Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

6 Sep, 2021

By Sophia Furber and Marissa Ramos

Italy's financial system appears much better equipped to handle the impact of the coronavirus pandemic than previous adverse events thanks to a sharp reduction in the number of highly indebted companies since the global financial crisis, S&P Global Market Intelligence data shows.

A smaller share of companies with a heavy debt overhang is good news for Italy's banks as it cushions them from defaults from overstretched

Lighter load

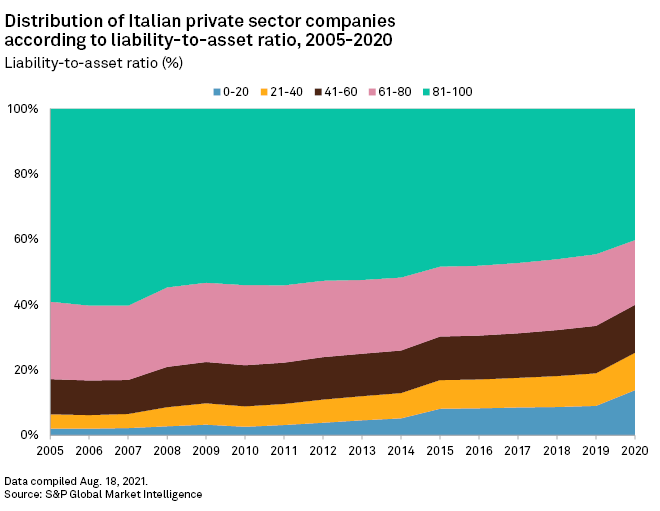

The proportion of highly indebted companies — defined as those with a liabilities-to-asset ratio of between 81% and 100% — stood at 44.56% at the end of 2019, just a month before Italy discovered its first COVID-19 cases, Market Intelligence data shows. This compares to 60.30% at the end of 2007, on the eve of the global financial crisis.

At the other extreme of the scale, the share of companies with a very low level of indebtedness — a liabilities-to-asset ratio below 20% — increased to 9.04% in 2019 compared with 2.24% in 2007.

The trend continued in 2020, with this figure rising to 13.86%. However, data for 2020 is not a perfect comparison with previous years as a significant number of private companies have been allowed to defer filing their results due to disruption caused by the pandemic. While the data set includes information on 832,857 individual companies in Italy for 2019, full information is available for only 50,706 companies in the 2020 sample.

"Comparatively low private sector indebtedness is a key sovereign credit strength of Italy, contributing to underpinning the country's resilience amid economic shocks and associated recovery prospects," Giulia Branz, a sovereign analyst at Scope Ratings, said in an email.

However, the relatively conservative levels of leverage in Italy's private sector stand in contrast to the country's public debt, which is proportionately the second highest in the euro area after Greece and stood at 155.6% of GDP as of the end of 2020. The government expects it to increase to 159.8% at the end of 2021, a post-World War II record.

'Mitigating factor'

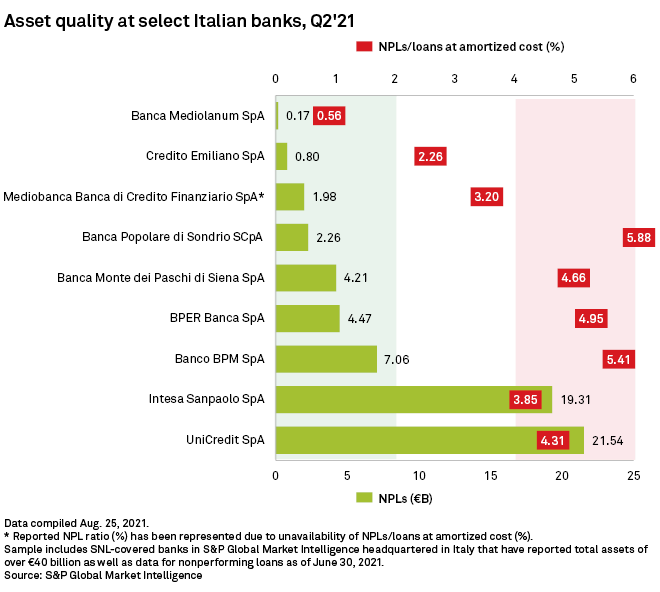

This lower degree of leverage is a "mitigating factor" for Italian banks, according to Nicola De Caro, senior vice president for global financial institutions at DBRS Morningstar.

"In addition, liquidity reserves, in the form of bank deposits, increased significantly since the onset of the pandemic as a result of lower retail consumer spending and higher liquidity cushions built up by corporates. This liquidity buffer adds further protection to Italian banks against large loan losses," De Caro said in an interview.

Client deposits at Italian banks increased by €135 billion year over year in May to a record €1.77 trillion, according to Associazione Bancaria Italiana, the country's banking lobby.

But there is a limit to how much can be inferred about the risks to the Italian banking system from private companies looking at aggregate levels of indebtedness alone, said Maartje Wijffelaars, senior economist at Rabobank.

