S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

7 Apr, 2021

By Yuzo Yamaguchi

More institutional investors in Japan will likely join Nippon Life Insurance Co. in dialing up pressure on their portfolio companies to go greener more aggressively, experts say, after the nation's largest life insurer went as far as threatening to off-load investments that are not tackling emissions adequately.

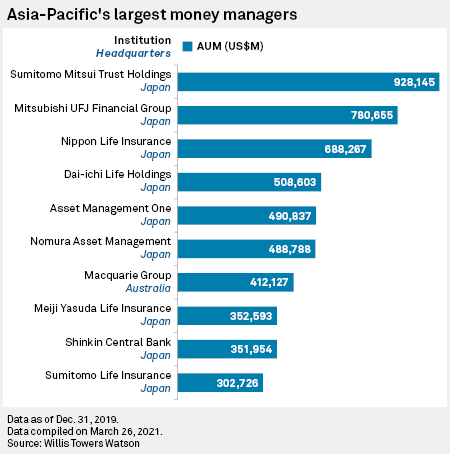

Nippon Life, also the third-largest Asian institutional investor by assets under management, said in February that companies in its ¥10 trillion domestic portfolio must achieve net-zero emissions by 2050, or risk being divested. The insurer also said it would start investing in companies actively tackling emissions from the current fiscal year beginning April 1.

Several other major Japanese insurers, such as Dai-ichi Life Insurance Co. Ltd., Meiji Yasuda Life Insurance Co. and Sumitomo Life Insurance Co., have since then announced plans or an intention to reduce carbon dioxide emissions in their invested companies. However, for now, those plans appear less ambitious or work in progress.

"You can't dial back an ESG trend for an investment," Shingo Ide, chief equity strategist at NLI Research Institute, said, referring to an environmental, social and governance policy. "There will be no doubt a zero-emission policy adopted by other [institutional] investors here for their investments."

Nippon Life's initiative is part of the Japanese financial sector's latest efforts to align with the government's pledge to go carbon-neutral by 2050. The three megabanks — Mitsubishi UFJ Financial Group Inc., Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc. — recently earmarked a total of ¥30 trillion in loans for green projects over the next decade. Japan's issuance of green debt also picked up significantly in the fourth quarter of 2020 despite the coronavirus pandemic, with analysts projecting another record year of green bond issuance in 2021.

Still, Japan is playing catch up with many other advanced economies in sustainable investing. France's AXA SA, for example, is among the most aggressive insurers in incorporating environmental consciousness in investment and client relations. The company has committed to a 20% reduction in carbon emissions on general-account assets by 2025, and recently dropped German power giant RWE AG as a client. Japan's recent efforts are also seen as a response to the U.S.' return to the Paris Agreement on climate change, which pushes Asian countries to decarbonize their economies more quickly, analysts said.

Jumping on the bandwagon

Nippon Life's action "will surely push other insurers to follow it," said Tamami Ota, a researcher at Daiwa Institute of Research. "They may have to leap a higher hurdle to set and achieve [emissions-cutting] targets, however, because they may face a lack of sufficient resources."

Sumitomo Life, Japan's fourth-largest life insurer and the 10th biggest institutional investor in Asia, said April 1 that it will follow Nippon Life in seeking net-zero emissions in its portfolio by 2050. It also plans to set an interim goal for 2030, though it was not elaborated upon.

Dai-ichi Life, the second-largest life insurer in Japan and the fourth-biggest institutional investor in Asia, will set a numerical target to reduce carbon dioxide emissions from its investment portfolio by 2025, a company spokesman said. However, he declined to comment on details such as the timeline and the amount of the reduction.

Over the next three years, Meiji Yasuda Life, Japan's third-largest life insurer and the eighth-biggest institutional investor in Asia, will consider setting an emissions-cutting plan for its invested companies.

Returns, patience matter

Amid a global environmental trend, Japanese insurers may face risks in the market if they are too slow to shift away from fossil fuels.

Stock prices of companies tied to coal-fired electric plants have underperformed, leading to a drag on their portfolio performance. As of April 7, the Tokyo Stock Price Index of the oil and coal sector was up about 22% from a year ago, underperforming the 38% gain for the overall TOPIX during the same period.

The investment returns from Nippon Life's overall investments declined to about 2.4% in the fiscal first half through September 2020 from more than 2.6% in the fiscal year that ended in March 2018, hit by the ultralow-interest rates.

The insurer's investments into carbon-heavy industries such as chemical, electric power and steels accounted for a combined 15% of total domestic portfolio at the end of last September. Nippon Life, which owns equity or debt in roughly 1,500 Japanese companies, will enter discussions separately with most of them to press for the decarbonization.

And if there is a lack of responsiveness after a certain period of time, then the life insurer will even consider divesting holdings in companies that fail to make sufficient progress on cuts, Shimizu said. "That would be a final option to exercise."

The insurer could reallocate the proceeds of those sales to companies that have taken the lead in carbon reductions, a company spokesman added.

As of April 7, US$1 was equivalent to ¥109.69.