued, said Mana Nakazora, chief environmental, social and governance strategist at BNP Paribas in Japan. "The question is, how do they incentivize investors?"

Green transition bonds are often used in heavy-polluting sectors such as oil and gas, steel, aviation and shipping, or "brown" projects that aim to reduce environmental impact or emissions. This debt instrument has yet to become mainstream in sustainable financing due to a lack of widely accepted criteria for eligible transition projects and concerns over greenwashing, where issuers claim they are more environmentally sound than is the case.

Up the interest ante

Transition bonds are rare in Japan: only three Japanese companies issued such bonds totaling a combined ¥140 billion in the fiscal year ended March 31, according to the trade ministry. In contrast, about ¥1.86 trillion of green bonds were issued over the same period, environment ministry data showed.

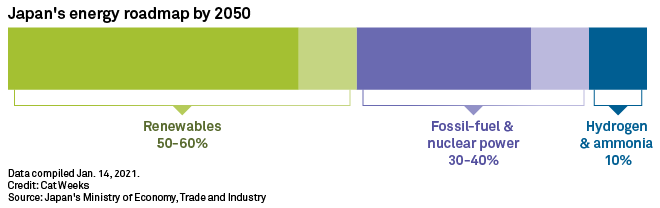

The proposed transition bonds are the Japanese government's latest effort to drive the nation toward carbon neutrality by 2050. The country aims to cut coal power to 19% in its energy mix by March 2031 from 32% as of March 2020, while it plans to double renewable energy sources to 36% or more during the same period.

The government will likely offer a coupon higher than that on regular government bonds, analysts said. The yield on the 10-year Japanese government bond stood at 0.233% as of June 21.

With more than ¥20 trillion needed for energy transition efforts, the premium on these instruments needs to be high enough to attract investors, said Takero Doi, professor of the faculty of economics at Keio University and a member of a government committee on fiscal policy.

Mizuho Financial Group Inc., one of Japan's three megabanks, would consider the purchase of the new sovereign transition debt, a spokesperson told S&P Global Market Intelligence. "As an institutional investor, however, we would seek a higher coupon."

More disclosure needed

The government will need to disclose more specifics about the use of proceeds from the green transition bonds, analysts said.

If the bonds stick to the recommended guidelines by the International Capital Market Association that Japan has adopted, the use of the money will remain unclear and the progress of the decarbonization plan will be vague, said Yoshihiro Fujii, executive director at the Research Institute of Environmental Finance. Transition bonds might seem easy enough to issue, yet that does not mean investors are lining up to invest, Fujii added.

Some investors, particularly foreign ones, could adopt a wait-and-see approach on these bonds, an environment ministry official told Market Intelligence on condition of anonymity. Foreign investors tend to prefer investing in green projects that are aligned with international green taxonomy, the official said.

The planned sovereign transition bond could replace some of the planned regular government bonds to help cap the country's fiscal deficit, said BNP Paribas' Nakazora.

Japan's sovereign bond issuance is estimated to reach ¥1,026 trillion in 2022 — the highest ever — swelling from ¥177.5 trillion 10 years ago, according to data from the finance ministry.

Last year's outstanding issuance of ¥990.3 trillion raised the ratio of outstanding issuance to GDP to more than 250% — the highest in the world — the data showed.

As of June 20, US$1 was equivalent to ¥135.03.