"The risk debt poses to the banking sector/financial system also very much depends on the quality of the loans, whether debt is in the hands of strong companies with strong balance sheets (assets), good income flows and good margins, or in the hands of vulnerable ones," Wijffelaars said in an email.

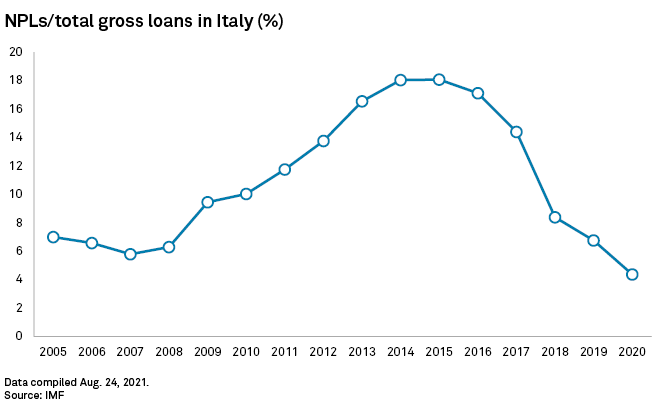

Italian banks have managed to reduce their nonperforming exposures to below pre-global financial crisis levels, IMF data shows, in no small part due to securitization programs that have enabled lenders to package together and sell bad loans to investors.

Real estate and tourism

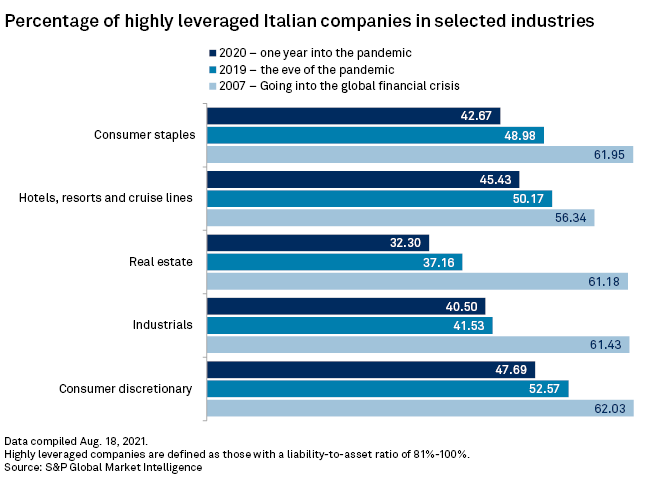

Evidence of deleveraging is particularly strong in the real estate and construction sector, where only 37.16% of companies had a liabilities-to-asset ratio of above 81% as of the end of 2019, compared with 61.18% in 2007. This figure had fallen to 32.30% by 2020.

The share of real estate companies with a very low level of implied leverage increased significantly, standing at 22.19% in 2019 compared with just 5.21% in 2007. Defaults in the real estate industry following the global financial crisis were responsible for a significant share of Italy's nonperforming loans.

But deleveraging has been less pronounced in the hotels, resorts and cruise lines segment — a part of the Italian economy that observers fear could be especially vulnerable to defaults due to the negative impact of lockdowns and travel restrictions on the tourism industry. The share of companies in the segment with a liabilities-to-asset ratio of over 81% stood at 50.17% in 2019, compared with 56.34% in 2007.

Reluctance to borrow

While a conservative approach toward private company debt may prove to be a saving grace for the Italian financial system, it is not without downsides for banks, which could struggle to grow their performing loan books again as the country emerges from the crisis.

Italian bank lending to businesses continued throughout the pandemic, supported by state-backed guarantees on loans, in a bid to ensure that viable companies had a steady supply of liquidity to get them through the worst of the crisis. State-guaranteed loans to Italian small and medium-sized enterprises totaled €79 billion in the first eight months of 2020, according to Italian Treasury data seen by academics Fabrizio Core and Filippo De Marco from Erasmus University and Bocconi University, respectively.

This helping hand from the government ensured a steady flow of credit from Italy's banks to the private sector throughout the pandemic, with UniCredit SpA and Intesa Sanpaolo SpA reporting in their first half results for 2021 that they had

But the question is what will happen to bank lending once these emergency measures come to an end. Demand has been slow to pick up in the Italian economy and despite a high savings rate, consumers are still reluctant to start spending again, Angela Gallo, lecturer in finance at Bayes Business School in London, said in an interview.

"Companies will have to adapt to a new demand level which is lower than in the past, and they may not be that interested in picking up more debt to do more investment, because there is still too much uncertainty about levels of spending by the public," Gallo said.

Disposable income for Italian households rebounded by 1.5% quarter over quarter at the end of the first quarter of 2021, but consumption expenditure fell 0.6%. Meanwhile, the savings rate increased by 1.8 percentage points to 17.1%, according to the Italian National Institute of Statistics.