S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Mar, 2021

By Vanya Damyanova and Francis Garrido

|

Analysts expect Banco BPM, Italy's third-largest lender, to play a major role in the consolidation of the country's banking sector this year. |

Italy is shaping up to be the busiest market for bank mergers in Europe in 2021 amid a wave of domestic consolidation across the continent that has been accelerated by COVID-19.

|

Weak profits, rising costs and the lack of scale to compete in a still-fragmented market have been driving European domestic bank consolidation for some time, particularly in overbanked markets such as Spain and Italy. In 2019, Spain had the second-highest number of bank branches in the eurozone at 49.66 per 100,000 adults, and Italy ranked third with 38.79 branches, compared to the eurozone average of 20.2 branches, according to World Bank data.

Both countries experienced a surge in M&A activity in 2020 as banks rushed to strengthen their domestic market positions and core business lines after a spike in loan loss provisions destroyed profits, bank market values plummeted and the sector braced for a rise in nonperforming loans.

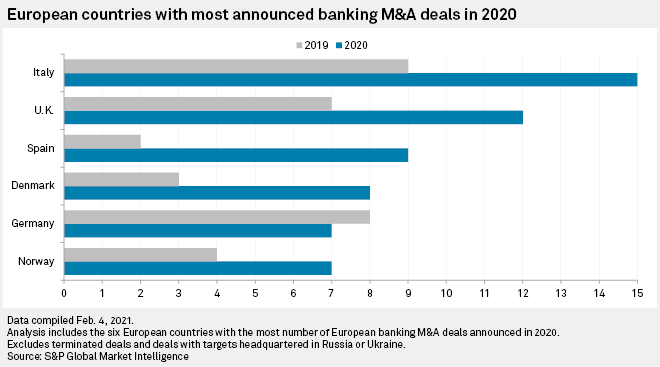

Italy booked the highest number of announced bank M&A deals in 2020 and Spain recorded the strongest year-over-year increase in deal volume, according to data compiled by S&P Global Market Intelligence.

Spain's M&A bonanza to ease in 2021

While both markets are expected to remain among the most dynamic in terms of domestic bank consolidation in 2021, Italy shows the biggest potential for M&A, according to analysts.

"The hotter market is really Italy because, in Spain, the scope for more consolidation has narrowed after the recent mergers of CaixaBank SA and Bankia SA, and Unicaja Banco SA and Liberbank SA," Marco Troiano, deputy head of the financial institutions team at Scope Ratings, said in an interview.

CaixaBank's tie-up with Bankia and the merger of Unicaja and Liberbank will create Spain's third- and fifth-largest banking groups with €664.03 billion and €110 billion in assets, respectively. Following these deals, the potential for further consolidation in Spain has lessened but there are still opportunities for regional bank mergers and perhaps a larger deal involving Banco de Sabadell SA, Troiano said.

Faced with bigger rivals at home, Sabadell entered merger talks with Spain's second-largest lender, Banco Bilbao Vizcaya Argentaria SA, last year, but negotiations were terminated in November 2020 due to a disagreement over price.

Bank M&A in Spain is likely to be more opportunistic in the future considering the first wave of consolidation has already happened, while in Italy a wave of domestic deals, especially among medium-sized banks, is yet to materialize, Arnaud Journois, vice president of global financial institutions at DBRS Morningstar, said in an interview.

More scope for consolidation in Italy

In Italy, there is still plenty of room for consolidation given the large number of banks and the relative size of the market share held by the top sector players, Troiano said. Italy's largest bank, Intesa Sanpaolo SpA, is the only one with a share over 20%, while second-placed UniCredit SpA and third-placed Banco BPM SpA have about 12% and 5% of the domestic market, respectively. Furthermore, a growing need for digitalization will push many banks to seek greater scale and secure the resources needed to invest in new technologies, Troiano said.

There is continuous M&A chatter around Banca Monte dei Paschi di Siena SpA, which the Italian state has to dispose of within the next 18 months, and Banco BPM is also exploring merger options, Giuseppe Latorre, head of the financial sector team at KPMG Italy and global head of deal advisory in financial services, said in an interview.

Banco BPM and Italy's BPER Banca SpA are said to be exploring a merger that may close sometime in the first half of 2021. Earlier in February, an Italian press report said Banco BPM started talks with BPER Banca's biggest investor regarding the potential deal.

Another domestic merger in the making, although with a foreign parent company involved, is the potential deal between Crédit Agricole Italia SpA, part of French group Crédit Agricole SA, and Italy's Credito Valtellinese SpA, or Creval. The Italian government, which has the power to block takeovers by foreign companies in key industries, including banking, approved the transaction earlier in February. Credit Agricole is waiting for ECB approval before it launches an official bid for Creval in April.

A key barrier for domestic mergers in Italy could be asset quality, given Italian banks' existing problems with legacy bad loans and concerns about loans under moratoriums that are difficult to value, according to Troiano and Journois. Nevertheless, increased M&A activity in the medium-sized segment is to be expected, given the government's continued support for bank NPL disposals and the fact that large deals like Intesa Sanpaolo's integration of Unione di Banche Italiane SpA, or UBI Banca, already happened in 2020, Journois said.

Domestic versus pan-European

Elsewhere in Europe, Germany, Poland and the U.K. were among the markets with potential for more M&A named by most market observers interviewed by S&P Global Market Intelligence, and while cross-border transactions are not expected in the short term, the growing momentum in domestic deals may set the scene for pan-European mergers in the medium term.

However, the lack of regulatory harmonization remains a key barrier to cross-border deals. "Regulatory requirements, for example on the size of capital buffers, can vary across jurisdictions, which is a key obstacle to cross-border M&A. Local capital requirements remain largely uncertain when banks assess the long-term business rationale of a merger," Gonzalo Gasos, senior director of prudential policy and supervision at the European Banking Federation, said in an interview.

Products & Offerings

Segment