S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

20 May, 2021

Italy's banks could significantly improve their capital structures by issuing more hybrid securities like Additional Tier 1, or AT1, bonds, according to analysts. More issuance would likely be well-received by investors — but only if the banks are in robust financial shape and have wrestled bad debts down to manageable levels.

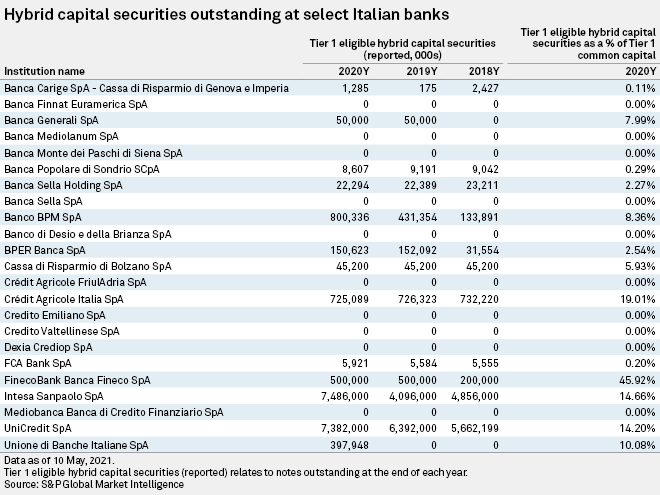

With the exception of the country's two largest banks, UniCredit SpA and Intesa Sanpaolo SpA, issuance of hybrid securities has been thin on the ground in Italy. At end-2020, about 14% of the two banks' Tier 1 common capital was made up of Tier 1 eligible hybrid securities, according to S&P Global Market Intelligence data, but most other large Italian banks had far lower proportions.

AT1s are securities that convert to equity in a crisis, often when a bank's capital falls below a certain threshold, and can be issued to satisfy Basel III regulatory requirements. They are not without risks to investors: Banco Santander SA rattled markets in early 2019 when it unexpectedly chose not to make an early repayment on €1.5 billion of AT1 bonds, and Scope Ratings flagged the risk of coupon nonpayment at the height of the pandemic.

Optimizing the capital stack

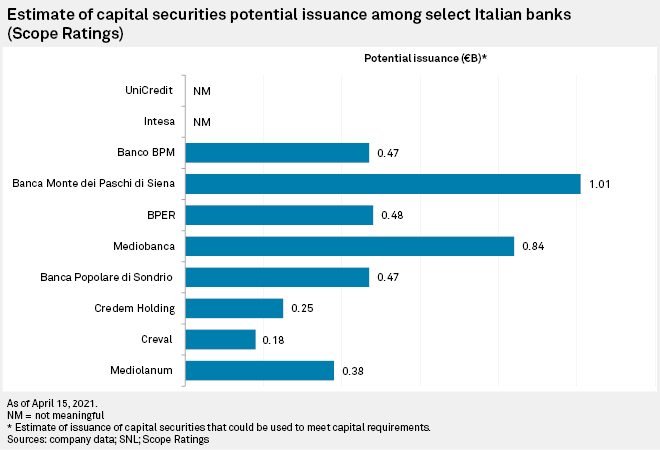

But in an April 15 note, Scope said Italian banks could be issuing more in order to optimize their capital structure. Currently they may not be taking full advantage of changes to rules that allow them to use AT1s and Tier 2 capital to meet Pillar 2 requirements, and are over-relying on expensive common equity Tier 1 capital, the agency said.

"In our view, the one-dimensional approach to regulatory capital that focuses solely on CET1 buffers is suboptimal as it leads banks to overutilize common equity, the most expensive form of capital," Scope said.

Of 10 Italian banks studied by Scope — UniCredit, Intesa, Banco BPM SpA, Banca Monte dei Paschi di Siena SpA, BPER Banca SpA, Mediobanca Banca di Credito Finanziario SpA, Credito Emiliano SpA and its supervisory entity, Credito Emiliano Holding SpA, Banca Popolare di Sondrio SCpA and Banca Mediolanum SpA — the average buffer to CET1 requirements was 8.4% as of the end of 2020. Buffers have grown thanks to factors including greater earnings generation and retention, even in the face of the pandemic, and lower risk-weighted assets, according to Scope.

Scope estimates that most Italian banks have only partially used up their AT1 allocations, while some second-tier lenders have not issued any of these securities at all.

"We expect to see AT1 issuance among second-tier Italian banks increasing going forward," Marco Troiano, deputy head of Scope's financial institutions team, said during a webinar.

Recent issuances include Banco BPM's €400 million of perpetual additional Tier 1 bonds in January 2021 and UniCredit's €1.25 billion AT1 issue in February 2020. FinecoBank Banca Fineco SpA issued AT1s in 2019, with a spokesperson telling S&P Global Market Intelligence the reason was to comply with leverage requirements.

Intesa, UniCredit and the rest

In terms of volume, Intesa and UniCredit stand head and shoulders above other Italian banks, with €7.49 billion and €7.38 billion of hybrid capital securities outstanding, respectively, as of the end of 2020. Next is Banco BPM with just over €800 million. These figures include core eligible preference or hybrid securities along with AT1s.

"Intesa and UniCredit are far ahead of the other Italian banks. A lot of the smaller banks just don't have the critical mass to issue [AT1s] in the capital markets," Gary Kirk, partner, portfolio management at TwentyFour Asset Management, said in an interview.

Banks would need to have made substantial progress cleaning up bad loans in order for AT1s to look attractive to investors, Kirk said.

Intesa's gross nonperforming loan ratio stood at 4.4% as of the end of the first quarter, while UniCredit reported a gross nonperforming exposure ratio of 4.8%. Of the second-tier Italian banks, Credito Emiliano and Mediobanca would be the two most obvious candidates for new AT1 issuance, Kirk said. Both have very low gross NPL ratios: 2.8% at Credito Emiliano as of the end of the first quarter, and 3.4% at Mediobanca.

Scope's Troiano agrees that high levels of NPLs partly explain historically low AT1 issuance in Italy.

"It was very difficult to market high-risk securities while banks were in the middle of the bad debt cleanup, which only really got going in 2015," he said during the webinar.

Scale is another factor, according to Marc Stacey, partner and senior portfolio manager at BlueBay Asset Management.

"The Italian banking sector is still too fragmented and unprofitable. If there is more consolidation, that will mean larger banks with economies of scale … which would be in a better position to tap the capital markets," he said in an interview.

European policymakers and analysts have argued that mergers in Italy's crowded banking market could solve long-running structural issues such as low profitability.

Italian banks have issued fewer AT1s than banks in other large Western European economies, with total issuance between 2010 and 2020 totaling €16.29 billion, compared with €61.23 billion in Germany, €27.25 billion in France and €67.89 billion in the U.K., according to data from S&P Global Ratings and Dealogic.

Investor appetite

If Italian banks were to issue more AT1s, they would likely be met with a good level of demand from investors because of the compression of margins in other asset classes, according to Filippo Alloatti, senior credit analyst at Hermes Fund Managers.

Now would also be a good time for Italian banks to "engage or reengage" with debt markets, especially given that bad debts could creep up again as loans migrate out of moratoriums, he said. Italian banks gave repayment holidays to borrowers struggling during the COVID-19 pandemic, and while many have returned to repaying status already, it remains to be seen how many of these loans will ultimately default and end up as NPLs.

As of November 2020, Italian banks had a total of €156 billion of loans under moratoriums, representing 13% of total loans to households and non-financial corporations, according to the European Banking Authority.

Salman Khan and Sahil Modi contributed to this article.