Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Apr, 2021

As returns-hungry Japanese banks may lend or invest even more abroad after a record year of 2020, the lenders face rising risk of defaults and market volatility in their growing overseas operations, analysts warn.

Japanese financial institutions have a long history of generating interest income and asset growth from operations outside their home market, which has been battered by a prolonged period of low interest rates and weak credit demand. The risks of global exposures came under the spotlight again in early April, when Nomura Holdings Inc., Mitsubishi UFJ Financial Group Inc. and Mizuho Financial Group Inc. flagged potential losses of around US$2.4 billion combined that were reportedly related to the downfall of U.S. hedge fund Archegos Capital.

The Archegos saga, while not directly related to banks' lending business, is "the result of accelerated allocation of funds to overseas markets, fueled by the low interest rates at home," said Shingo Ide, chief stock strategist at NLI Research Institute.

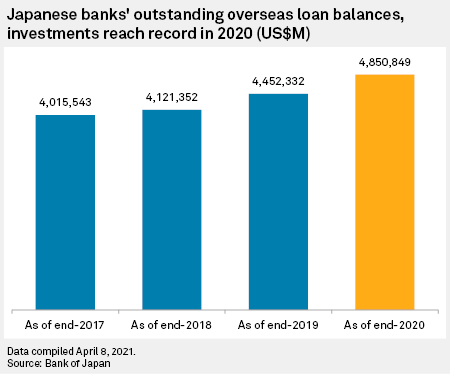

As of 2020-end, the outstanding overseas loans and investments of Japanese banks with offshore assets of more than ¥100 billion each rose to a record of $4.851 trillion, up 9% from a year earlier, the biggest increase in more than four years, according to the Bank of Japan that cited a Bank for International Settlements’ analysis in March.

Nearly half the $4.851 trillion that Japanese banks financed or invested as of the end of 2020 was destined for the U.S., while 23% of that amount was allocated to Europe and 9% to Asia-Pacific, according to the BOJ data.

According to a Japanese government official, who asked not to be named, much of the growth of overseas investments comes from sovereign bonds, asset-backed securities and mutual funds.

U.S. corporate bankruptcies reached their highest levels almost in a decade in 2020 as the pandemic upended global industries and struggling companies faced their breaking points.

"Some lending risks are there for them [Japanese banks] -- default risk, credit risk and market risk" as they allocate more funds to overseas markets, Nana Otsuki, chief analyst at Monex Inc., said. "There is a possibility that they [Japanese banks] will suffer a loss from a market volatility in the U.S. and Europe."

Luring yields abroad

Despite the risks, Japanese banks aren't likely to slow their overseas lending and investments due to strong demand for cash, analysts say.

Japanese banks "are building up win-win relations" with businesses overseas seeking cash, Otsuki said. "This move could become a trend, given a recovery of economies from the pandemic and the continued low interest rates here [in Japan]."

Deposits are piling up at Japanese mega and regional banks as consumption at home slowed amid the prolonged pandemic, providing a war chest to lend to or invest in higher-yielding assets. The average outstanding amount at all Japanese banks in December of 2020 stood at ¥5.77 trillion, up from ¥5.46 trillion in March of the same year when the outbreak of the coronavirus in Japan started.

As of April 15, Japan’s 10-year government bond yields stand at 0.085%, compared with 1.639% for the U.S. treasuries, 1.743% for Australia and 6.011% for India with the same maturity.

The U.S. economy, for example, is forecast to expand 6.5% in 2021, surpassing an estimated 5.6% growth for the global economy, according to Organization for Economic Cooperation and Development. OECD expects Europe’s GDP to grow 3.9% this year, above 2.7% for Japan.

Bumpy road outside Japan

While yields on loans and investments are in general higher outside Japan, they don't always directly translate into stronger performance for the Japanese financial institutions.

MUFG’s record-high nonperforming loans in the end-December quarter of 2020 was a case in point.

During the quarter, the megabank's total NPLs rose to ¥575 billion and its NPL ratio rose to a three-year high of 1.17%. It was largely driven by loan defaults in pandemic-hit Southeast Asia, particularly Thailand where the bank has a 76.88% interest in a local lander Bank of Ayudhya PCL.

The largest bank in Japan had set aside 62% of its loan-loss provisions for its overseas lending during the first three fiscal quarters ended Dec. 31, 2020. As of 2020-end, MUFG extended ¥38.5 trillion of loans outside Japan, or 36% of its total loan book.

In addition, the sinking valuation of MUFG's stake in the Thai bank, as well as its 92.47% stake in Indonesia's PT Bank Danamon Indonesia Tbk and a 20% stake in the Philippines' Security Bank Corp. had led the Japanese lender to book about US$3.34 billion impairment losses for the fiscal year ended March 31, 2020.

"Unless the gap in interest rates between Japanese and other countries narrows, they [Japanese banks] would keep allocating money to overseas markets," said Hajime Takata, executive economist at Okasan Research Center. "Risks are everywhere, however."

As of April 14, US$1 was equivalent to ¥108.97.